There is no point in comparing February 2023 with February 2022. February 2022 was the apogee of the pandemic residential real estate market. The average sale price achieved last February, $1,334,544, remains, and will for some time, the all time monthly average sale price record. Interest rates were at an all time low, the Bank of Canada benchmark rate was a mere 0.25 percent and is now 4.50 percent. The pandemic had created a buying hysteria, which in conjunction with low mortgage interest rates, set the stage for the most egregious example of FOMO (the emotional response to the belief that others are living better, and that important opportunities are being missed, namely buying a home in the Greater Toronto Area).

In March of last year, the Bank of Canada began its steady and continuous implementation of higher rates, and the resale market began to tumble. The months long continuous decline appears to be over, a position supported by February’s resale market data.

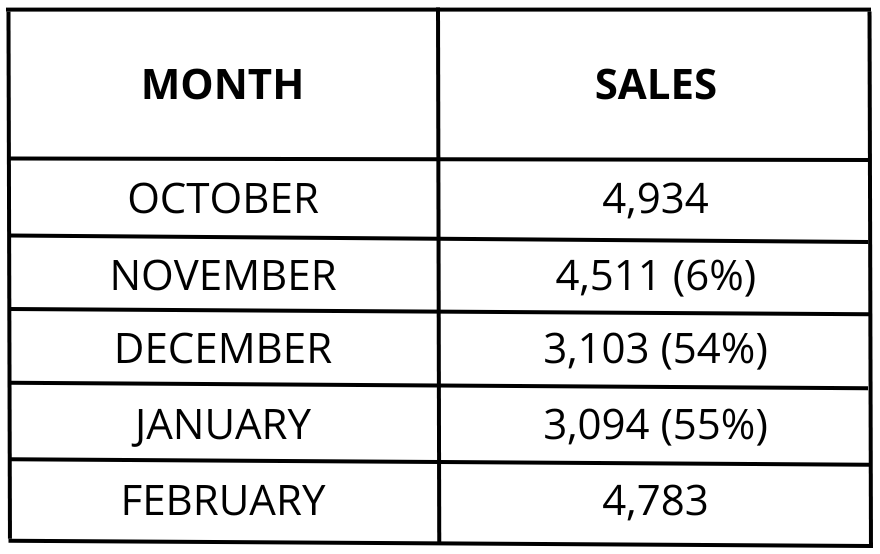

In February there were 4,783 properties reported sold. Viewed from a historic perspective it has been decades since a February market has produced such low volumes. Viewed from a more recent perspective these numbers are encouraging.

February’s sales results are the best month since October of last year, when the market was in free-fall.

Significantly February’s performance was 6, 54 and 55 percent better than the market’s performance in November, December and January, respectively.

Similar to the volume of sales, the average sale price has also shown improvement. The monthly sale price has stabilized and is showing signs of increasing. In February the average sale price for the greater Toronto area came in at $1,095,617. In June of 2022 the average sale price had fallen to $1,145,804. Since then it has continued to fall until February’s performance.

February’s average sale price was 5.5 percent higher than the average sale price achieved in January.

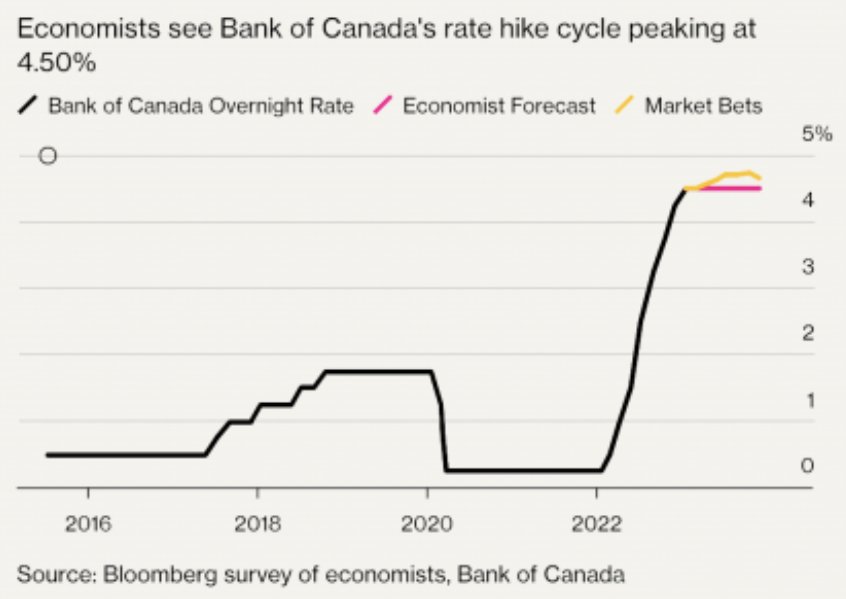

The reason for these positive market changes is mortgage interest stability. As the chart below indicates, a recent Bloomberg survey of economists see the Bank of Canada rate hike cycle as having peaked at 4.50 percent.

As buying history has demonstrated, once the consumer has determined that stability has been achieved the market will re-engage which is what is beginning to happen. Since the benchmark rate is not expected to decrease dramatically until at least 2024, a gently strengthening market can be expected for the remainder of 2023.

One problem that buyers will have to contend with will be supply. In February only 8,367 new properties came to market, some no doubt being re-listed properties that did not sell at their initial list price. This number is more than 40 percent fewer listings than the 14,153 that came to market last February. Although the total number of active listings was 9,643 at the end of the month, that is substantially too few to meet market demand. This speaks to two prevailing market trends. Sellers are under no pressure to sell and at least for the time being are continuing to wait for a market improvement. Given that that market improvement is now here, over the next few months the market should see more supply, which in turn will see an increase in sales volumes.

Demand is demonstrated by the length of time properties remain on market before being reported sold. In February all properties sold in only 22 days, many in multiple offer competitions. Depending on location and property type the average days on market was

substantially, in fact shockingly less – all semi-detached properties in the greater Toronto area sold in 15 days, while all semi-detached properties in Toronto’s eastern districts sold in an eye-popping 11 days, and at 106 percent of their asking price. This data indicates that the greater Toronto market, certainly on the demand side, is extremely robust, but constrained by affordability, low inventory and a slow adjustment to price expectations.

Very early March results indicate that the market’s performance is about 15 percent better than sales volumes achieved in February. If this pace continues (supply permitting with no further hikes in the benchmark rate) then March should achieve approximately 5,500 sales, if not more. That means we will see sales numbers that have not been achieved since August of 2022. The market is finally showing signs of moving in a positive direction.

Have questions about the market, selling or buying?

Contact me any time. I’m happy to answer any questions you may have.

Prepared by Chris Kapches, LLB, President and CEO, Broker, Chestnut Park® Real Estate Limited, Brokerage.