Are you looking to purchase property in the Toronto area? If so, you may have heard of Land Transfer Tax (LTT) and its importance when it comes to closing on a real estate transaction. This blog post will provide an overview of what Land Transfer Tax is, how much it costs, who pays for it, and other important information about LTT in Toronto. We’ll also discuss strategies that can help buyers lower their overall costs associated with purchasing property in the city. With this knowledge, you can make sure you’re fully informed and prepared when it comes time to buy a home or commercial space in Toronto. Keep reading to learn more!

Land Transfer Tax (LTT) is a fee charged by the province of Ontario on all transfers of ownership of real estate property within Toronto and Ontario. It is based on the purchase price and paid at the time of closing to the provincial government.

The amount of Land Transfer Tax that must be paid depends on several factors, such as where in Toronto the property is located, how much you are paying for the home, and if there are any special exemptions or rebates offered by your municipality.

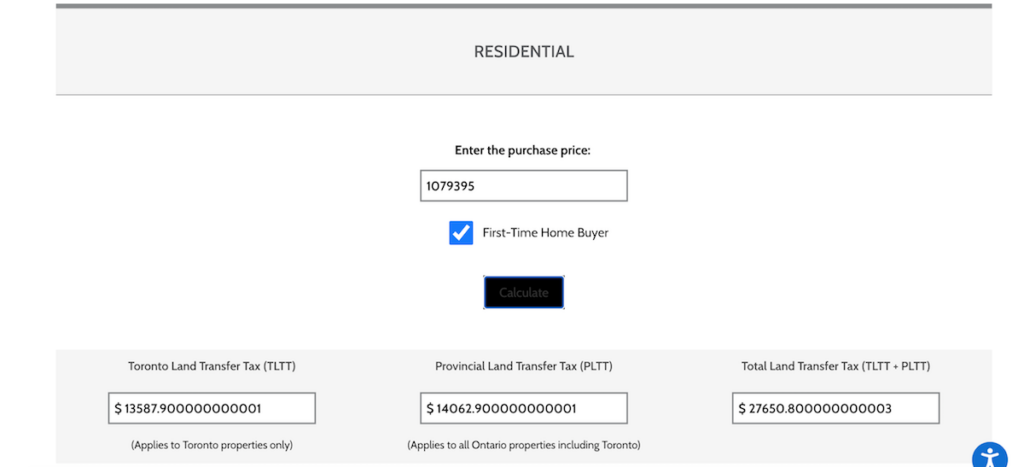

For example, First-time buyers may be eligible for a rebate of the provincial and municipal (Toronto) land transfer taxes, to a maximum of $4,000 of the payable provincial land transfer tax and $4,475 of the payable municipal land transfer tax (Toronto), respectively.

This is designed to help make housing more affordable to young people just getting into the market. However, as you are likely aware, these rebates are nothin substantial when taking into consideration the average sale price of a home in Toronto.

Regardless of any exemptions or rebates, the amount of Land Transfer Tax paid is usually a significant sum and should be factored into your overall financial plan when buying a home in Toronto. To help you estimate what your LTT may amount to prior to closing, you can use TREBB’s online land transfer calculator HERE.

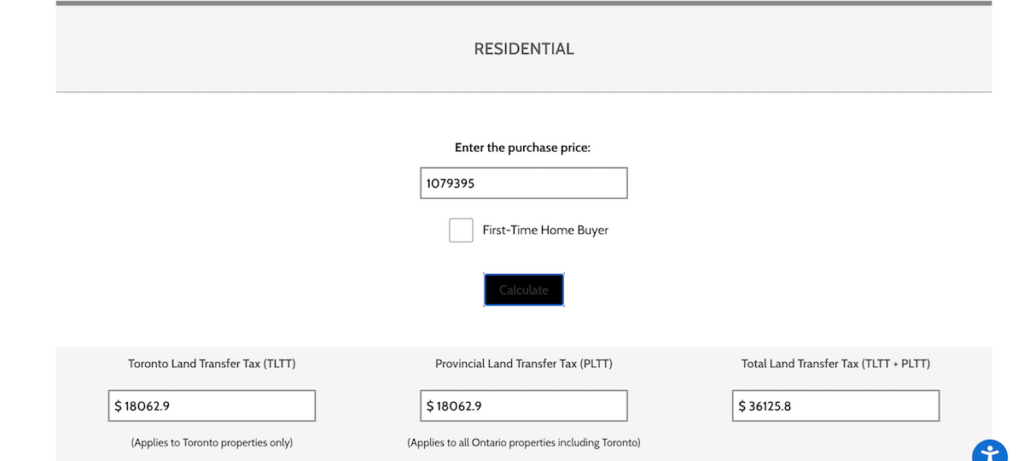

At the time of this blog post, November 2022, the average sale price for a home in Toronto is currently $1,079,395. In order to provide you with an example of the calculation of LTT that a buyer would be required to pay on this amount, I have included screenshots below which show both the LTT due on a home at a sale price of the current average sale price as a first-time buyer as well as the amount due for a purchase at the same price by someone who doesn’t qualify as a first-time buyer.

If you would prefer to avoid paying both the municipal (Toronto) LTT in addition to the provincial land LTT, you may want to consider buying a home outside of Toronto. When buying a property outside of Toronto, you are only required to pay the provincial LTT.

Overall, understanding the amount of Land Transfer Tax you need to pay prior to closing can ensure that you have all the funds necessary before taking ownership of your new home in Toronto. It’s important to factor this tax into your pricing plans so you don’t end up with unexpected surprises at closing time!

Feel free to reach out if you have further questions on the Land Transfer Tax and how it applies to your specific situation or if you have questions about buying or selling. I’m always happy to help.