As a full time real estate agent, my seller clients often ask me “what if the buyer doesn’t deliver the deposit?”. This is a great question and if you are wondering the same thing, I’ve included an explanation below.

I completely understand the stress that sellers may feel when waiting for the deposit to be delivered, it’s not an easy time waiting and wondering if the money will arrive. I myself have been in this position in the past when I have sold my previous properties prior to becoming a real estate agent. The process of selling a home can be confusing when you don’t do it on a daily basis.

Although many people think that a deal is automatically dead if the deposit isn’t delivered by the buyer, this isn’t the case. There is often a misconception amongst both buyers and sellers when it comes to what happens if the buyer doesn’t deliver the deposit. Ontario law states that in order for a contract to be valid, the following must be included: an intention to contract, an offer to contract, an acceptance of that offer and consideration.

For those of you who may not be familiar with legal terminology, the term “consideration” applies to the deposit when referring to a real estate transaction. Based on this wording, many would assume that if there is no deposit (consideration), there is no binding deal and that the buyer can simply walk away from the deal without any penalty, but isn’t correct.

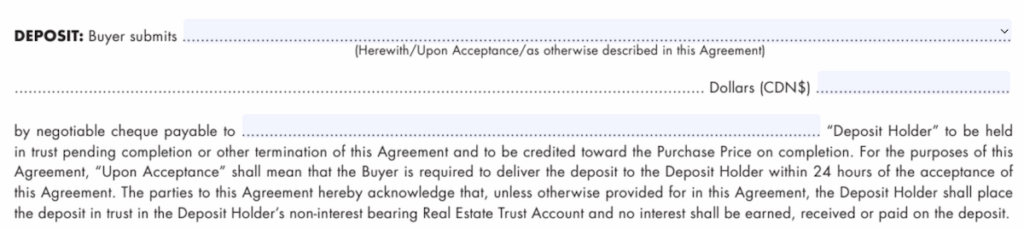

The majority of (standard form) offers that are used to sell real estate in Toronto state that the buyer must deliver the deposit within 24 hours of acceptance of the offer. The exact pre-printed wording in the standard form reads as follows:

In most cases, when the buyer doesn’t deliver the certified deposit at the same time they submit their offer, they will typically insert the wording “Upon Acceptance” in the top line. This means they will deliver the deposit to the listing brokerage within 24 hours of the offer being accepted, whether the offer ends up being accepted by the seller or buyer once negotiations are completed and both parties have come to an agreement. The “Upon Acceptance” option tends to be the more common approach versus delivering the deposit with the offer. This is mainly due to buyers avoiding the hassle of taking their deposits back to the bank if their offer isn’t accepted.

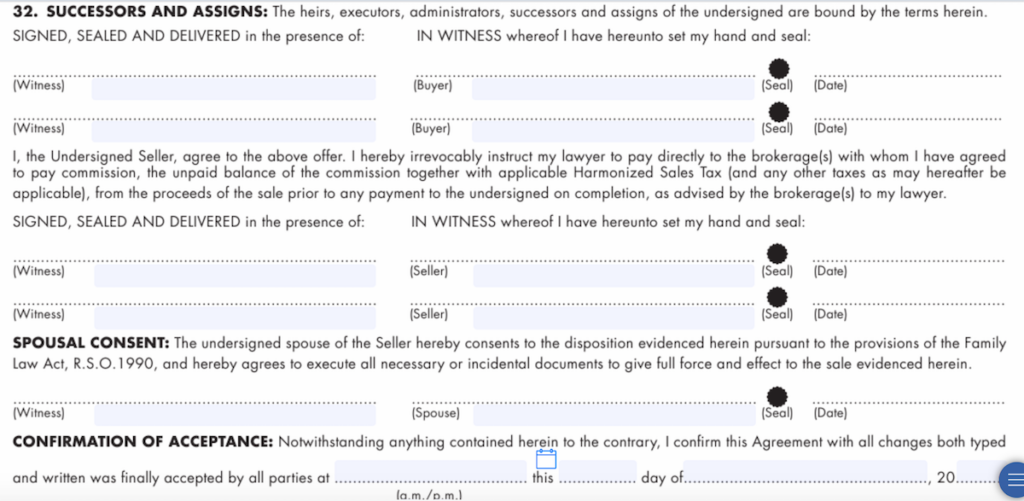

So, what if the buyer doesn’t deliver the deposit? Well, the good news for you as a seller is that according to the law the deal isn’t dead. On page 5 of 6 of the offer where all parties to the agreement sign, they sign “under seal”. You are likely wondering what this means. In short, based on Ontario laws, a contract signed under seal is one that is “formal” and one that does not require any consideration (deposit) to make it firm. Below, you can view the section of page 5 of 6 being referred to and can view the black dots with the wording “seal” under them. These black dots indicate that the agreement being signed is being signed under seal and that all parties are bound to the contract with or without consideration.

Now you are probably thinking, this is helpful to know but what happens next if the buyer doesn’t deliver the deposit? Once the buyer hasn’t delivered the deposit within the stated 24 hour period, they are considered to be in breach of the agreement. At this point, the listing brokerage will send the buyer’s agent’s brokerage (co-operating brokerage) a notice informing them that they are in breach and that the seller will continue to market the property at this point. Should the seller continue to market the property and accept another offer that is for less money than the original offer or an offer that requires the seller to take on any other financial losses outside of the sale price, the seller then has the right to sue the original offerer for those losses. For example, if the original offerer submits an offer for $1,500,000 but the seller can only sell for $1,300,000, the seller could then sue the original offerer for the $200K loss as well as the legal fees associated with recovering that loss.

With all of the above being said, suing a buyer can be a time consuming and costly task. If the person doesn’t have the funds to cover your loss, you may find yourself out of pocket thousands of dollars and mentally drained from the amount of time and effort dedicated to going after them.

The best way to avoid running into a situation like this is to request that all offers include a bank draft or certified cheque covering the deposit amount included with the offer at the time of offer presentation. You typically want to receive a deposit of at least 5% of the offer price or more, the higher the better. By doing this, you are ensuring that the person purchasing your property has the funds for the deposit and it is less likely for them to walk from the deal once you are in possession of their deposit. If you have any questions or concerns regarding legal aspects of your real estate deal, it is best to get advice from a local Toronto real estate lawyer as they will be able to provide you with all of your options based on Ontario’s laws.

Are you thinking about buying or selling or do have questions about the current market? Contact me any time with your questions. I’m always happy to help.