There are thousands of available homes on MLS that may be perfect for you! Include your name and email address below to receive your custom list of new available homes in your desired neighbourhoods each morning. You will often receive new listings before they appear on other sites such as REALTOR.ca, giving you a head start with your search.

There were no surprises in the May resale figures for the Toronto and area residential market. The three themes that emerge are that the city of Toronto resale market continues to strengthen (416 regions); the 905 region continues as a drag on the overall market, and the high-end of the resale market ($2 Million plus) has yet to return to anywhere near its early 2017 performance.

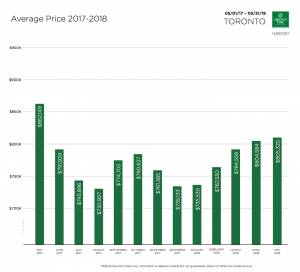

The City of Toronto has almost returned to the way it was performing last year. The average sale price for all properties came in at $861, 970. Last year at this time it was $899,000. The number includes condominium apartment sales which, significantly, continue to represent the most affordable housing available in Toronto, and accounted for more than 56 percent of all properties reported sold in May.

All properties (including condominium apartments) sold in only 16 days, and impressively, sold for 101 percent of their list price. In the eastern districts located closest to the central core (Riverdale, Leslieville, Beaches) all properties sold in just over 8 days, at more than 110 percent of their asking price. These are some remarkable statistics that are generally ignored by the daily newspapers and articles related to the Toronto and area marketplace.

The data immerging from the 905 region is not as impressive. Notwithstanding the size of the 905 region, only 60 percent of all reported sales (7,834) took place in the region. The average sale price of $805,320 was more than $55,000 lower than the average sale price of $861,970 achieved in the City of Toronto.

What is troubling about the 905 region is that 73% of all available inventory is located in the region. In May there were 20,919 properties available to buyers, but only 5,797 in the City of Toronto. As a result, the sales to list ratio in Toronto was 56.5 percent, but only 46.8 percent in the 905. The months of inventory in the 905 is 2.6, while only 1.9 in Toronto. All sales in the 905 took place in 20 days, but only 16 in Toronto, and not surprisingly, all sales in the 905 took place at 99 percent of their asking price, but at 101 percent in Toronto. Given this discrepancy in market performance, it becomes extremely deceptive if the Toronto and area resale market are analyzed as a whole, and not as two distinct marketplaces.

In May 233 properties having a sale price of $2 Million or more was reported sold. This compares very poorly with the 427 similar properties reported sold in May last year. This represents a 45 percent reduction year-over-year. The explanation for this decline is many-fold. Last year, on the obsessive belief that house prices would continue to skyrocket, high-end average sales prices reached unsustainable levels. Since then there have been three mortgage interest rate hikes, and banks are now applying more restrictive stress testing on all properties. The 15 percent of foreign buyers tax is playing some role in this scenario, but less significant than the provincial government’s perception.

All of these factors have had a strong psychological impact on buyers. They are clearly waiting to see if prices will continue to fall at the high end. That hesitation has resulted in the sharp drop in sales in this price category. However, as May’s results for the City of Toronto indicate, the market is improving which will have an ameliorative impact on the psychological hesitation of buyers in this price category.

Inventory levels are becoming a concern, particularly in the City of Toronto. Last year there were 5,779 active listings at the end of May, a period of severe inventory shortages. This year there are only 5,797. Although the difference is marginal, it represents a pattern that has been emerging. Declining inventory will lead to rising prices and hyper-competition for good properties in desirable neighbourhoods.

Condominium apartment inventory is also declining. Last year there were 2509 active listings at the end of May. This year there are 2552. Again, the difference is insignificant but a declining pattern is emerging. This is very concerning because condominiums apartments remain the most affordable housing in Toronto, at least for the time being. Prices for condominium apartments have been increasing. The average sale price for condominiums apartments in Toronto is now $602,000 and a stunning $671,000 in the central core. Considering that 64 percent of all apartment sales in Toronto are in the central core, affordability is now becoming a concern, even for condominium apartments.

Looking forward to June, it’s possible to see a marketplace that once again can be favourably compared to last year. The initial impact of the Ontario Fair Housing Plan measures will be history and next month’s chart will look much smoother than the one below:

Prepared by Chris Kapches, LLB, President and CEO, Broker, Chestnut Park® Real Estate Limited, Brokerage.

Have questions about the market or selling or buying?

Contact me any time. I’m happy to answer any questions you may have.