The Canada Revenue Agency has taken a stance against real estate flipping with the introduction of Canada’s new anti-flipping tax which took effect January 1, 2023. This new tax seeks to curb profiteering within Canada’s housing market by taxing property sales for properties that sell within 12 months (365 days) from the date of the previous sale.

The new anti-flipping tax prohibits property owners from using the Principal Residence Exemption as a way to shelter the capital gain realized on a property that is “flipped”. For those who are unfamiliar with the Principal Residence Exemption, prior to this new tax being introduced, homeowners who sold their properties for a profit could be exempt from paying any tax on the gain (the difference between the original purchase price and sale price) so long as the property was declared as a principal residence. For clarity purposes, as of 1982, in Ontario, you are only allowed to declare one property as your principal residence. The new anti-flipping law prevents homeowners from utilizing this exemption if they sell within 12 months of buying their principal residence.

As an example, if you purchased a property for $600K and sold it for $650K six months later, prior to the new anti-flipping law, you would not be required to pay tax on the $50K gain if the property was declared as your principal residence.

In order to declare a property as your principal residence, either you, your spouse, common-law partner or child must live in the property for at some portion of the year. Properties that are purchased as an investment which generate income, such as a rental property, do not qualify as a principal residence. The income and profit generated from these investment properties are generally taxed as business income at your specific tax rate (the rate is different for each individual). The new anti-flipping law will restrict one’s ability to capitalize on quick returns resulting from market improvements and renovation investments due to the one year time restriction being enforced by the government.

Prior to the new anti-flipping law being implemented, many investors would purchase new construction properties to later sell or assign prior to or shortly after their completion in order to benefit financially from the gain realized between the time of signing and completion. Additionally, some investors would invest in traditional rehabilitation flips that consisted of purchasing a neglected home or condo, investing in improvements and then selling the home at a profit within a short period of time.

Despite the limitations this new tax introduces, some see potential benefits from Toronto’s new anti-flipping rules. By discouraging quick flips, it’s possible that more individuals and families will have more properties to choose from without having to compete with investors. This could increase the availability of housing for Toronto residents, which is a major benefit for those who are looking to buy in Toronto.

If you’re looking to buy or sell a home in Toronto, it’s important to understand the rules and regulations of Canada’s anti-flipping tax. Be sure to work with an experienced Toronto real estate agent who is familiar with the restrictions and can help you navigate the market. With their help, you’ll be better equipped to find the right property while also avoiding unexpected issues. It is also best to speak with an accountant prior to purchasing an investment property to ensure you can limit your tax liability as much as possible and avoid running into unexpected expenses.

It remains to be seen whether or not Toronto’s anti-flipping law will have a positive impact on the city’s housing market. As more buyers and sellers become aware of the new law’s provisions, it may start to have an effect on property values and availability. For now, potential buyers and sellers should be aware of this important change in order to make informed decisions about their real estate transactions.

By understanding the terms of Canada’s anti-flipping tax and working with and experienced real estate professional, buyers and sellers can make sure that their transactions comply with the legislation. With this knowledge, they can ensure that they get the best deals possible.

Are you thinking about buying or selling this year?

Contact me with any questions you may have about the market or to discuss how I can help you achieve your specific real estate objectives. I’m always happy to help.

The Toronto and area residential resale market limped to the end of 2022, a continuation of the pattern that became clear and established as interest rates began to rise in March of this year. As the Bank of Canada continued its punishing benchmark rate hikes, both sales and average sale prices have been decimated. Once again, no surprises in December.

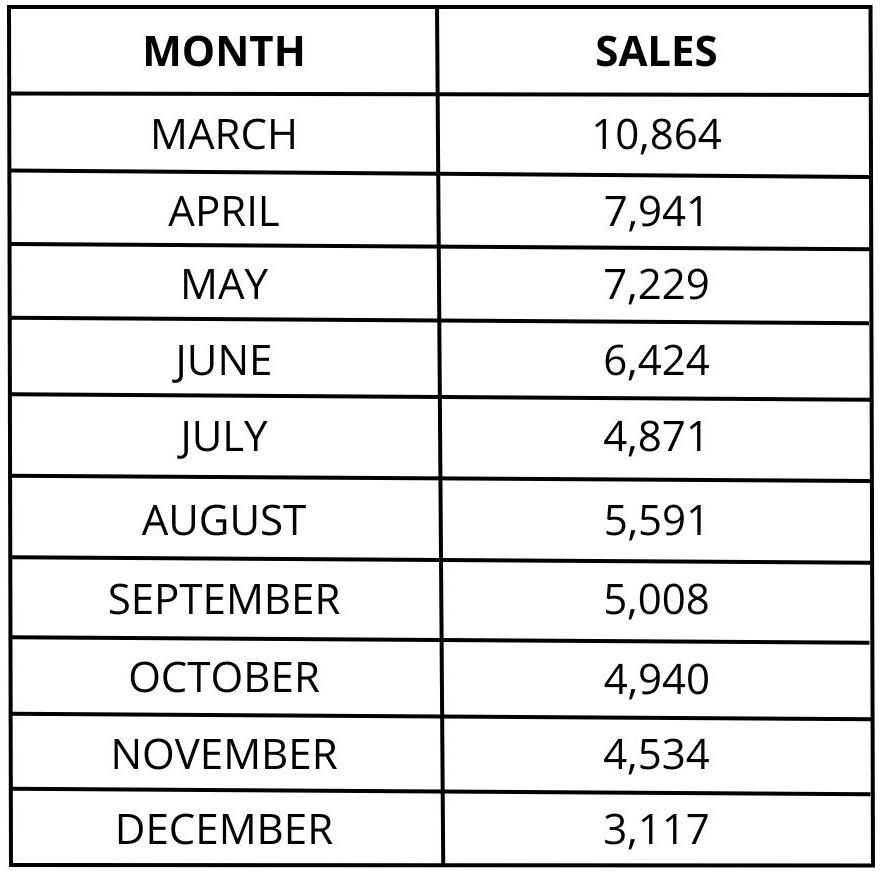

Here is what has happened to sales since the Bank of Canada commenced its rate hikes in March.

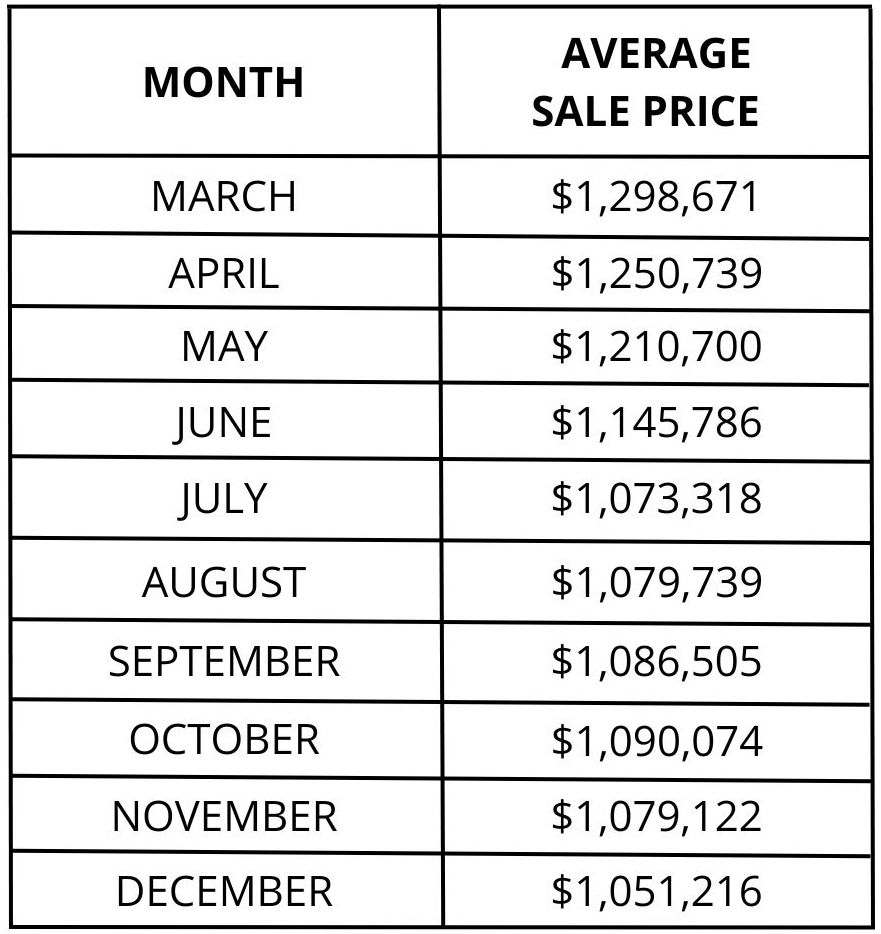

December’s sales results were more than 48 percent lower than the 6,013 properties reported sold last December. Since March the number of monthly sales has decreased by more than 70 percent. It should be noted however, December’s sales results have historically been the lowest in any year. The trajectory of average sale prices in Toronto and area has been similar to monthly sales.

Last December the average sale price was $1,157,877. December 2022’s average sale price is almost 10 percent lower than last year. More significant is the dramatic tumble in prices since March. At the end of the year, prices are $247,455, or almost 20 percent, lower than they were in March. In the City of Toronto, primarily due to the preponderance of condominium apartment sales, the average sales price was even lower in December, coming in at $1,015,000.

The underlying driver responsible for the current marketplace is affordability. Even with a 20 percent decline in average sale prices since March, the even more accelerated rise in mortgage interest rates has made Toronto and area homes unaffordable, extremely unaffordable. A recent study by the National Bank has indicated that even with Toronto and area’s alarmingly lower average sale prices affordability is beyond the reach of all but a small number of buyers.

The National Bank reports that a mortgage on a typical home now takes up to 67.3 percent of a household’s income to service, the highest level of debt service since 1981. The Bank’s analysis indicates that to own a non-condominium home in Toronto, households need an annual income of $273,549 and many months of savings in order to have sufficient down payment funds to afford a “representative home” priced at $1,351,000. In December the average sale price for detached properties in Toronto was $1,627,000. Semi-detached properties came in at $1,162,000. For a representative condominium apartment, priced at $738,000, households need $174,466 in annual income. The average household income in Toronto in 2022 is approximately $105,000. That’s about $70,000 less than the price of a “representative” condominium apartment and almost $170,000 less than a “representative” freehold home. In December, the average sale price for condominium apartments in the City of Toronto was $741,584.

There is no good news in December’s resale data. Not only are sales and prices falling, but further declines can be expected. Unafordability has forced even would-be buyers to downscale their expectations based on their ability to qualify and then service the debt that they will be assuming. As a result, gone are the days when Toronto and area’s average selling price exceeded list prices by as much as 120 percent. In December all properties reported sold came in with a sold price of only 98 percent of the asking price. In the City of Toronto, it was lower at only 97 percent. In some trading areas, ratios were even lower. Even Toronto’s powerful eastern trading districts, which have not seen sales to list price ratios since 2008 below 100 percent came in at 99 percent.

Active available properties have increased over the last few months, a common result of declining sales but not excessively. In December there were 8,692 apartments, detached, semi-detached, and townhouse available to buyers, 169 percent more than the 3,231 active listings available last December.

Even though 2022 started with three strong months, January, February, and March, the total number of annual sales was dismal. Only 75,140 properties changed hands, even less than the 78,017 sales reported in 2018 when legislative changes brought the resale market to a halt. Beyond 2018 it’s necessary to go back almost two decades to find a year when sales were as low.

Given the co-relation between mortgage interest rates, sales, average sale prices, and affordability the immediate future of the Toronto and area residential resale market is self-evident.

The market will remain sluggish well into 2023, especially since the growth in Canada’s employment numbers will lead the Bank of Canada to further benchmark rate increases. Average sale prices will continue to decline. Unfortunately, buyers are constrained by a lack of affordability given the prevailing economic factors. Buyers simply can’t pay what sellers expect (hope?) to achieve for their properties, which ultimately will have the concomitant effect of bringing prices down. There is no way of determining how low average sale prices must fall – it would be easier to forecast if the Bank of Canada’s position on rates was final – but a further 10 percent decline from December’s average sale price of $1,051,000 is a reasonable estimation. It won’t be until the beginning of the latter half of the year, and perhaps even the end of 2023, when the residential resale market begins to show signs of growth. Growth but not a return to the halcyon days of the pandemic market. The Bank rate would have to return to 0.25 percent, an impossible likelihood.

Have questions about the market, selling or buying?

Contact me any time. I’m happy to answer any questions you may have.

Prepared by Chris Kapches, LLB, President and CEO, Broker, Chestnut Park® Real Estate Limited, Brokerage.

Toronto is a city that attracts people from all over the world and it has continuously been experiencing rapid growth over the last several decades. However, in some parts of Toronto and the GTA, this growth has also come with a downside: an increasing number of vacant homes. To combat this issue and encourage owners to put their properties to use, the City of Toronto has introduced the Vacant Home Tax (VHT).

In this blog post, we’ll take a look at what the Vacant Home Tax is, how it works, and why it’s important. We’ll also discuss some potential implications of this tax and outline what you need to know if you’re an owner of a vacant home in Toronto.

What is the Vacant Home Tax?

The Vacant Home Tax is a tax levied on certain properties in the city of Toronto that are not occupied for at least six months of the year. This tax is intended to encourage owners to put their properties to use and reduce the number of vacant homes in Toronto in hopes of increasing more supply of housing throughout the city. The tax rate for each property depends on its location and the length of time it has been unoccupied.

What is the Mandatory Declaration?

All Toronto residential property owners must submit a declaration of their property’s 2022 occupancy status by February 2, 2023. You will likely have received a declaration form in the mail which you can submit to the City of Toronto or you can complete an online declaration HERE. You will need your 21-digit assessment roll number and customer number from your property tax bill or property tax account statement.

For residential properties that are not occupied by the homeowner(s), an audit may be required. If the City conducts an audit, owners may be required to submit information or documentation about tenants and/or permitted occupants to confirm occupancy during the taxation period.

It is important that you submit or complete the declaration form prior to the deadline (Feb 2, 2023) and ensure that the form is fully completed in order to avoid a fine of $250.

Residential properties will be deemed vacant if the owner fails to make the annual declaration by the deadline and/or provide supporting documentation.

How does the Vacant Home Tax work?

The Vacant Home Tax is based on a property’s assessed value, which is determined by the Municipal Property Assessment Corporation (MPAC). Owners of taxable vacant homes are required to complete an annual declaration to confirm that their property is occupied for at least 183 days of the year. If a property has been vacant for more than six months, owners must pay the vacant home tax.

Why is the Vacant Home Tax important?

The Vacant Home Tax is an important tool that can potentially help reduce the number of vacant homes in Toronto. When owners are required to pay taxes on their vacant properties, they are more likely to rent or sell the property in order for that property to be used by individuals who are in need of a residence. This can help improve the city’s housing supply and affordability.

How Is Toronto’s Vacant Home Tax Calculated?

As stated on the City of Toronto’s website:

“A Vacant Home Tax of one percent of the Current Value Assessment (CVA) will be imposed on all Toronto residences that are declared, deemed or determined vacant for more than six months during the previous year. For example, if the CVA of your property is $1,000,000, the tax amount billed would be $10,000 (1% x $1,000,000).

The tax is based on the property’s occupancy status for the previous year. For example, if the home is vacant in 2022 the tax will become payable in 2023.”

What are the Potential Implications of the Vacant Home Tax?

The Vacant Home Tax could have a number of implications for Toronto. For example, it may increase the burden on owners of vacant properties and make it more difficult for them to sell or rent out their homes. It could also lead to some homeowners attempting to game the system by underreporting the amount of time their property is occupied in order to avoid paying taxes.

How Does The Toronto Vacant Home Tax Effect Buying & Selling Toronto Real Estate?

The Vacant Home Tax has implications for property transactions, both for purchasers and vendors:

Who is Exempted From Toronto’s Vacant Home Tax?

There are some exemptions that apply to the vacant home tax. Below is a list of current exemptions which may be updated over time:

Death of a registered owner: The property was vacant for six months or more in the previous year due to the death of an owner.

The vacant property is undergoing repairs or renovations, and all the following conditions have been met:

a) occupation and normal use of the vacant property is prevented by the repairs and renovations;

b) all necessary permits have been issued for the repairs and renovations;

c) the City’s Chief Building Official is of the opinion that the repairs or renovations are being actively carried out without unnecessary delay.

Principal resident is in care: The principal resident of the vacant property is in a hospital, long term or supportive care facility for at least six months during the taxation year. This exemption may be claimed for up to two consecutive taxation years.

Transfer of legal ownership: You purchased your property in the previous year, and the sale involved a 100 per cent transfer of an interest in the property to an unrelated individual or corporation. This excludes name changes, adding a second owner and removing a second owner.

Occupancy for full-time employment: The vacant property is required for occupation for employment purposes for a total of at least six months in the taxation year, by its owner who has a principal residence outside of the Greater Toronto Area.

Court order: There is a court order in force which prohibits occupancy of the vacant property for at least six months of the taxation year.

What Owners of Vacant Homes Need to Keep in Mind

If you are an owner of a vacant home in Toronto, it is important to understand the implications of the Vacant Home Tax. Make sure that you declare your property accurately and pay taxes on time if applicable. It is also advisable to seek professional advice from a qualified accountant, real estate lawyer or the City of Toronto to ensure that you are in compliance with the rules and regulations of the Vacant Home Tax.

Make sure you understand how the Vacant Home Tax works and what your responsibilities are as an owner, so you can stay in compliance with the law and avoid costly fines.

Are you thinking of buying or selling or do you have questions about the current market? Contact me any time with your questions as I am always happy to answer them for you.