If you’ve taken part in a Toronto multiple offer situation (“bidding war”) in the past, you can very likely relate to the frustration that many buyers feel when blindly bidding on a home while competing with other offers.

The method of listing low and holding an offer date without disclosing the details of multiples offers during a “bidding war” has played a part in driving up home prices throughout Toronto and the GTA for well over a decade. You may or may not recall, but there was once a time when properties were listed at what was perceived to be their fair market value with it being common for offers to include several conditions which we have seen less of over the recent years. However, the list low and keep everything secret method isn’t the only factor that has driven up prices, a lack of supply and a long stretch of historically low interest rates has also contributed significantly.

When buyers are not aware of how much the other parties are offering in a bidding war, they can easily spend much more than they need to in order to secure the property. In many cases, buyers have unnecessarily thrown away many thousands of dollars above the market value of a property just to get their offer accepted. In addition to the financial risks that come along with blind bidding, buyers have often only visited the property once in person for a 30-60 minute window of time, and many find themselves waiving all conditions and representations and warranties in their offers in order to compete against other offers. This can amount to the buyer taking on a significant amount of risk if there ends up being any major structural, mechanical, appliance, legal or property boundary issues relating to the property being bought.

With all of this being said, in most cases, buyers unfortunately haven’t had a choice but to participate in a multiple offer situation over the past decade as the majority of listings have been listing below market value and holding an offer date. Additionally, as stated above, the historically low rates and lack of supply hav have pretty much ensured that there would be multiple offers on the offer date.

Due to the lack of transparency in the multiple offer process, TRESA has recently implemented a new rule which, as of April 1, 2023, will allow sellers to disclose all details within an offer such as the price, deposit, closing date, conditions, etc. to all other parties who are competing for the same property should the seller direct the listing agent to disclose such information. The only information that is not permitted to be shared is personal information about each bidder, such as their names, etc.

This new rule has been implemented in hopes of introducing more transparency to the bidding process. However, it’s important to remember that buyers are not entitled to this information unless the seller directs their agent to provide such information.

At a quick glance, this news may be exciting for buyers, but an important question to consider is: will this actually make a difference if there is no upside for a seller?

Historically, a seller has always wanted to achieve the highest sale price for their home and a buyer has always wanted to secure a property for the lowest price possible, and this isn’t likely to change. If keeping the offer prices private from the bidders provides the seller with the upper hand, why would the seller want to limit their return on investment by disclosing this information?

When living in a city such as Toronto where home prices have continued to skyrocket, mainly due to a lack of supply, combined with historically low interest rates in addition to substantial and constant demand and in a city where household incomes haven’t been able to keep up with the average sale price, it’s unlikely that sellers will choose to voluntarily take a hit to their return on investment. Toronto (and Canada more broadly) are constantly growing and home prices are becoming even more unaffordable for the average Toronto citizen, so it’s likely that sellers are counting on their return on investment to assist their children with securing their very own home one day in the future, paying for university tuition or paying off other debts, among many other valid financial reasons.

Not only is it unlikely that sellers will want to voluntarily disclose the details of an offer, but based on the way the new rules are currently written at the time of this blog post, it would be logistically challenging in a multiple offer situation if a seller changes their disclosure directions in the middle of an offer presentation.

Due to the potential complexity of disclosing such details of the offers such as price, deposits, conditions, reps and warranties, closing dates, irrevocable dates and times (deadline to accept) etc, and there being no real benefit to the seller for sharing such information about the offers, it’s unlikely for listing agents to recommend disclosing this information, resulting in potentially no change to the way offer presentations take place. Unless the entire offer presentation process is re-designed (which may be possible as it’s not set in stone), we will likely continue to see the same offer presentation structure.

Although it’s completely understandable for buyers to be frustrated with the lack of transparency during a multiple offer situation, the irony is that those same buyers who may be feeling frustrated today would likely have a different outlook on the situation should they purchase a property and later be required to disclose the offer prices to potential buyers when the time comes to sell as this could potentially negatively effect their return on investment.

With all of this being said, even if more transparency isn’t created from this new optional disclosure rule, as long as buyers continue to work with experienced Toronto real estate agents who actually know the Toronto real estate market extremely well, buyers will be making market based decisions when it comes to the amount that they are willing to offer on an offer date. When preparing for an offer date, your Toronto real estate agent should be able to provide you with statistical information and an approximate market value for the home that you are bidding on so that you aren’t going in to the offer presentation blindly and so that you can pre-set your limits in regards to how much you are willing to offer.

Are you thinking about buying or selling or do you have questions about the current market?

Contact me any time with your questions or to discuss your real estate questions. I’m always happy and here to help.

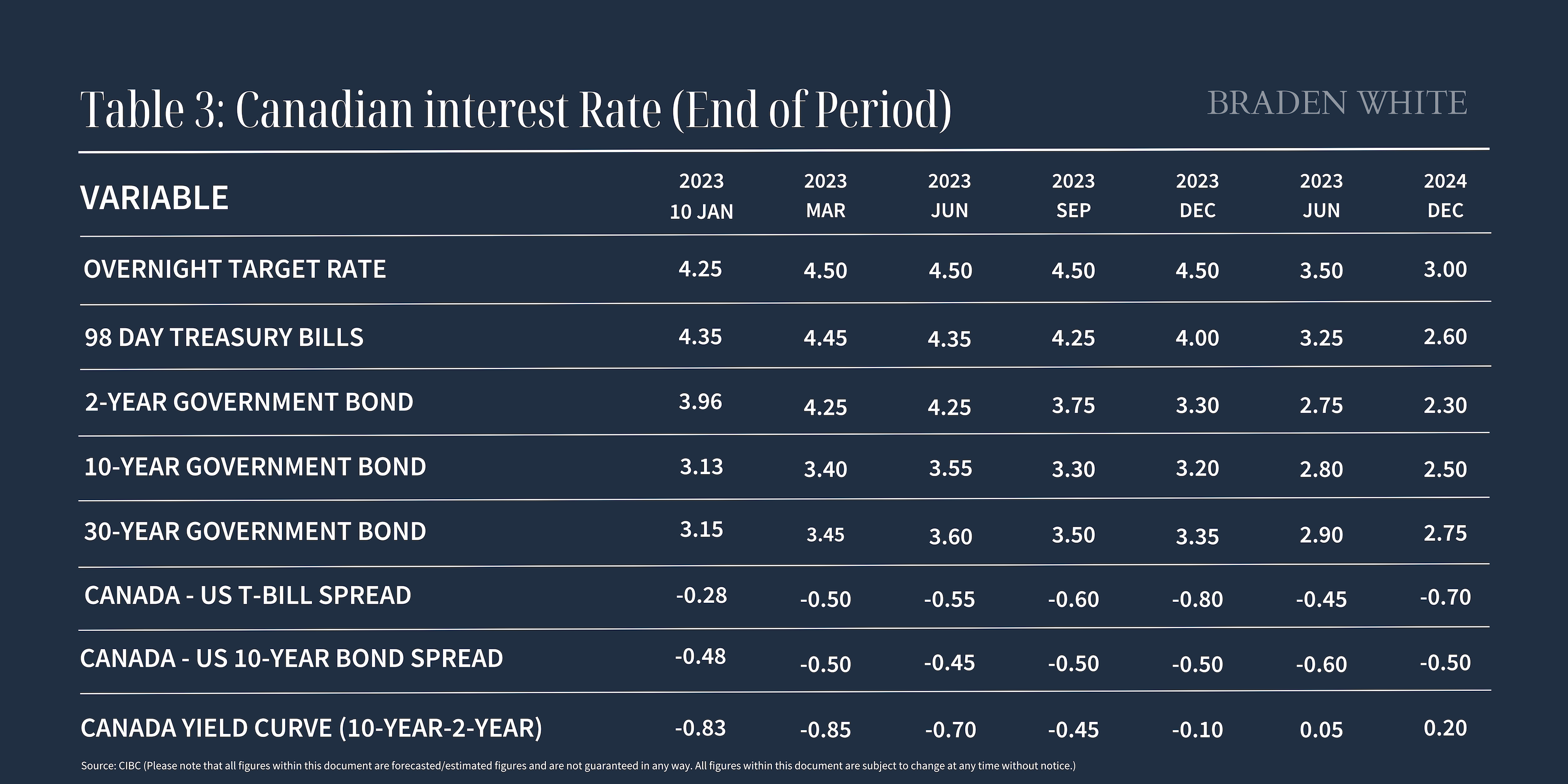

CIBC Bank recently released the following forecasted rates in the chart below. Although these figures are simply estimates, many in the financial and lending world agree that 4.5% will become the new normal key interest rate and that we likely won’t see a reduction in rates until mid to late 2024. We are unlikely to see the return of the historically low rates that we have become accustomed to over the recent years which will most definitely play a big part in Toronto’s future real estate market moving forward.

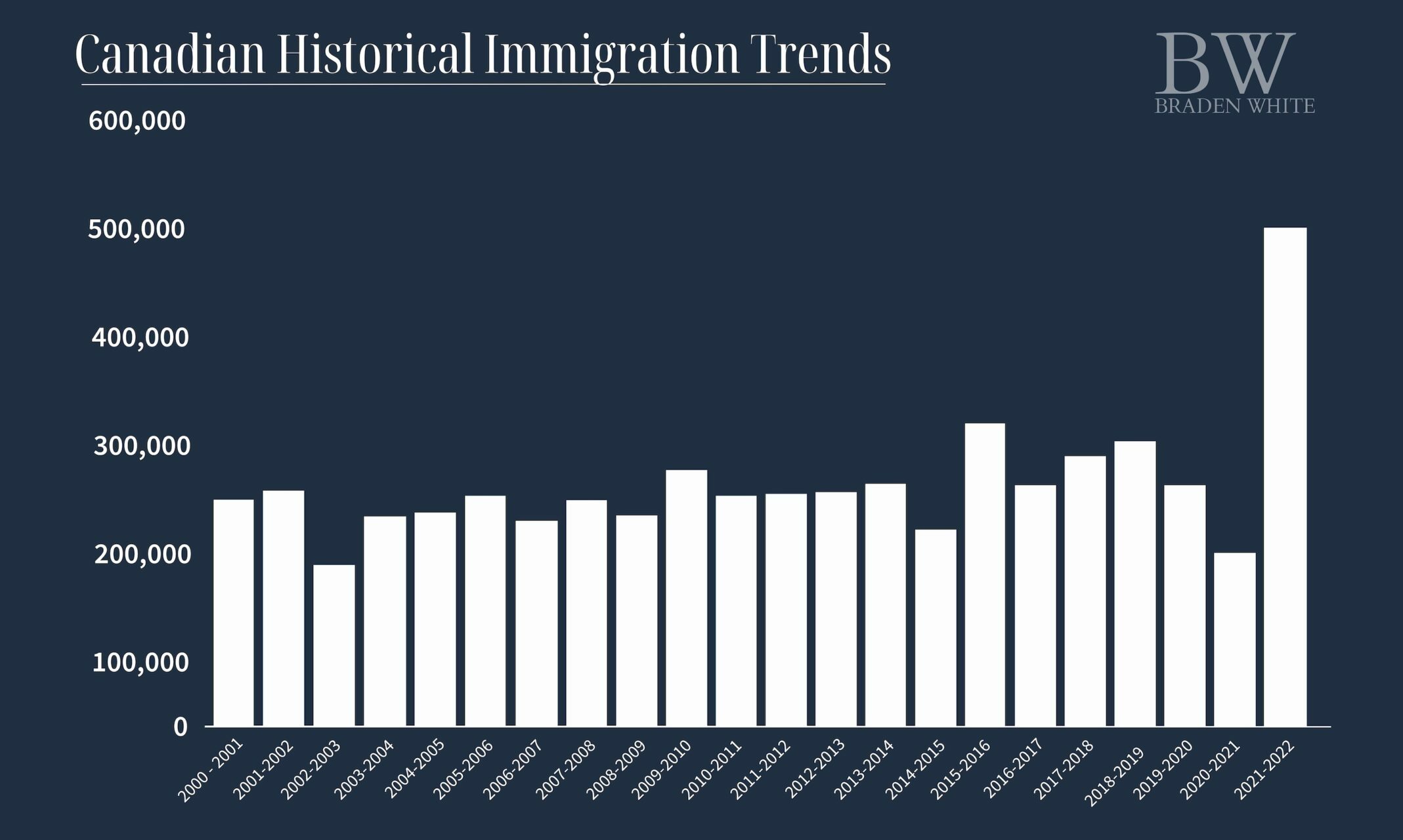

In addition to a higher key interest rate, Canada plans to admit 1.45M new immigrants over the next couple of years. Many of these new immigrants will be coming as “homebuyers” with funds to purchase a property. This large increase in population will very likely fuel an increase in the average sale price once rates have dropped in 2024. Until then it’s unlikely that we will see a drastic increase in the average sale price. Below is a chart showing Canada’s immigration trends between 2000-2022. As you can clearly see, there was a substantial growth in immigration between 2021-2022 with even more substantial growth coming over the next couple years.

With Bank of Canada’s recent announcement to stick with 4.5% as the key interest rate, many lenders are seeing an increase in buyers applying for mortgages but not as many deals taking place or closing when compared to before the rate hikes took place. Many borrowers are now borrowing money from family or using co-signers to secure their mortgages due to the limitations that the higher rates, limited household income and stress test imposes on them. The average household income in Toronto and the GTA is struggling to keep up with the higher key interest rate, growing demand for available homes and restrictions imposed by the stress test.

Are you thinking about making a move?

Contact me any time with your real estate questions or to discuss how I can help you achieve your real estate objectives. I’m here and happy to help!

There is no point in comparing February 2023 with February 2022. February 2022 was the apogee of the pandemic residential real estate market. The average sale price achieved last February, $1,334,544, remains, and will for some time, the all time monthly average sale price record. Interest rates were at an all time low, the Bank of Canada benchmark rate was a mere 0.25 percent and is now 4.50 percent. The pandemic had created a buying hysteria, which in conjunction with low mortgage interest rates, set the stage for the most egregious example of FOMO (the emotional response to the belief that others are living better, and that important opportunities are being missed, namely buying a home in the Greater Toronto Area).

In March of last year, the Bank of Canada began its steady and continuous implementation of higher rates, and the resale market began to tumble. The months long continuous decline appears to be over, a position supported by February’s resale market data.

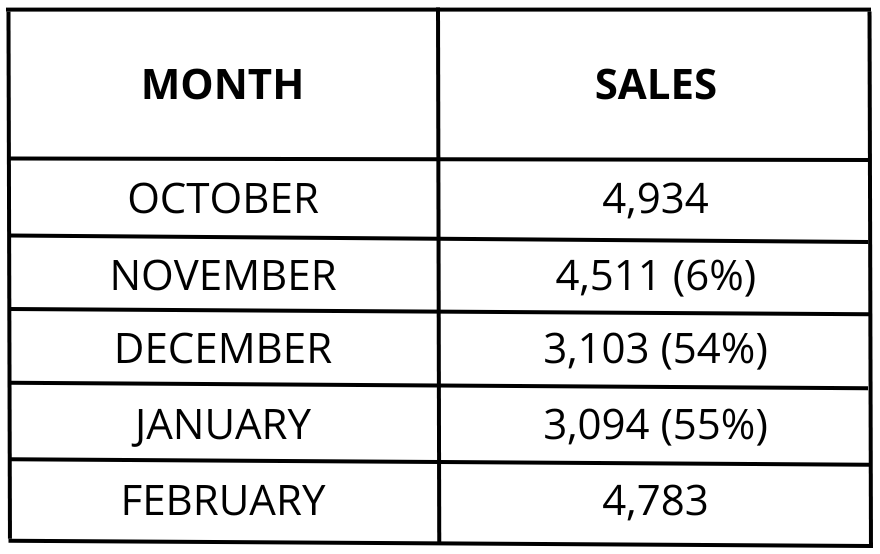

In February there were 4,783 properties reported sold. Viewed from a historic perspective it has been decades since a February market has produced such low volumes. Viewed from a more recent perspective these numbers are encouraging.

February’s sales results are the best month since October of last year, when the market was in free-fall.

Significantly February’s performance was 6, 54 and 55 percent better than the market’s performance in November, December and January, respectively.

Similar to the volume of sales, the average sale price has also shown improvement. The monthly sale price has stabilized and is showing signs of increasing. In February the average sale price for the greater Toronto area came in at $1,095,617. In June of 2022 the average sale price had fallen to $1,145,804. Since then it has continued to fall until February’s performance.

February’s average sale price was 5.5 percent higher than the average sale price achieved in January.

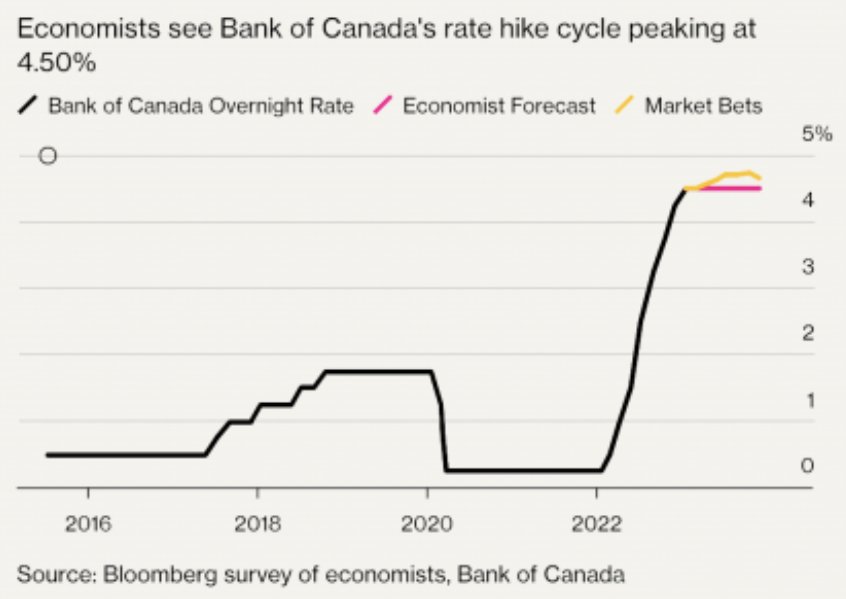

The reason for these positive market changes is mortgage interest stability. As the chart below indicates, a recent Bloomberg survey of economists see the Bank of Canada rate hike cycle as having peaked at 4.50 percent.

As buying history has demonstrated, once the consumer has determined that stability has been achieved the market will re-engage which is what is beginning to happen. Since the benchmark rate is not expected to decrease dramatically until at least 2024, a gently strengthening market can be expected for the remainder of 2023.

One problem that buyers will have to contend with will be supply. In February only 8,367 new properties came to market, some no doubt being re-listed properties that did not sell at their initial list price. This number is more than 40 percent fewer listings than the 14,153 that came to market last February. Although the total number of active listings was 9,643 at the end of the month, that is substantially too few to meet market demand. This speaks to two prevailing market trends. Sellers are under no pressure to sell and at least for the time being are continuing to wait for a market improvement. Given that that market improvement is now here, over the next few months the market should see more supply, which in turn will see an increase in sales volumes.

Demand is demonstrated by the length of time properties remain on market before being reported sold. In February all properties sold in only 22 days, many in multiple offer competitions. Depending on location and property type the average days on market was

substantially, in fact shockingly less – all semi-detached properties in the greater Toronto area sold in 15 days, while all semi-detached properties in Toronto’s eastern districts sold in an eye-popping 11 days, and at 106 percent of their asking price. This data indicates that the greater Toronto market, certainly on the demand side, is extremely robust, but constrained by affordability, low inventory and a slow adjustment to price expectations.

Very early March results indicate that the market’s performance is about 15 percent better than sales volumes achieved in February. If this pace continues (supply permitting with no further hikes in the benchmark rate) then March should achieve approximately 5,500 sales, if not more. That means we will see sales numbers that have not been achieved since August of 2022. The market is finally showing signs of moving in a positive direction.

Have questions about the market, selling or buying?

Contact me any time. I’m happy to answer any questions you may have.

Prepared by Chris Kapches, LLB, President and CEO, Broker, Chestnut Park® Real Estate Limited, Brokerage.