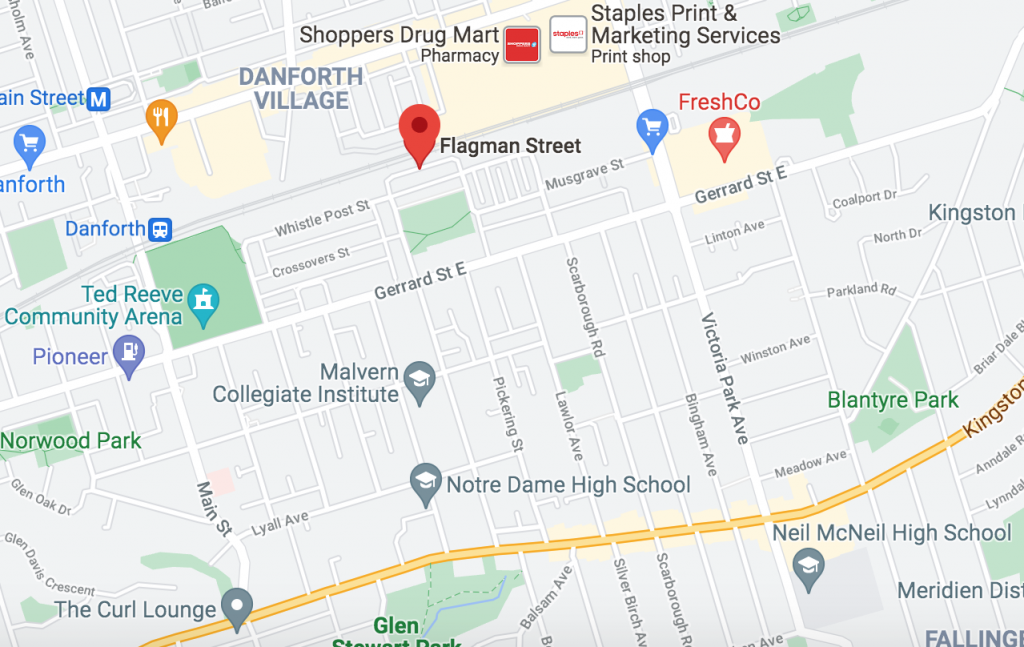

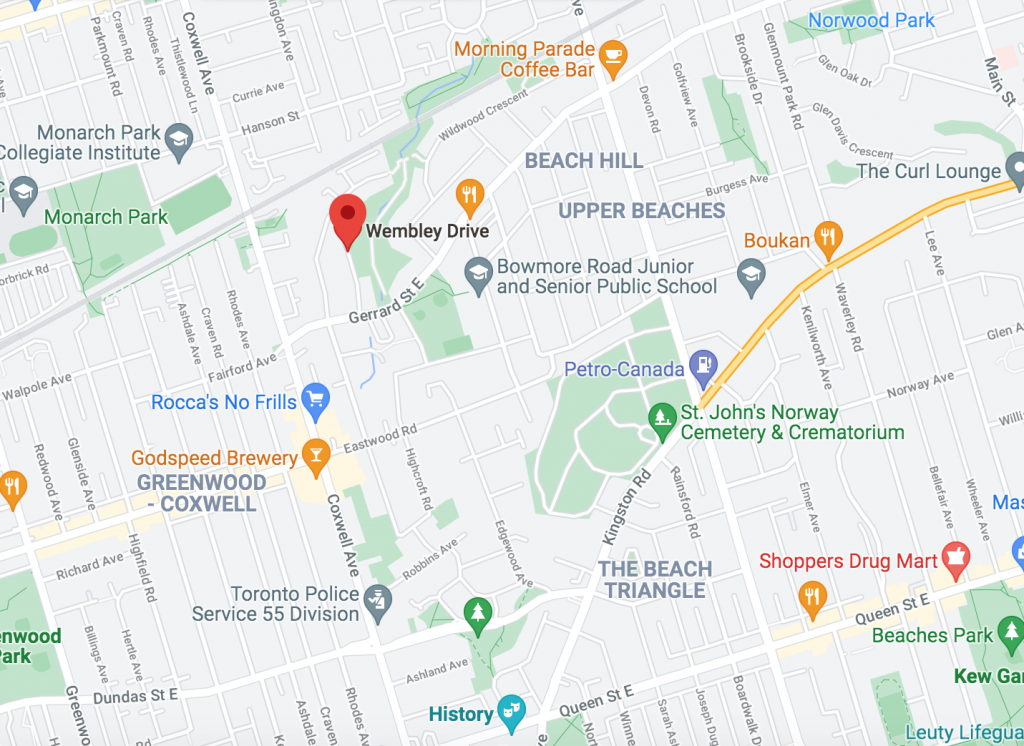

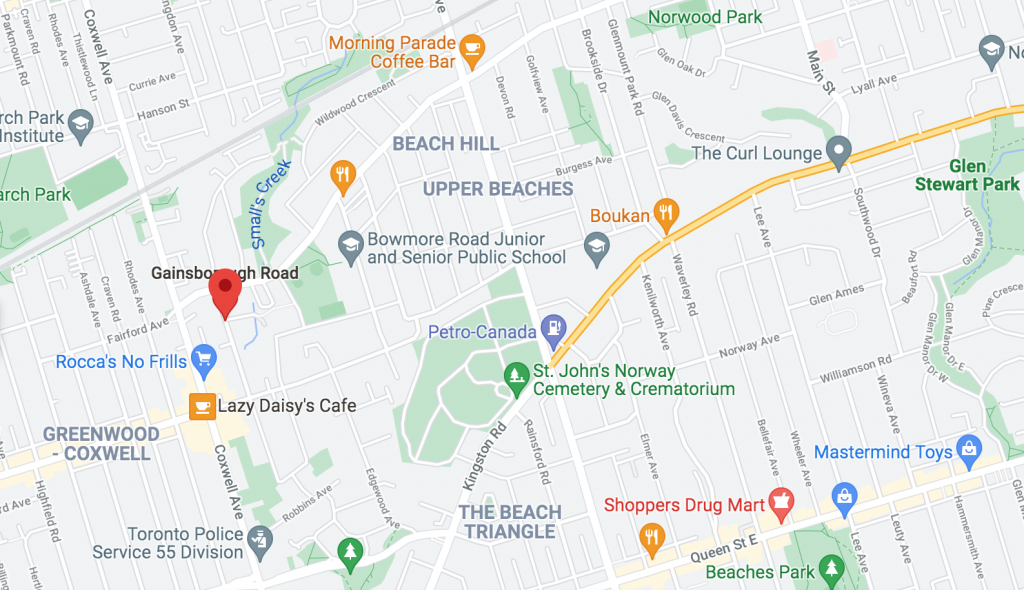

The Upper Beaches community is one of Toronto’s most popular neighbourhoods amongst buyers, especially young professionals looking to transition from condo living to a freehold home. With its enchanting tree-lined streets, historical homes that date back to the 1800’s, spacious parks, family friendly and dog loving neighbours, it’s no surprise that so many buyers want to live in this great neighbourhood. These are just some of the many reasons why I personally choose to live in this area of Toronto and why I highly recommend it to my clients who are looking to move the east end of the city.

The Upper Beaches mostly consists of older smaller detached and semi detached homes making them an ideal transitional property for those looking to move to a larger space from a condo and those looking to downsize from larger homes.

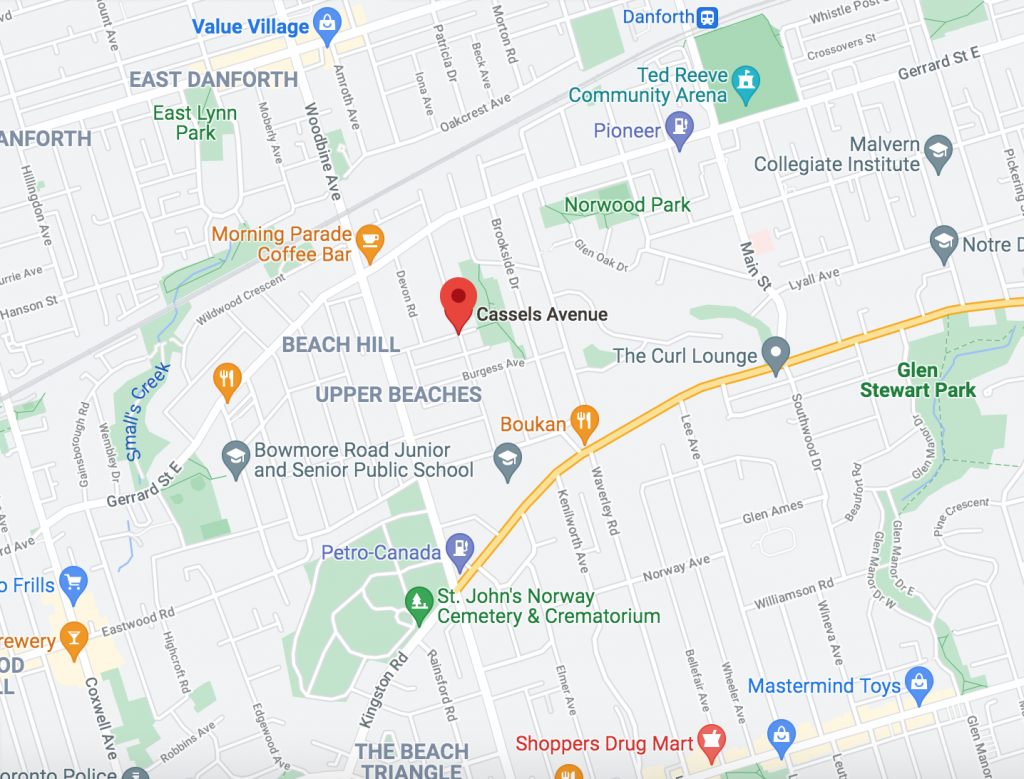

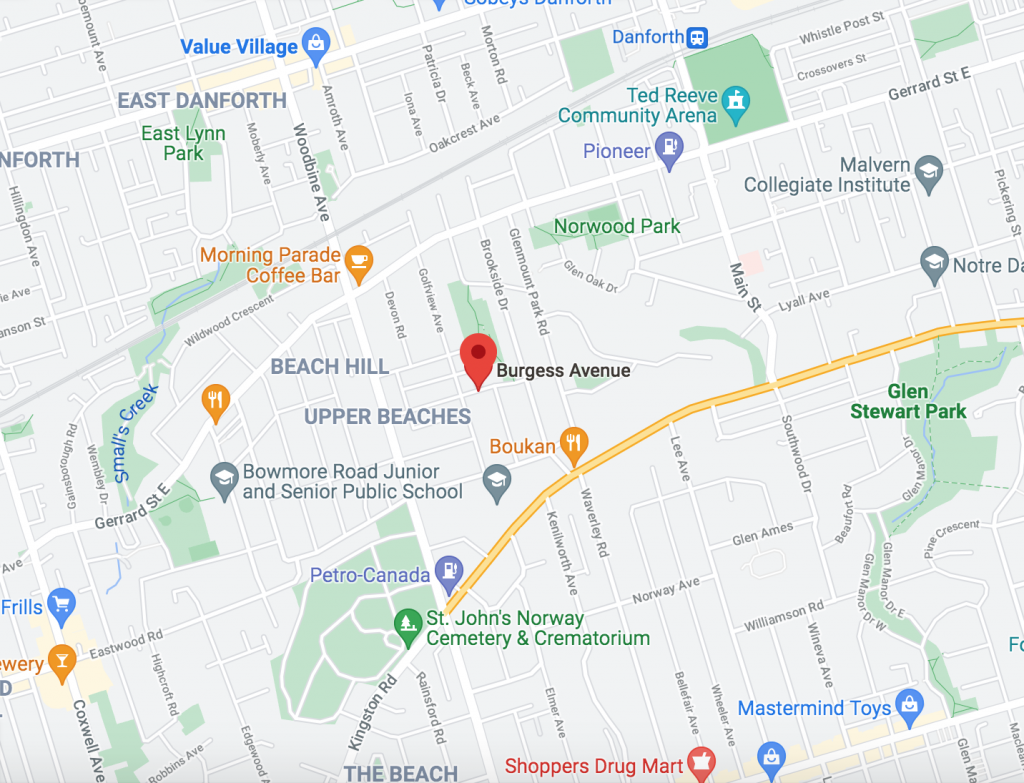

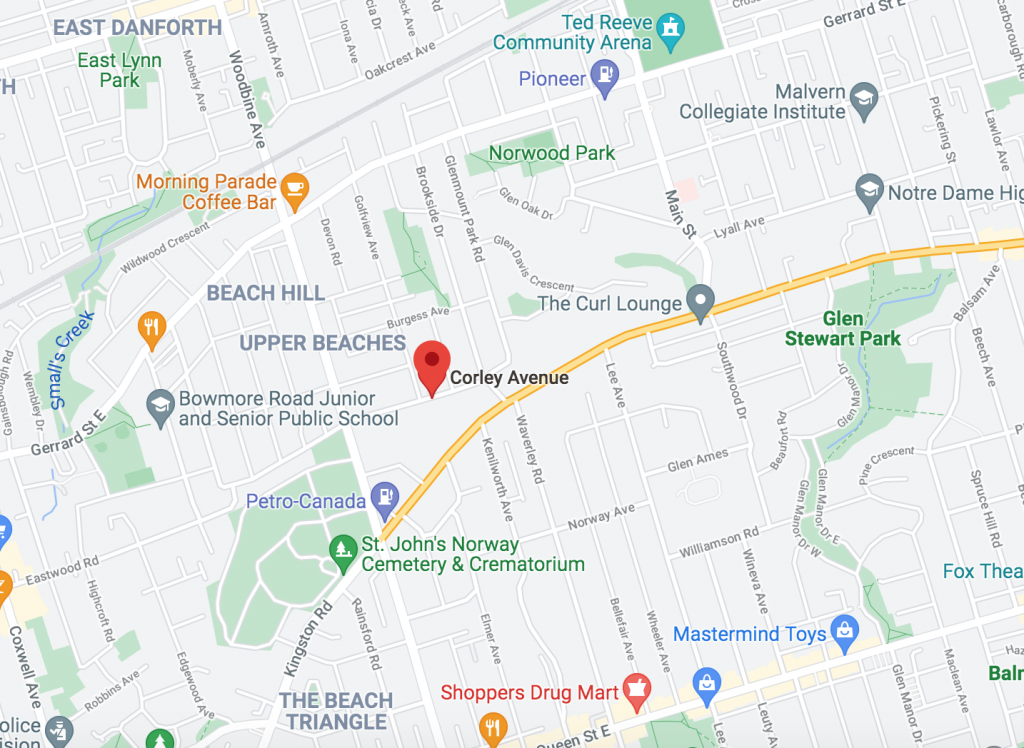

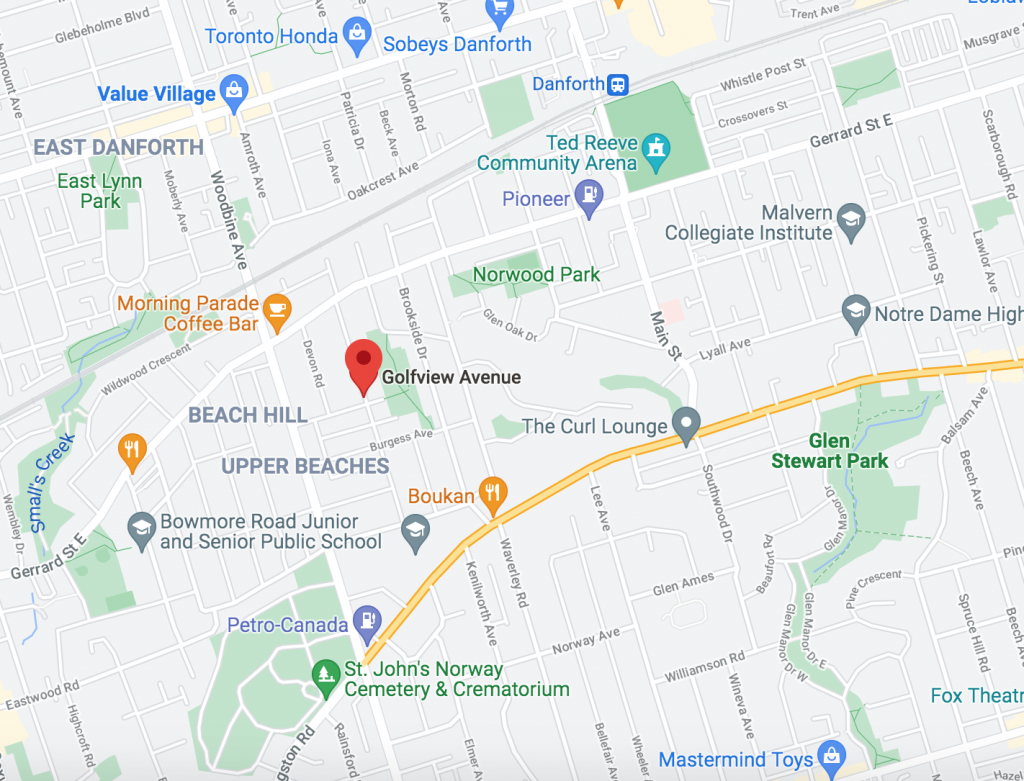

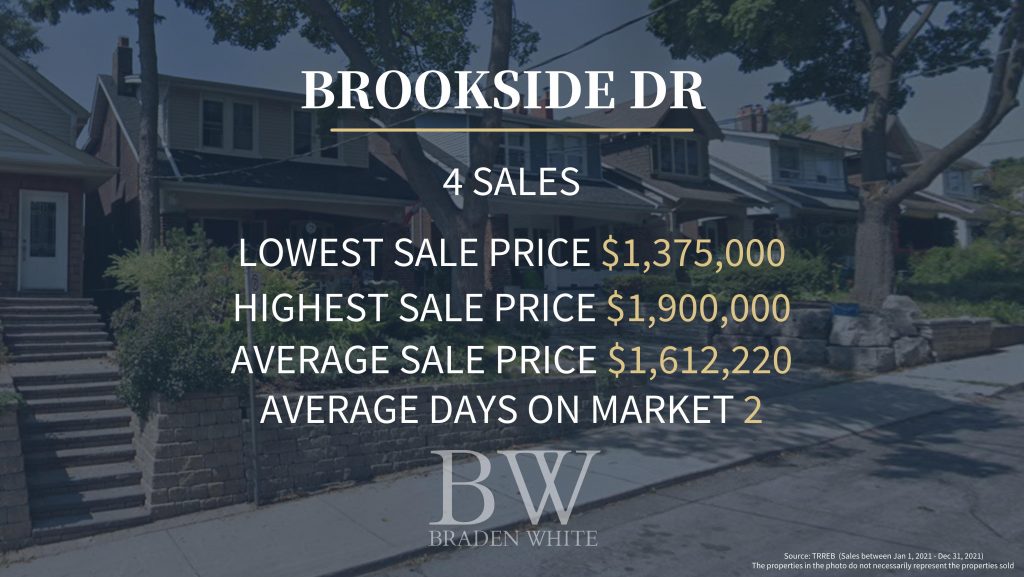

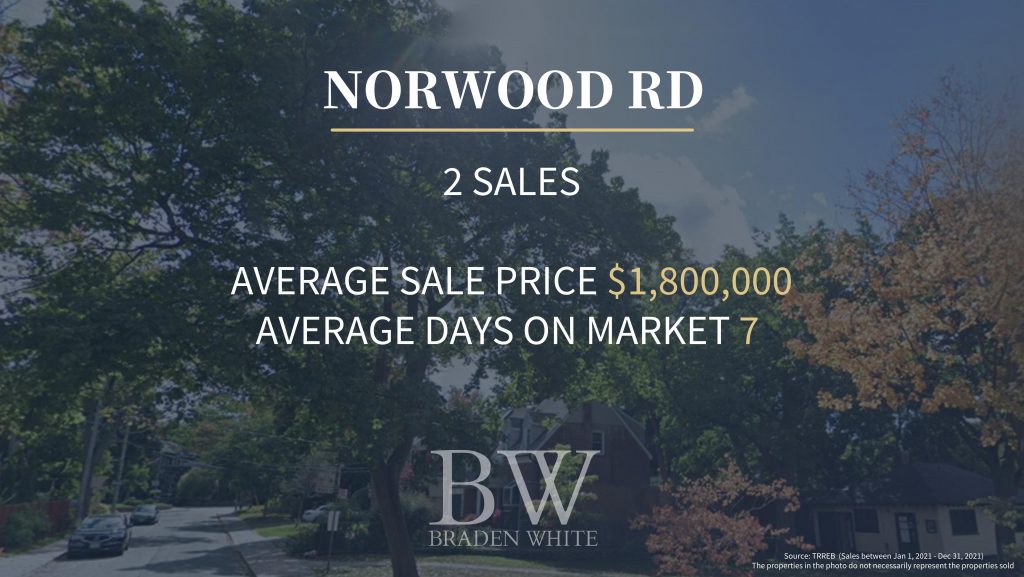

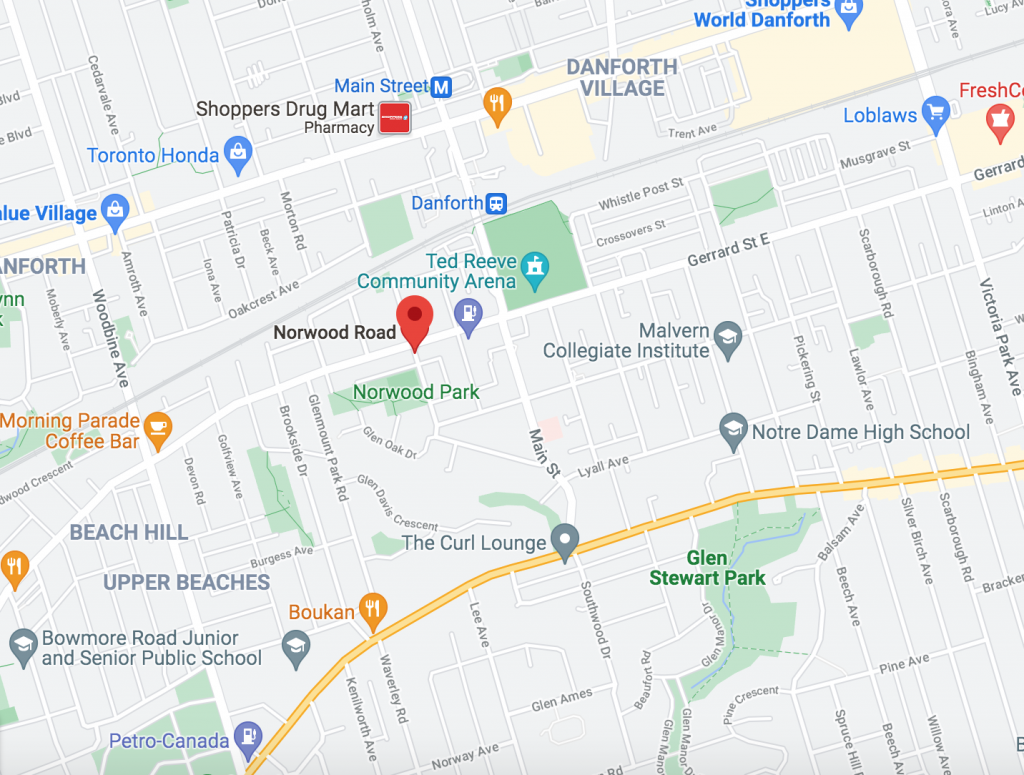

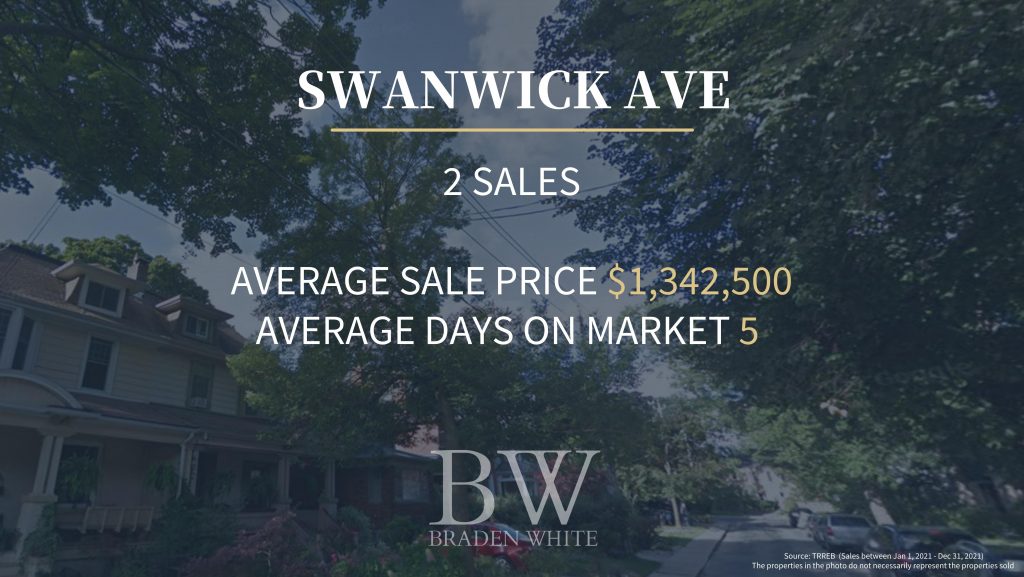

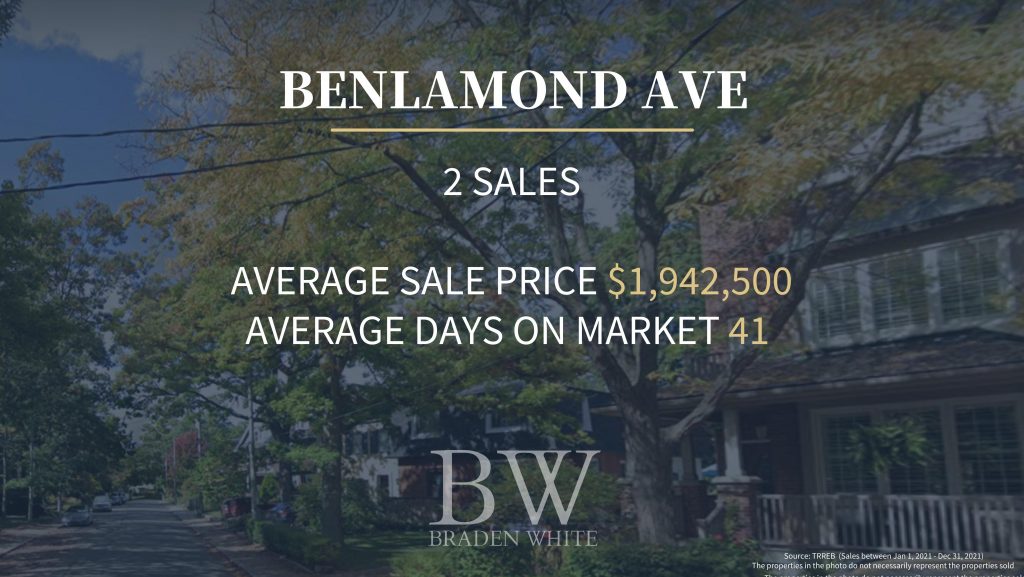

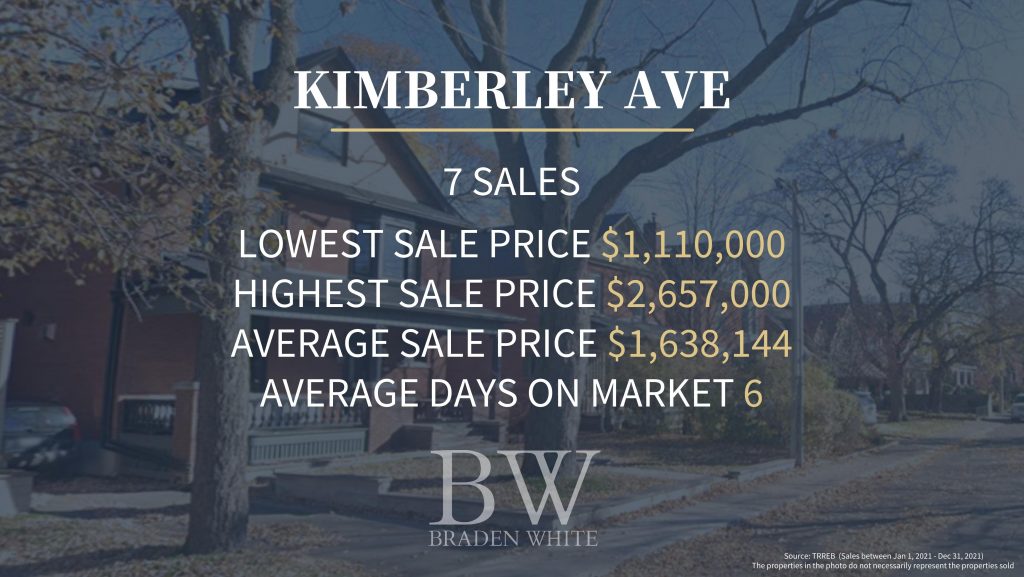

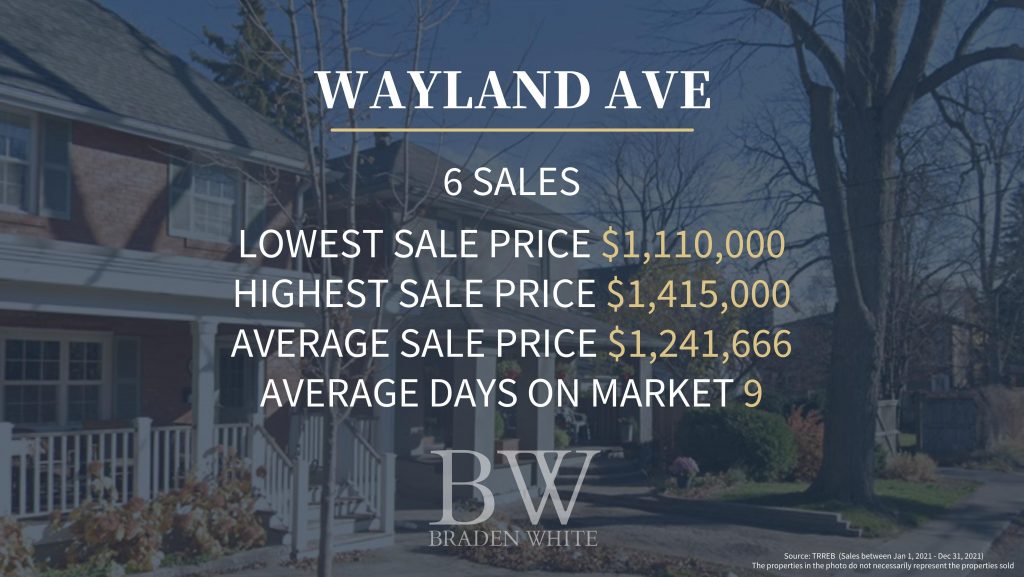

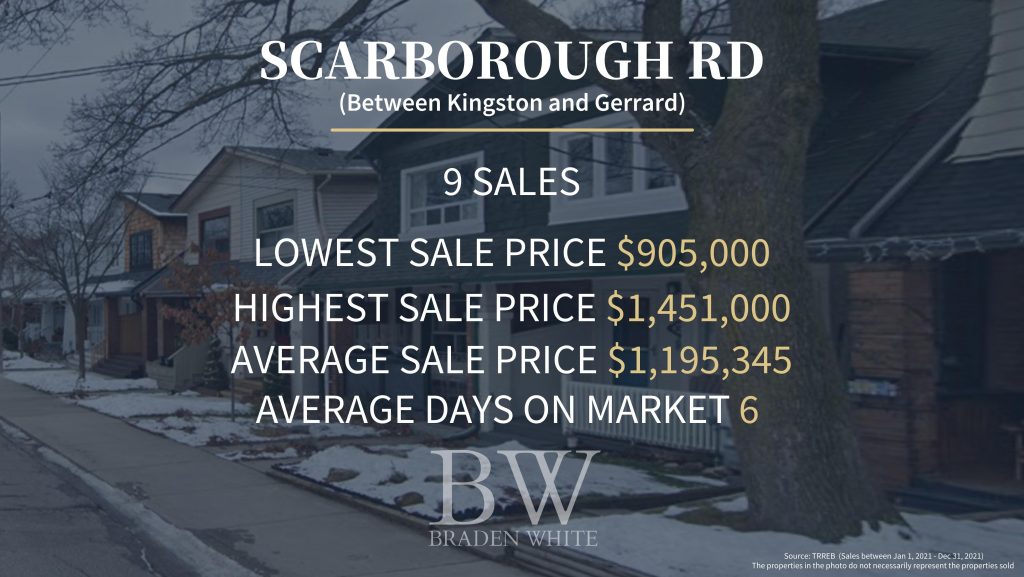

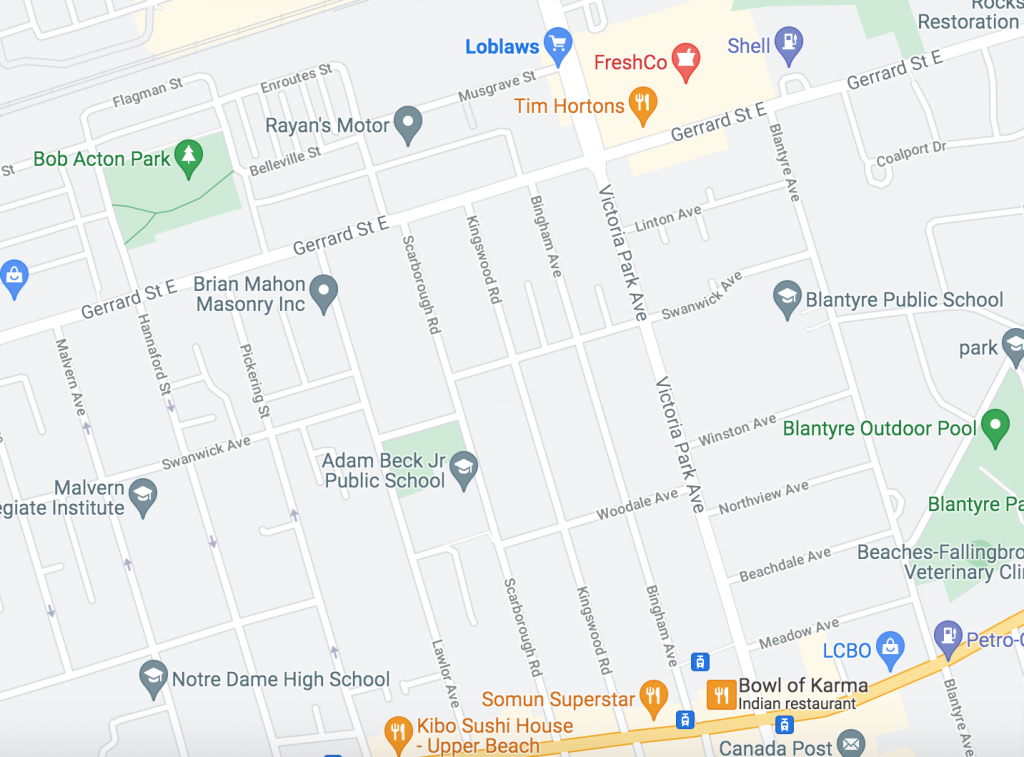

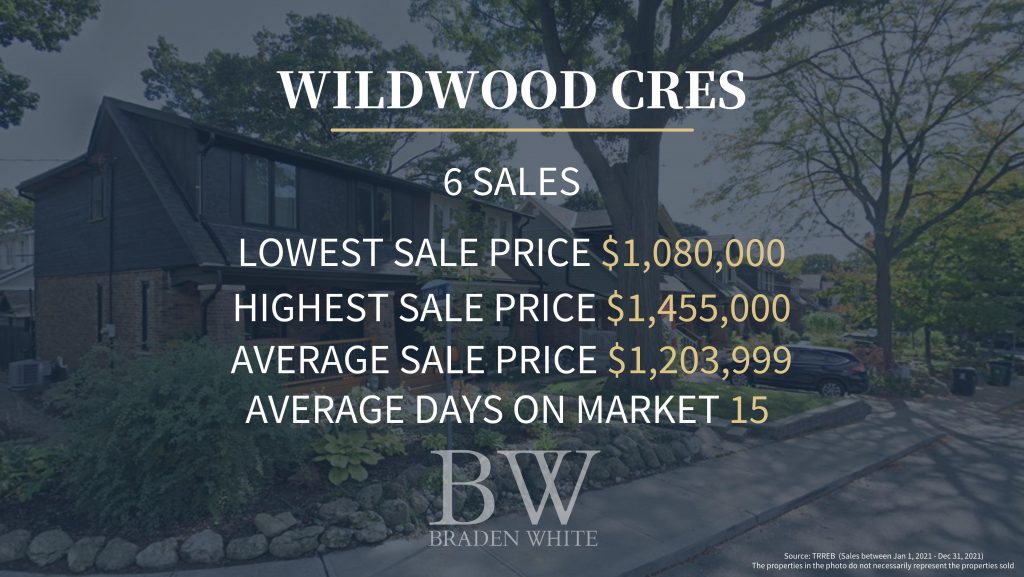

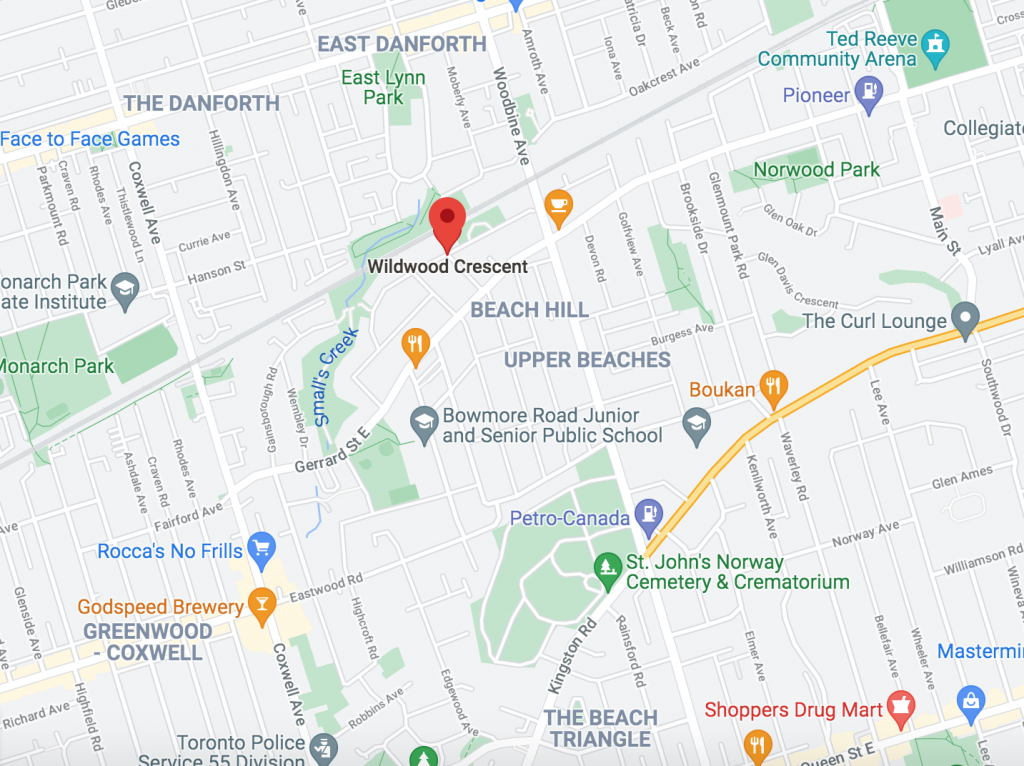

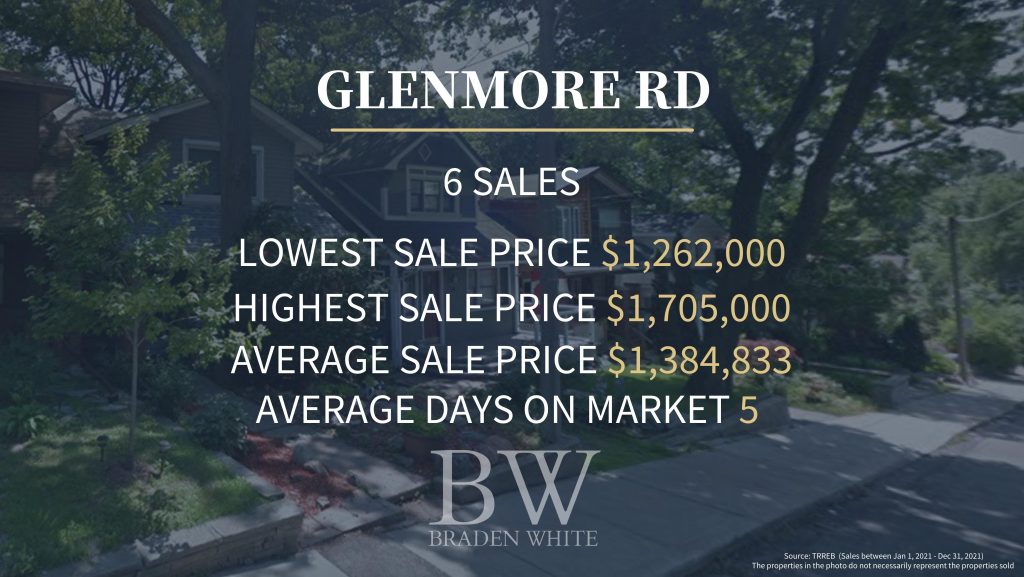

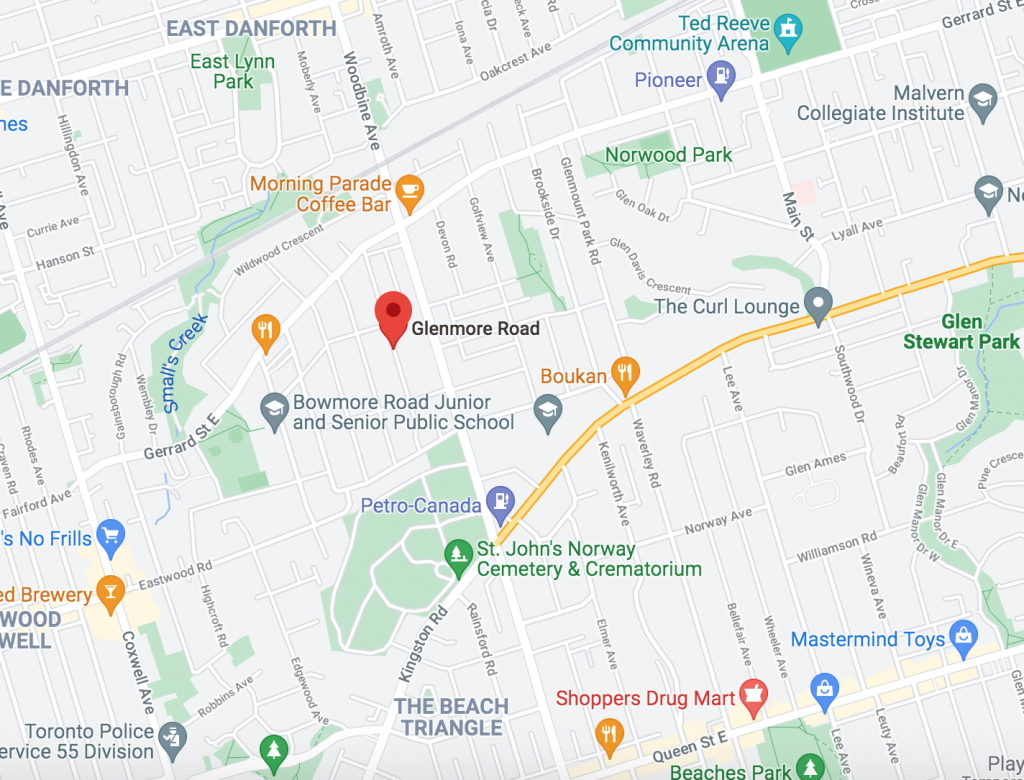

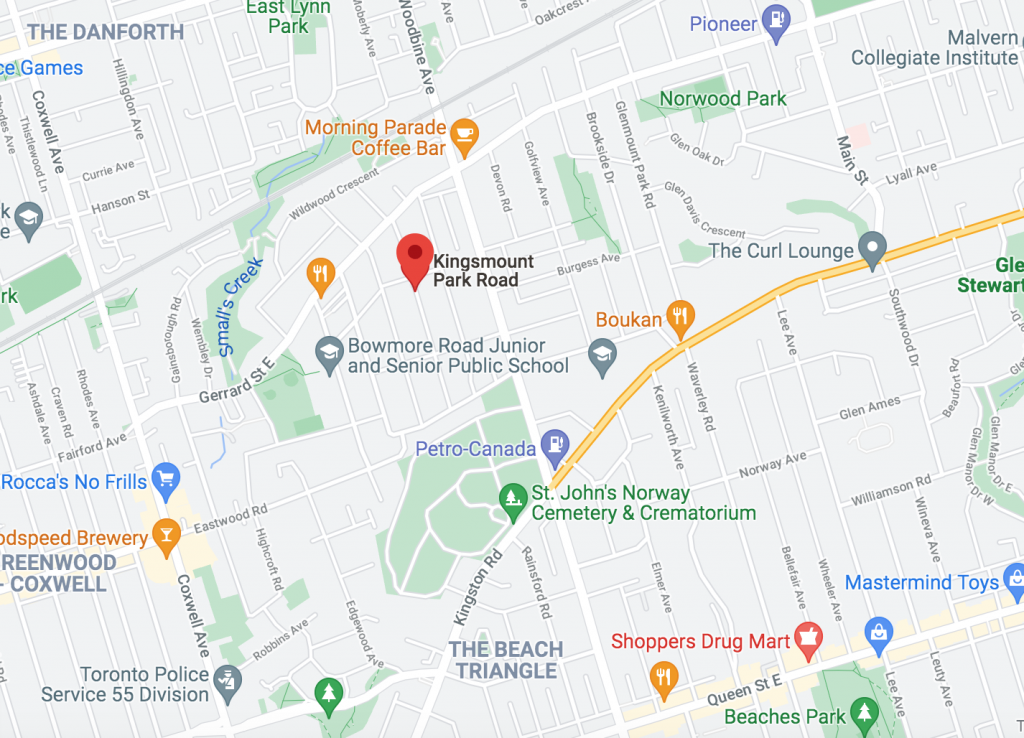

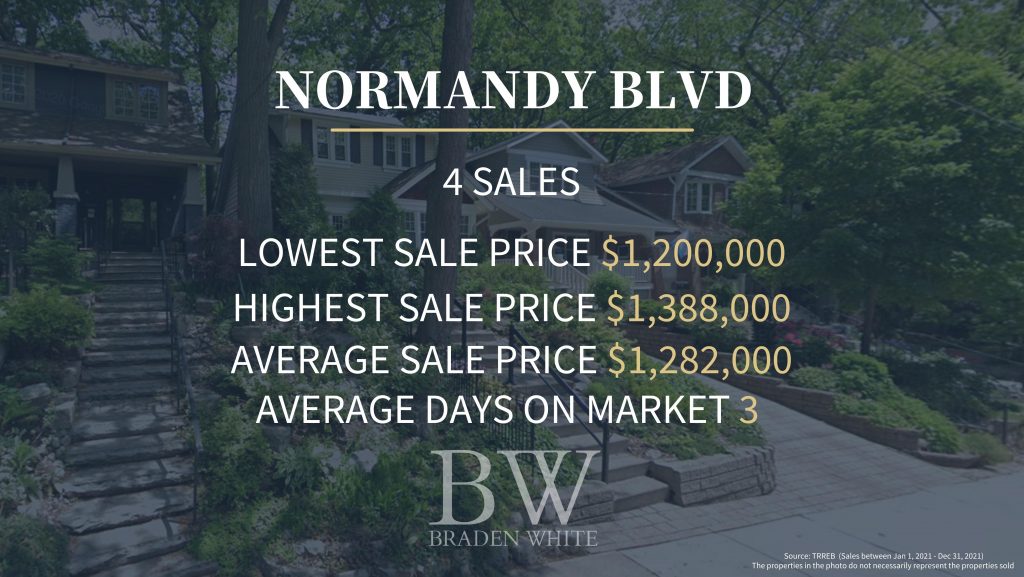

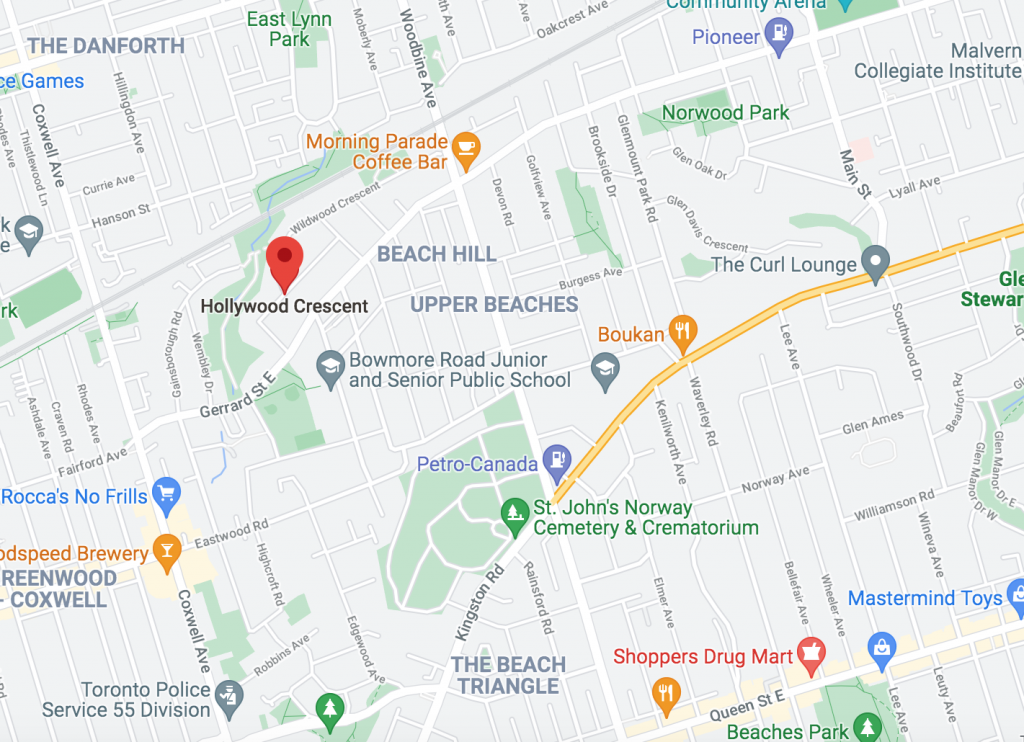

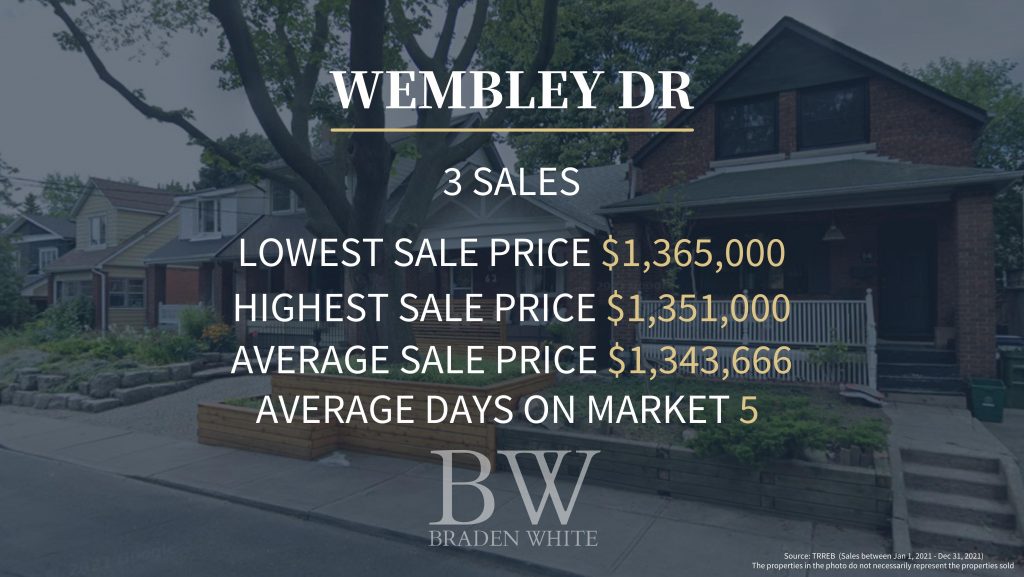

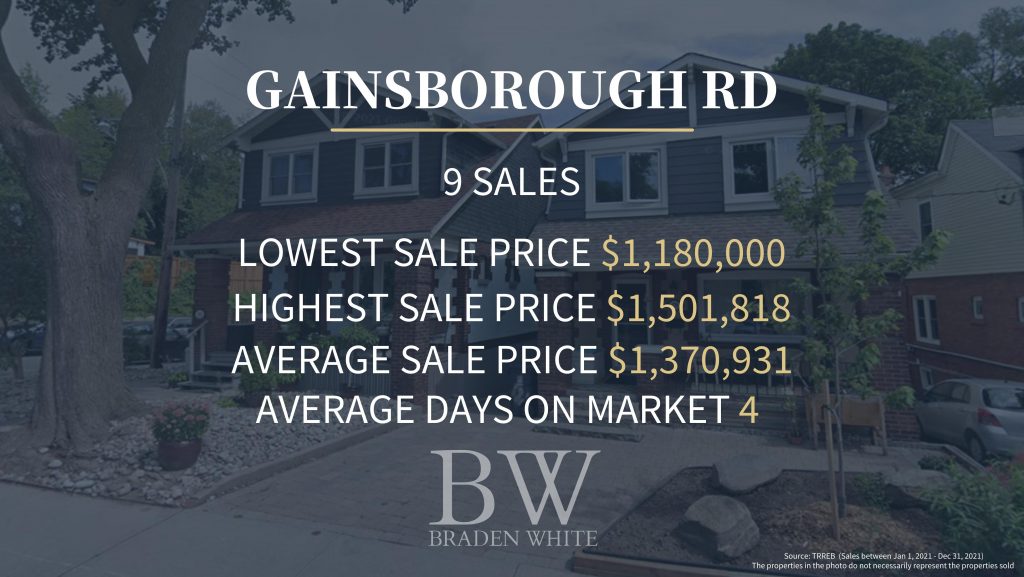

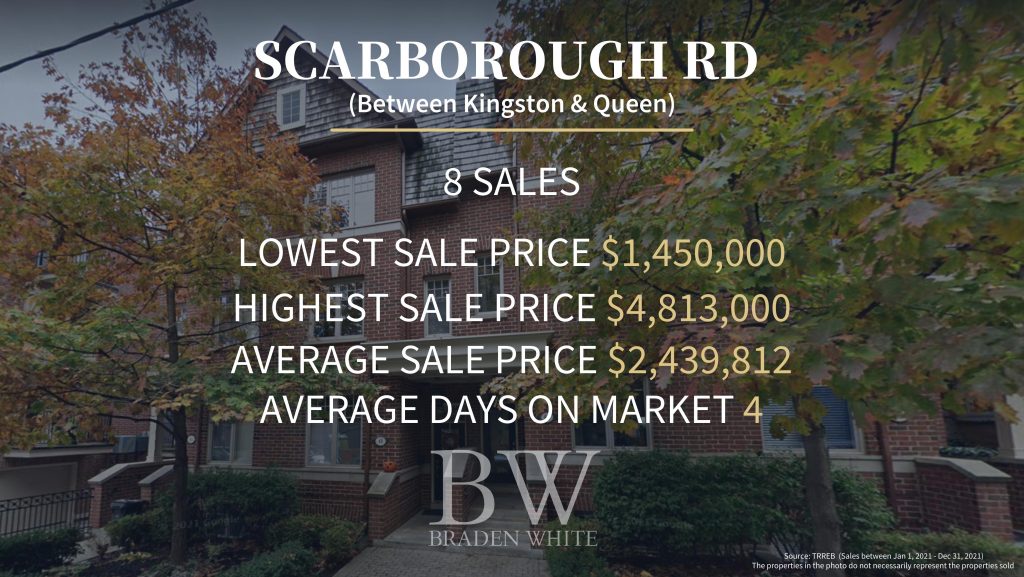

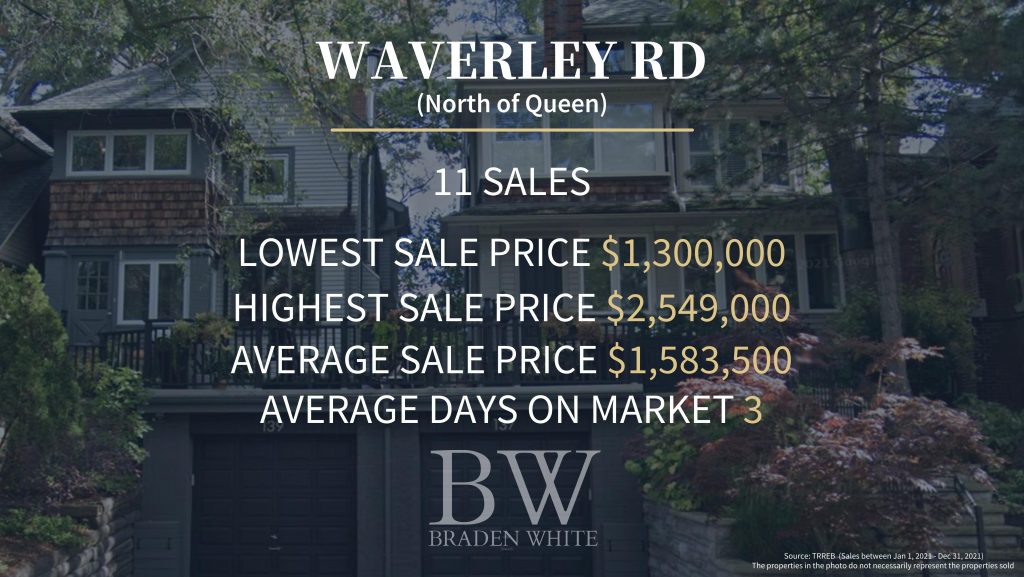

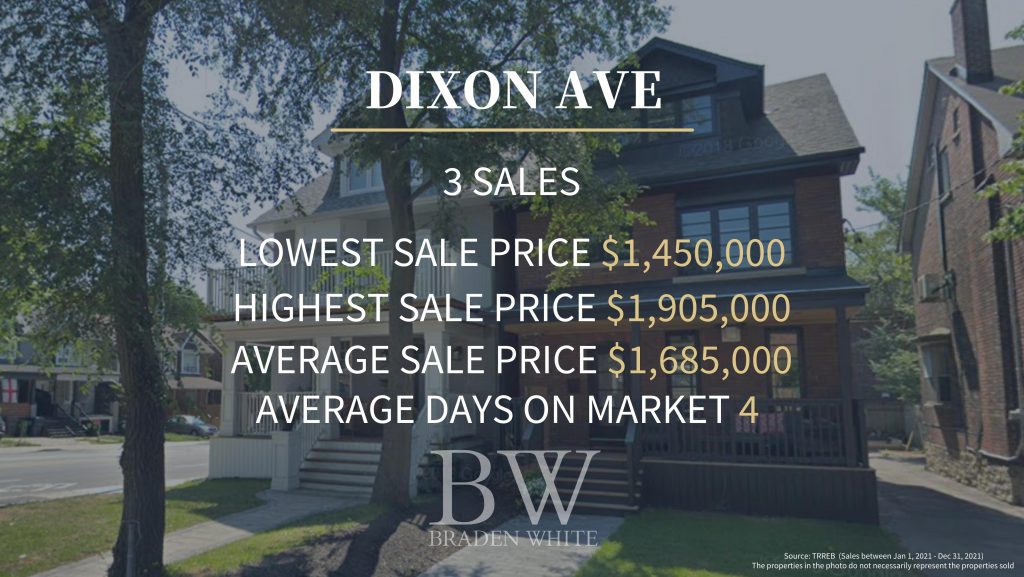

When assisting my buyer clients, they often ask me how much homes cost in The Upper Beaches. If you are reading this post, you’re likely looking for the same answer or you are fortunate enough to already live in The Upper Beaches and are curious to know how much homes are selling for in your neighbourhood. In order to answer this question and to provide you with a point of reference, I have put together a list of some of the top streets in The Upper Beaches along with the lowest and highest sale prices for each street as well as the average sale price and average days on market. All of the stats are based on sales that have taken place between January 1, 2021 and December 31, 2021. Although this list is extensive, it doesn’t include every single street in the area.

If you don’t see your street of interest included in the list, feel free to contact me to find out the stats for your specific street of interest or to ask any questions you may have about the market or selling or buying in The Upper Beaches. I’m always here and happy to help.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Source of stats: TRREB

(Sales between January 1, 2021 – December 31, 2021. Figures do not included off market sales)

The homes in the photos do not necessarily represent the homes sold in 2021. All photos are publicly available photos. Streets with one or less sale have intentionally been left out due to privacy reasons.

Are you considering selling your home in The Upper Beaches or thinking of buying a home in this amazing community?

Contact me today to discuss how I can help you with achieving your specific real estate objectives in The Upper Beaches. I look forward to speaking with you.

Interested in seeing how much homes sold for in The Beaches? Visit my other recent post relating to pricing in The Beaches HERE.

In 2021 we experienced an unprecedented residential resale market. More records were shattered in 2021 than in any other year of record keeping – sales prices, properties sold, and, unfortunately, inventory levels all established new records. As we end 2021 and move into 2022, it will be inventory that will have the greatest impact on the resale market.

Let’s begin with December’s data.

Sales declined in December as compared to 2020 only because of a lack of inventory. Demand continues to be at record breaking levels, but to put it bluntly, there just weren’t enough properties on the market for buyers to purchase. That is dramatically illustrated by the fact notwithstanding declining sales, the average sale price for all properties sold, including condominium apartments, came in at $1,157,849, 24.2 percent higher than December 2020.

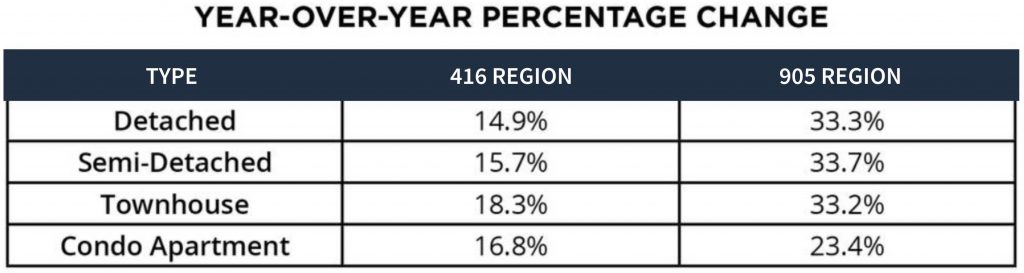

It should be noted that increases in average sale prices were substantially higher in the 905 region as compared to price increase in the City of Toronto, as the chart below clearly illustrates.

The increase in average sale prices in the 905 region during the pandemic has been nothing but stunning. As forecast in a monthly Market Report earlier in 2021, the difference in average sale price between properties in the City of Toronto and the 905 region has all but disappeared. The reasons for this market change are due to the pandemic driving buyers away from the denser concentration of population in the City of Toronto, the ability to work remotely, affordability, and supply. It would now appear the attraction of supply and affordability may no longer exist.

The luxury end of the resale market also broke records in 2021. In December 473 properties traded hands having a sale price of $2 Million or more. Last year only 287 properties sold in this price category. On a year-to- date comparison, 7,807 properties valued at $2 Million or more sold in 2021 compared to only 3,649 last year, an increase of 114 percent. Sales in the 905 region in this category contributed substantially to this increase in 2021. Detached property sales in Oakville, King, Richmond Hill, Whitchurch-Stouffville and Uxbridge all came in with average sale prices in excess of $2 Million, with King approaching an average sale price of $3 Million. Historically this only happened in central Toronto.

Throughout the greater Toronto area average sale prices continued to be eye-poppingly higher than asking prices. This is also a strong indicator of demand, first witnessed after buyers adjusted to the protocols of viewing and buying properties during the first wave of the pandemic in May and June of 2020. For example, in Oshawa, all properties presented to the market sold in only 9 (yes 9!) days at sale prices 121 percent of their asking price. The case was the same in Pickering. Two trading areas in Toronto also exceeded sale prices of 120 percent or more than asking prices. We are short of superlatives to describe this phenomenon.

In 2021, the condominium apartment sector came back very robustly after pandemic fears in 2020 caused it to shrink dramatically. With that revived interest in condominium apartment living came rising prices, and perhaps most shockingly, the disappearance of condominium apartment inventory. In central Toronto, where most condominium apartments are located, 977 sold in December, last year over 1,000 apartments sold in the same trading area. The decline was due to lack of supply. On the price side, those 977 condominium apartments sold for $790,611, almost 20 percent higher than last December’s average sale price of $669,000.

The decline in condominium apartment supply over the course of 2021 has been breathtaking. In December of 2020 there were 4,294 active condominium apartment listings in the greater Toronto area, and 3,120 in the City of Toronto, the bulk of those to be found in the central core of the city. As 2021 comes to a close, there were only 1,488 active listings in the entire greater Toronto area and a paltry 1,189 in the City of Toronto, 20 percent fewer than the 1,447 condominium apartments that sold in December! The only source of affordable housing is disappearing.

Overall, 2021 proved to be the strongest year in recorded resale history. Total number of sales for the year came in at 121,712 surpassing 2016, the previous best year, by more than 7 percent. In 2016 113,040 properties traded hands. During 2021, except for January ($966,068) every month saw the average sale price exceed $1 Million, with November setting a new record at $1,163,287. A truly exceptional year!

How the market performs in 2022 will depend entirely on supply. December’s numbers are not encouraging. During December 5,174 new properties came to market, almost 12 percent fewer than came to market in 2020. What is even more shocking is the fact that entering 2022 there are only 3,232 active listings for the entire greater Toronto area, more than 46 percent of which are condominium apartments. By contrast last year there were 7,892 active listings which at the time we reported were totally inadequate to meet the growing pandemic demand.

Many economists have deemed 1996 to be the year that the Toronto and area market broke from its six year recessional slide and began to show signs of strength and robustness that have continued through to today’s market. That year set a record for sales at 55,779. In 1996 the population of the greater Toronto area was approximately 4.2 million people. Since then the population of the greater Toronto area has grown to well over 7 million people. In December of 1996 the Toronto Real Estate Board reported that there were 16,964 active listings available to buyers in the greater Toronto area. At 3,232 active listings this December, we find ourselves with only 1⁄4 of the listings available to buyers in 1996, and we have a lot more buyers.

So supply will be the major driver in 2022. As immigration numbers to the greater Toronto area will continue to increase, even more supply will be necessary. It will take aggressive, innovative, and rapid thinking, planning and decision-making by all three levels of government alleviate this housing crunch.

Prepared by Chris Kapches, LLB, President and CEO, Broker, Chestnut Park® Real Estate Limited, Brokerage.

Have questions about the market, selling or buying?

Contact me any time. I’m happy to answer any questions you may have.

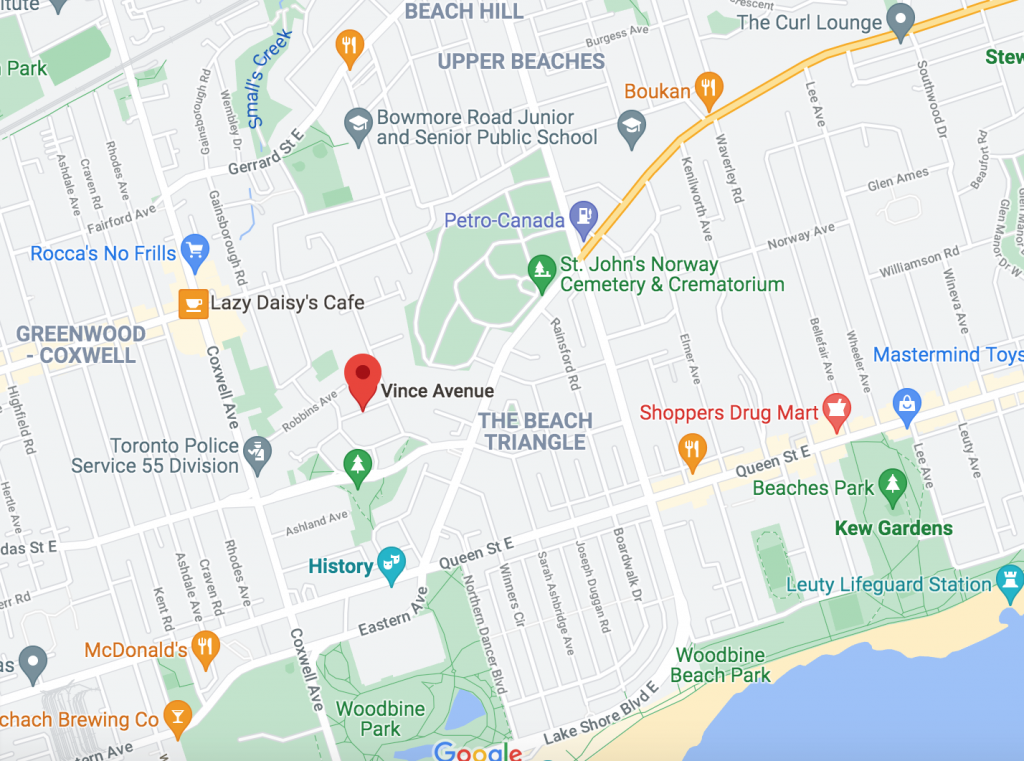

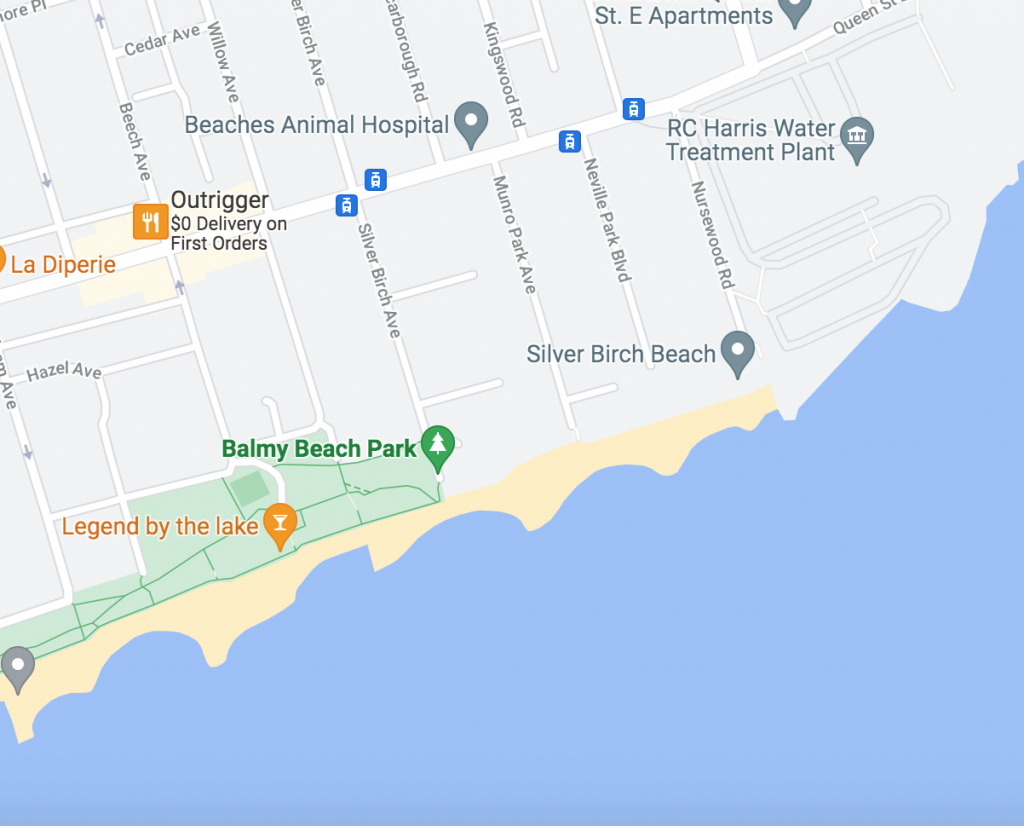

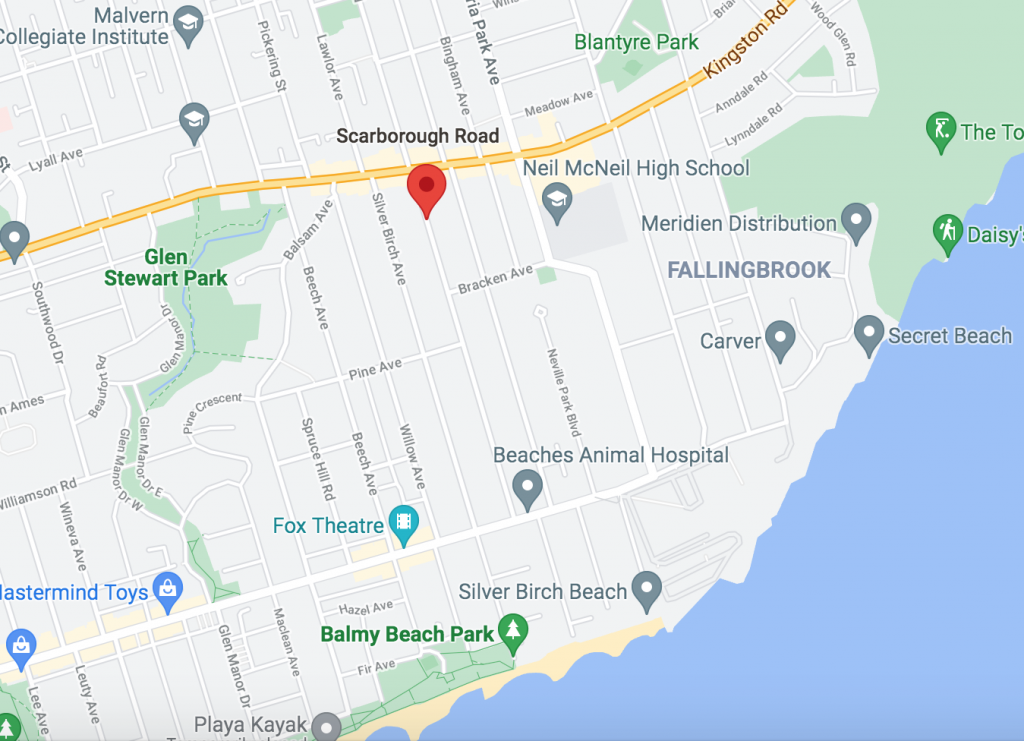

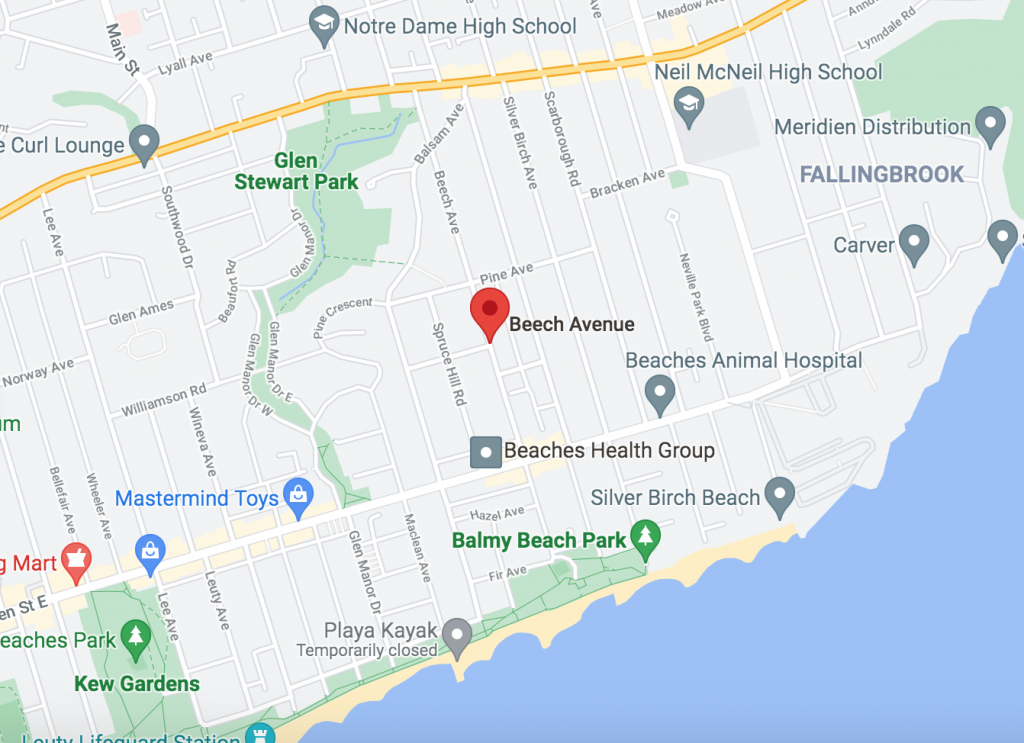

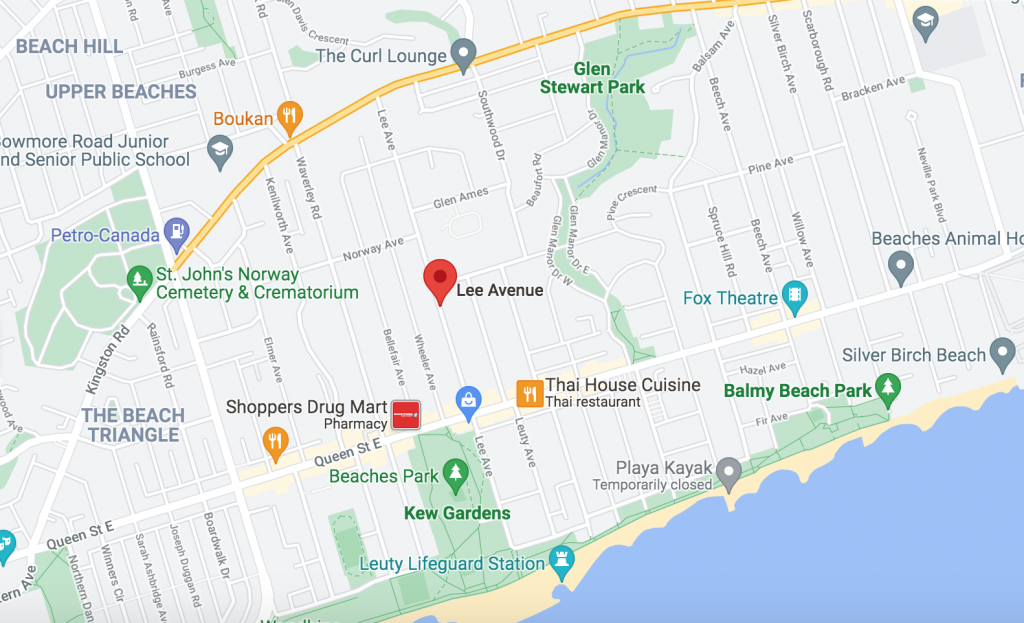

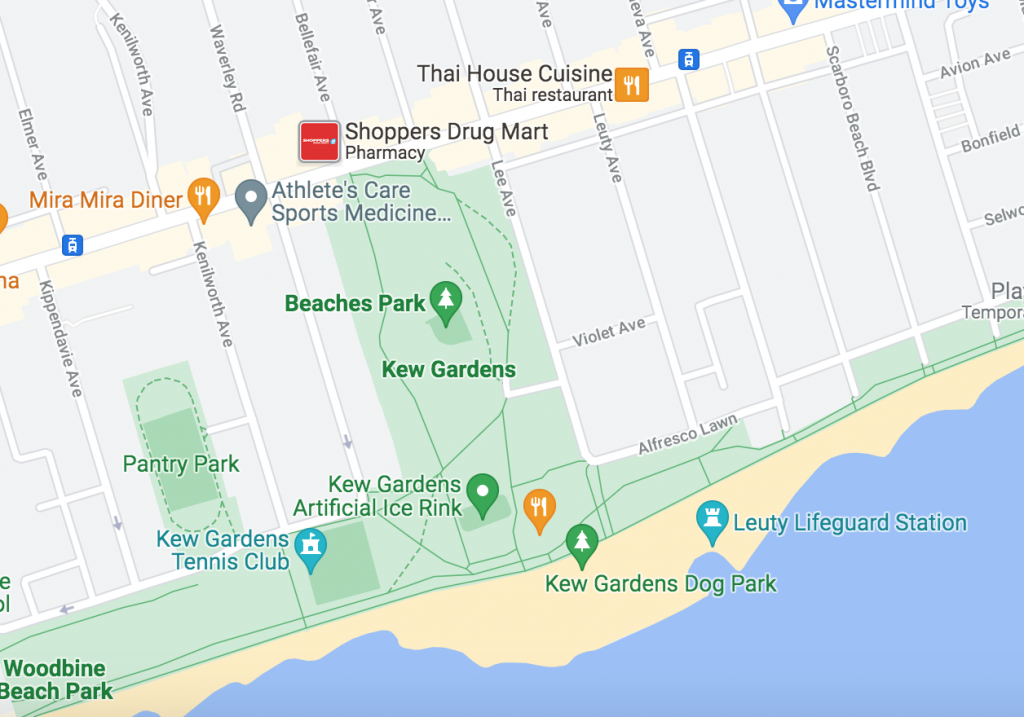

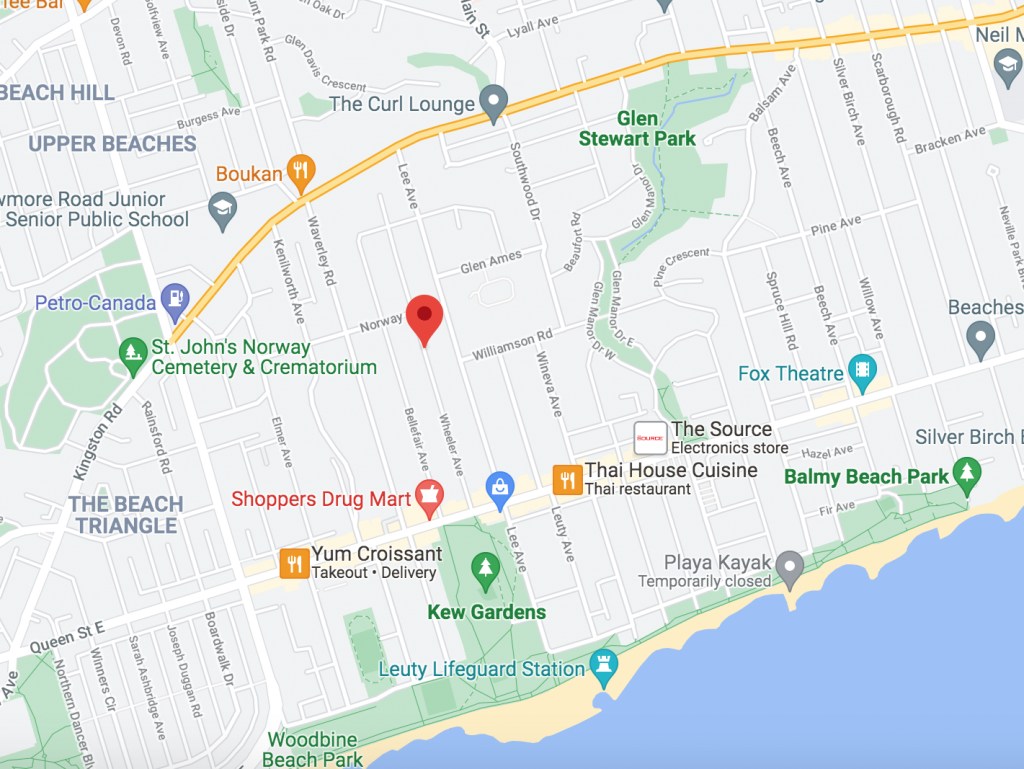

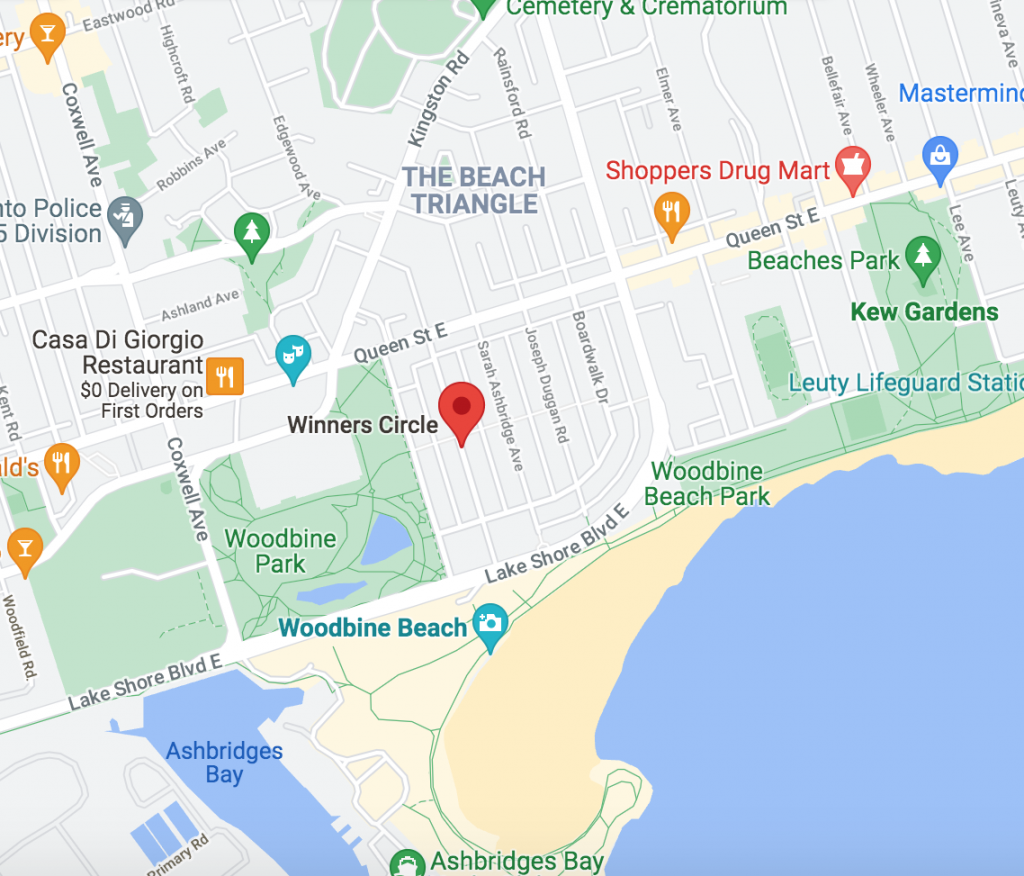

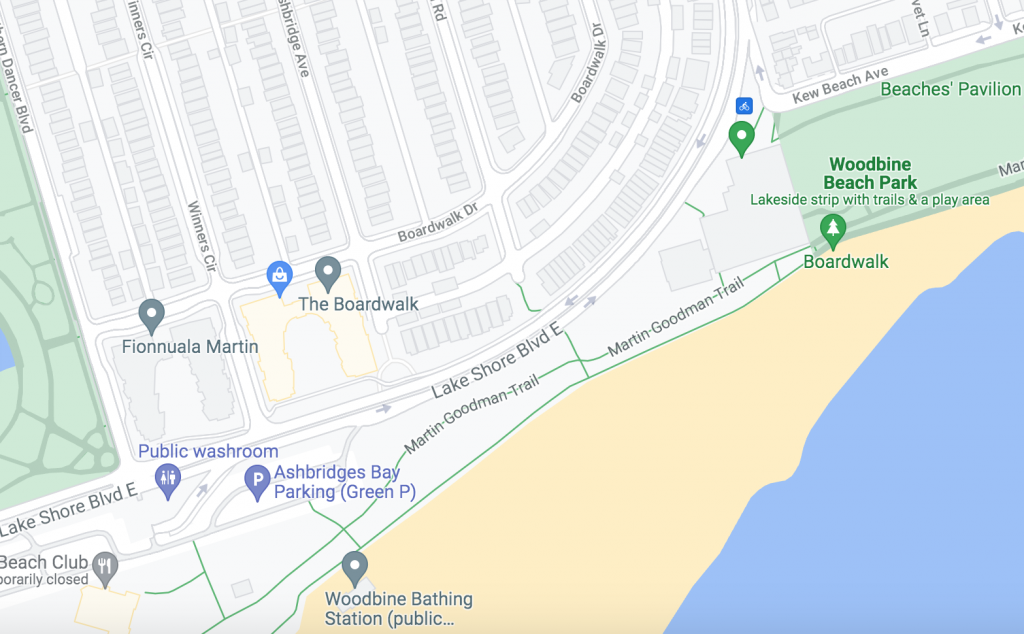

The Beaches community is one of the highest sought after neighbourhoods for buyers in Toronto. With its beautiful tree-lined streets, charming and historical homes, long historical boardwalk, stunning sunrise views from the beach, winter warrior surfers, family friendly and dog loving neighbours, there’s no surprise that so many people want to live in this charming and picturesque neighbourhood. These are just some of the many reasons why I personally choose to live in this area of Toronto and why I highly recommend it to my buyer clients.

The Beaches offers a variety of styles and sizes of homes. Although the neighbourhood mostly consists of older detached and semi-detached homes, many of the homes have been updated and in some cases torn down and replaced with new modern homes or newer versions of the old architectural style.

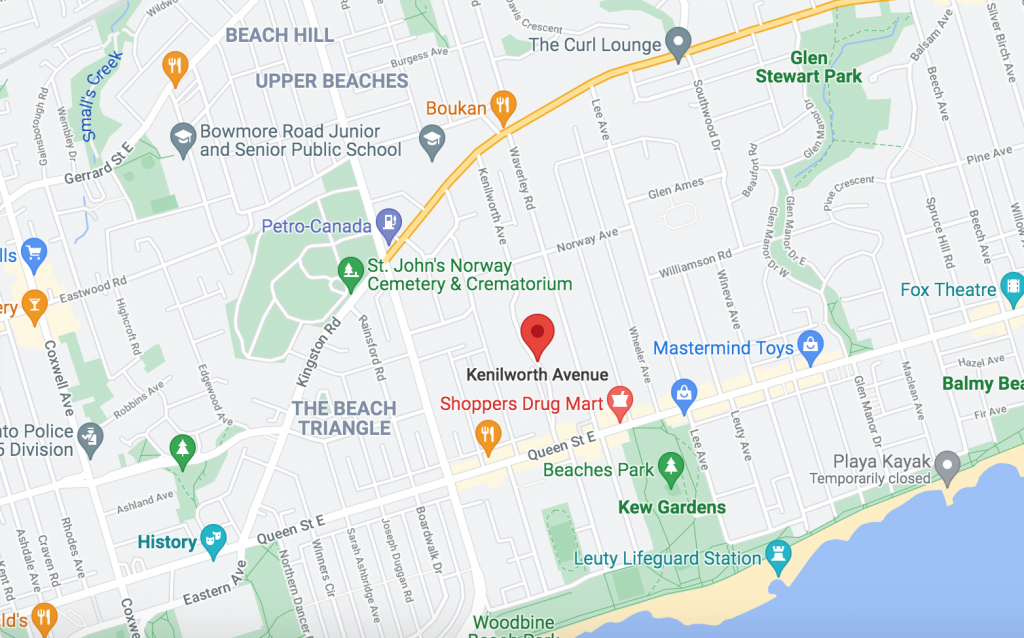

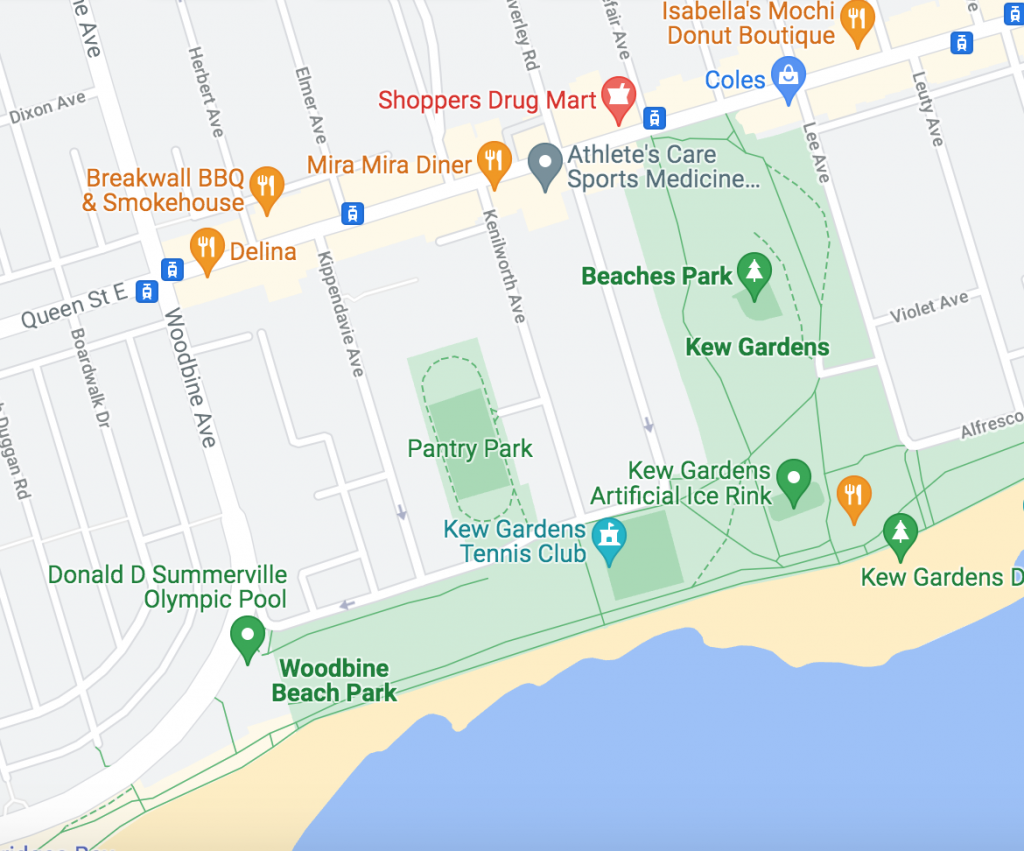

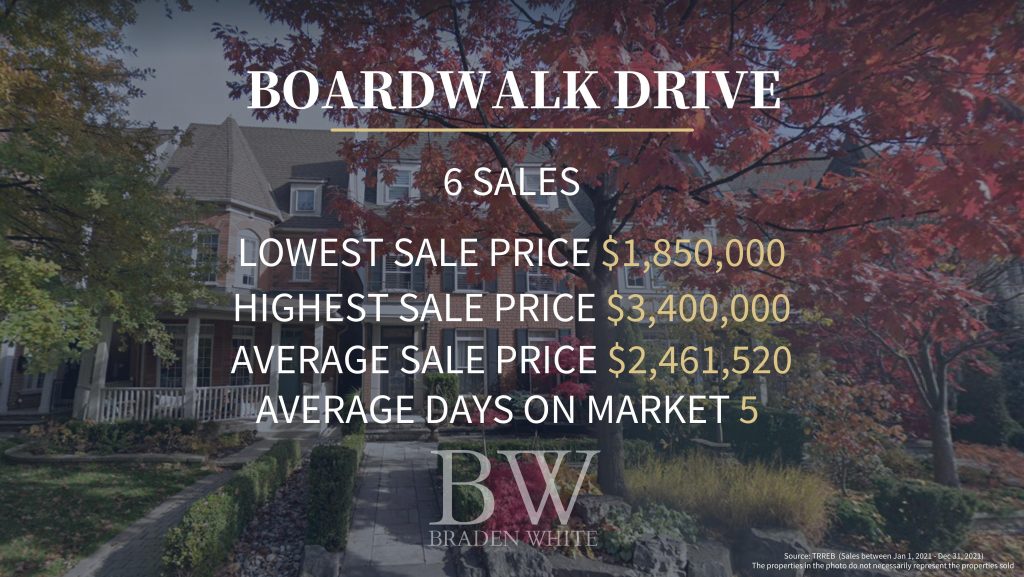

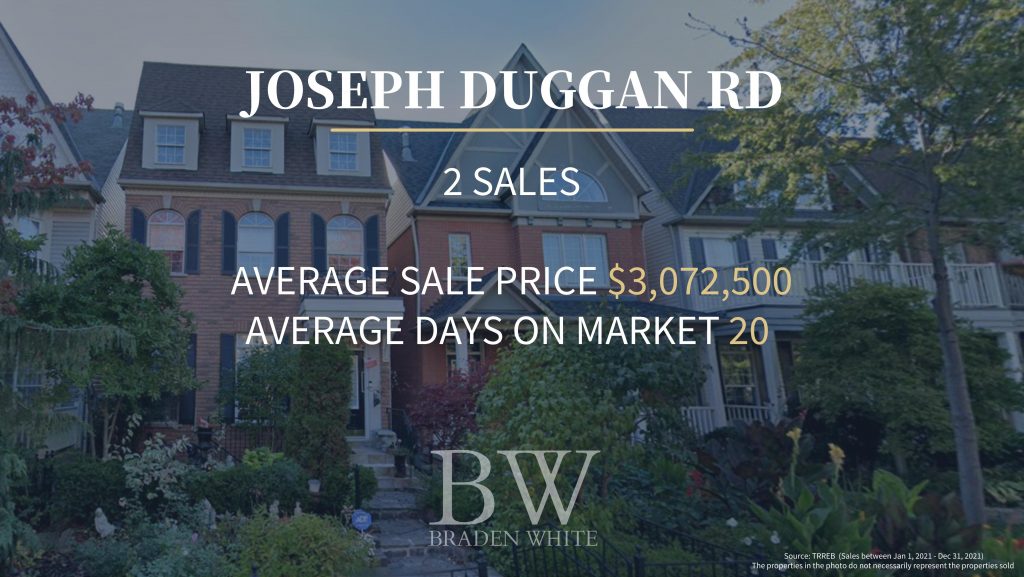

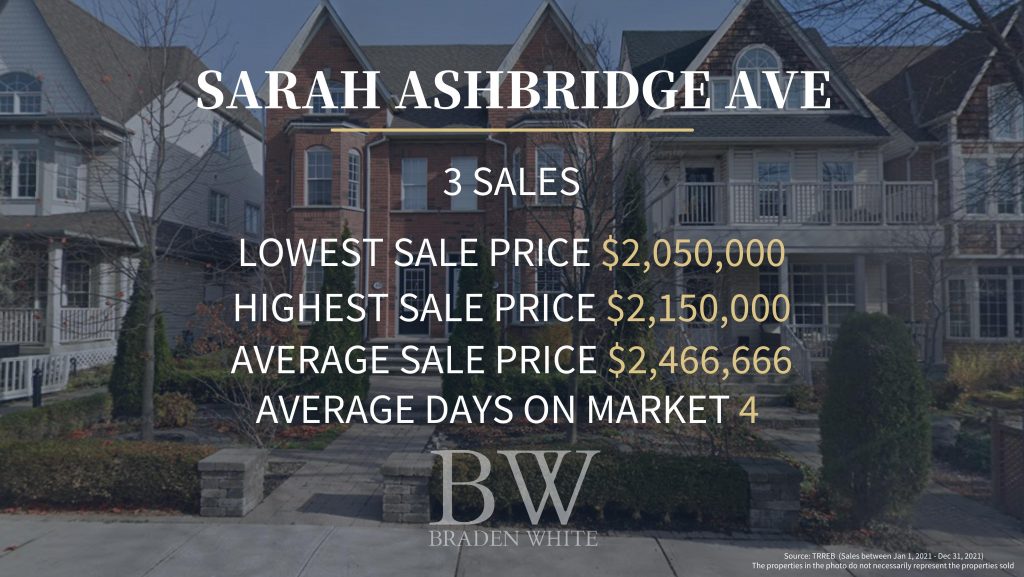

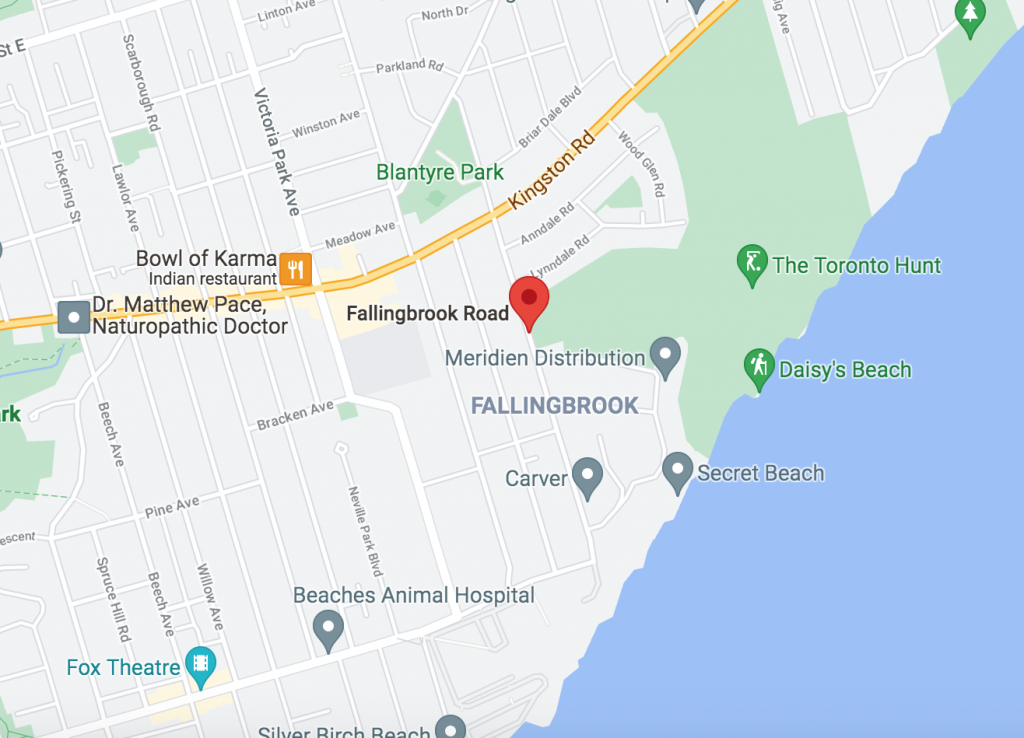

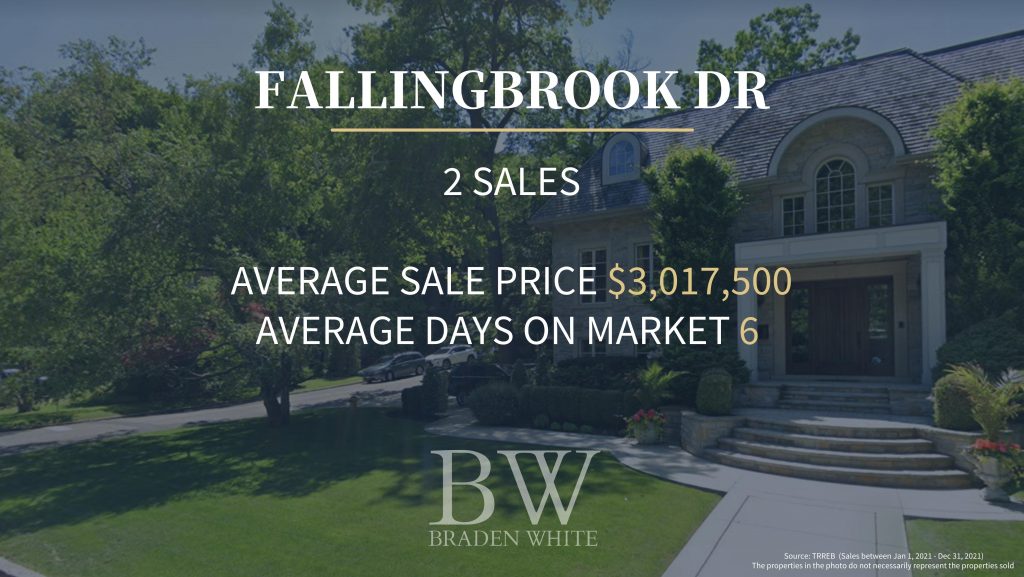

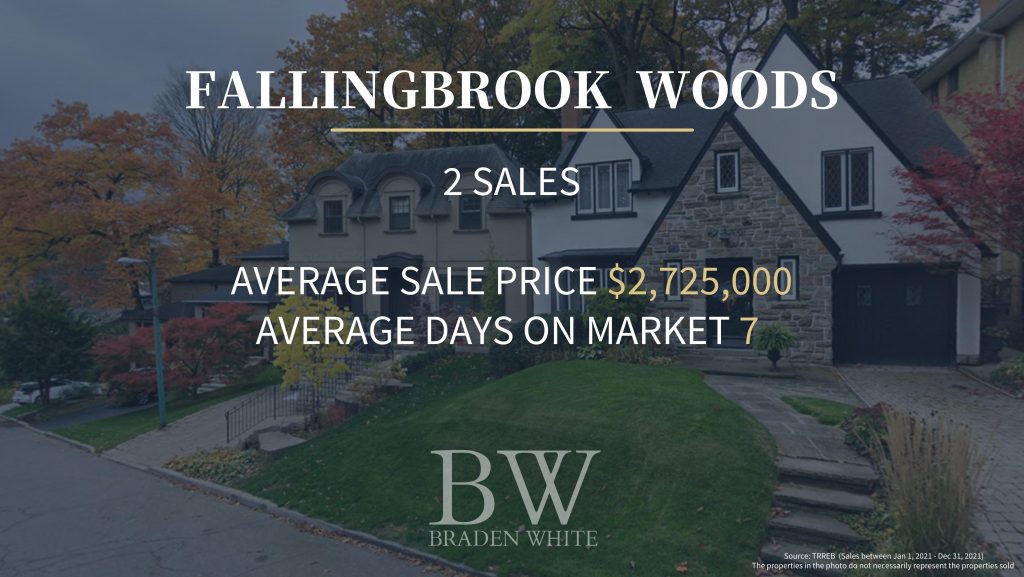

I’m often asked how much homes cost in The Beaches by my clients and my response is pretty much almost always the same each time, “It really depends on which part of The Beaches and which street”. If you are reading this post, you likely have the same question and would like to know the answer or you are fortunate enough to already live in The Beaches/The Beach and are curious to know how much homes are selling for in your area. In order to answer this question and to provide you with a point of reference, I have put together a list of some of the most popular streets in The Beaches along with the lowest and highest sale prices for each street along with the average sale price and average days on market. All of the stats are based on sales that have taken place between January 1, 2021 and December 31, 2021. Although this list is extensive, it doesn’t include every single street in the area (which I personally believe are all great as you simply can’t beat this location).

If you don’t see your street of interest in the list, feel free to contact me to find out the stats for your specific street of interest or to ask any questions you may have about the market or selling or buying in The Beaches/The Beach. I’m always here and happy to help.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

The additional streets included below do not fall within “E02 The Beaches” as per the TRREB MLS municipality designations. However , many consider these streets as being part of The Beaches community and therefor I have included these stats.

![]()

![]()

![]()

![]()

![]()

Source of stats: TRREB

(Sales between January 1, 2021 – December 31, 2021. Figures do not include off market sales)

The homes in the photos do not necessarily represent the homes sold in 2021. All photos are publicly available photos. Streets with one or less sale have intentionally been left out due to privacy reasons.

Are you considering selling your home in The Beaches or thinking of buying a home in this amazing community?

Contact me today to discuss how I can help you with achieving your specific real estate objectives in The Beaches. I look forward to speaking with you.

Interested in seeing how much homes sold for in The Upper Beaches? Visit my other recent post relating to pricing in The Upper Beaches in 2021 HERE.

Whether you are selling or buying real estate in Toronto, the real estate world can be a confusing place for those who aren’t already familiar with it. Below is a list of the top 25 real estate questions I receive from both buyers and sellers on a daily basis as well as the answers to each question.

Q #1: Who pays the buyer’s agent?

A: This is a common question from both sellers and buyers. The commission is paid by the seller from the proceeds of the sale.

Q #2: How much does it cost to list and sell a home in Toronto?

A: Although there is no standard amount for commission, the cost of listing and selling your home in Toronto is typically 5% of the sale price plus HST.

Q #3: Does a seller have to accept my offer if I offer more than the list price?

A: No, the seller is never required to accept an offer, even if it is for an amount higher than the list price.

Q #4: Will I automatically get a chance to improve my offer in a multiple offer situation?

A: No. Although some listing agents and sellers will give buyers the opportunity to improve their offers, it is not guaranteed that buyers will be given a chance to do so. There are no rules or regulations that state that buyers are to be given such a chance when involved in a multiple offer situation.

Q #5: When do I have to provide the deposit when submitting an offer on a home in Toronto?

A: This all depends on how the offer is written. In most cases, you have 24 hours from the time that your offer is accepted to deliver the deposit to the listing brokerage. In some cases, the deposit is delivered in person with the offer and in other cases, the deposit may be delivered at a date later than 24 hours from the offer being accepted if all parties agree to such an arrangement.

Q #6: How much does my deposit have to be when buying a home in Toronto?

A: The typical minimum amount that sellers expect is 5% of the purchase price or more. As a buyer, you will also want to consider whether you will need to pay CMHC mortgage insurance in addition to your mortgage payments which is discussed in further detail in the answer to question #7 below. You will need to provide at least 20% down on a property if you would like to completely avoid paying mortgage insurance. When in a multiple offer situation, it is common for buyers to offer larger deposits that exceed 5% of their offer price in order to help their offer stand out from the other competing offers.

Q #7: What is mortgage insurance?

A: If you want to buy a home without putting down at least 20%, you will be required to get mortgage insurance through CMHC. Such insurance allows you to get a mortgage of up to 95% of the purchase price (as of December 2021). In order to obtain mortgage insurance, you will need a minimum down payment. The amount depends on the final purchase price of the home and is broken down below:

Your mortgage insurance is typically added to your monthly mortgage payment. You can learn more about the cost of CMHC mortgage insurance HERE.

Q #8: What forms of payment are acceptable for a deposit when buying a home?

A: Bank draft, certified cheque or wire transfer are the most common forms of payment. Payment is made out to the listing brokerage’s name. It is always recommended to include the wording “In Trust” after the brokerage’s name to clarify that the funds are to be held in the brokerage’s trust account.

Q #9: How much is land transfer tax in Toronto?

A: Anyone that purchases real estate in Ontario is required to pay provincial land transfer tax on the purchase price of their new home. In addition to the provincial land transfer tax, anyone purchasing property in Toronto is required to pay both provincial and municipal land transfer tax. For example, if you are NOT a first-time buyer and you buy a home in Toronto for $1,000,000, the provincial land transfer tax would be $16,475 (as of December 2021) and the municipal land transfer tax would be $16,475 (as of December 2021) for a total of $32,950. As of December 2021, if you purchase property outside of Toronto, you are currently only required to pay provincial land transfer tax. You can use TRREB’s land transfer tax calculator HERE to calculate how much land transfer tax you will need to pay on your purchase price. This calculator also applies first-time buyer credits to the calculation if you are a first-time buyer.

Q #10: When does land transfer tax need to be paid?

A: “Ontario’s land transfer tax is payable when the transfer is registered. If the transfer is not registered within 30 days of closing, you must submit a Return on the Acquisition of a Beneficial Interest in Land form to the Ministry of Finance, along with the payment of tax within 30 days after the closing date.” (source: Ontario.ca)

Q #11: Can I add the land transfer tax to my monthly mortgage payments?

A: No, this is not an option. The land transfer tax is paid when the transfer is registered, typically on the closing date.

Q #12: What is the foreign buyer tax?

A: “The Non‑Resident Speculation Tax (NRST) is a 15% tax on the purchase or acquisition of an interest in residential property located in the Greater Golden Horseshoe Region (GGH) by individuals who are not citizens or permanent residents of Canada or by foreign corporations (foreign entities) and taxable trustees.” (source: Ontario.ca)

Q #13: What is the average sale price in Toronto right now?

A: As of October 31, 2021, the average sale price for Toronto and the GTA was $1,155,345. This average sale price was up 19.3% from $968,535 in October 2020.

Q #14: What is causing the drastic increases in home values in Toronto?

A: Toronto has been facing a supply and demand crisis for quite some time. There simply aren’t enough affordable homes to keep up with the amount of demand. The lack of supply and a growing population, as well as more properties being purchased as investment properties (which are typically held as long-term investments), has been fuelling the drastic growth.

Q #15: Should I stage my home before listing it for sale?

A: This all depends on your current local market as well as the condition of your home. If your current market is considered a “seller’s market” (more demand than available supply) and your home is in overall good condition, clean and decluttered without any major repairs needed, you may not need to stage your home. If your home desperately needs some TLC and repairs, you may want to invest in completing the necessary repairs and staging your home. When listing in a “buyer’s market” (more supply than demand), you will likely want to invest in fixing as many repairs as you can financially afford as well as staging your home. A “buyer’s market” typically requires more work on the seller’s end in order to stand out from the competition. Your agent should be able to provide you with advice on what makes the most sense based on your home’s condition and your current local market. Most reputable agents will provide the service of staging your home when needed.

Q #16: When is the best time to sell my home in Toronto?

A: Historically, Toronto’s real estate market has been pretty predictable as it tends to follow the local weather patterns. We tend to see more buyers looking to purchase homes in the spring, late summer and early fall. It is ideal to showcase your property when it looks its best, which usually isn’t during the winter months.

Q #17: Should I get pre-approved for a mortgage?

A: Yes! It is definitely in your best interest to get pre-approved for a mortgage before starting your search. Without knowing your limitations/maximum budget, you will likely waste a lot of valuable time looking at properties that you can’t actually afford. It is best to get pre-approved and to know your numbers so that you can make an offer quickly if needed. The last thing you want to do is find your dream property, then wait to get approved to then find out that your dream property is no longer available because someone else bought it while you were arranging your financing. You need to be prepared to make an offer at any time in Toronto’s current competitive market.

Q #18: Can the listing agent tell the buyer agents the price and details of the other offers in a multiple offer situation?

A: No. The listing agent is strictly prohibited from sharing the list price or details of the competing offers. An agent sharing such information could lose their license if they do this and a complaint is filed with RECO (Real Estate Council of Ontario).

Q #19: What are my options if my home doesn’t sell?

A: If your home doesn’t sell, you have several different options:

Q #20: Am I required to install a “For Sale” sign in my lawn?

A: No, you are not required to have a sign in your lawn. However, it is in your best interest to allow your agent to install a sign as it ensures that your property receives the maximum exposure it needs in order to sell for the highest price possible.

Q #21: What is a status certificate?

A: The status certificate is a document that each condominium has which includes essential information relating to the financial status of a condo unit and building, the rules and bylaws, planned maintenance fee increases as well as any ongoing litigation or special assessments and more. It is highly recommended to arrange for a real estate lawyer to review the status certificate before submitting an offer on a condo. It is common for a listing agent to have a copy of the current status certificate available when listing a property below market value in order to make the offer process smoother should they receive multiple offers. This gives all of the buyers the opportunity to review the status certificate in detail before they submit an offer. A new status certificate is made available to owners and agents each month for a fee which is why it is essential that you review a current status certificate for the current month. If your agent needs to order a status certificate, they can usually speak with the property manager to either request it through management or through a website such as condocafe.com.

Q #22: Should I buy or sell first?

A: The answer to this question all depends on the market you are currently living in as well as the market you are looking to buy in. Depending on the current market conditions (amount of supply and demand, current interest rates, etc.), you may need to arrange bridge financing if you buy first and sell after. Keep in mind that there are risks to buying first should your local market conditions change and the amount of supply suddenly outweigh the amount of demand as you could get stuck with two homes. It is best to discuss your options with both your agent and your lender before making a decision on this.

Q #23: What is a “CMA”?

A: CMA is short term for Comparative Market Analysis. This is a document that is typically provided to sellers by their listing agent when determining an appropriate list price for their home. This document typically includes details about other comparable homes that have recently sold within the local market, up to date real estate market stats as well as some calculations to determine an appropriate list price.

Q #24: What is a Buyer Representation Agreement (B.R.A) and am I required to sign it?

A: A Buyer Representation Agreement is an agreement between the buyer, their agent and the agent’s brokerage. In general, by signing this agreement, a buyer is committing to using the agent and their brokerage for the purchase of their property and the agent and brokerage are committing to providing the buyer with service. You are not required to sign this form; however, some agents may refuse to work with you if you decline to sign it. There have been many cases of buyers using multiple agents at one time which has resulted in agents not being compensated for their time.

Q #25: How do I know how much my home is worth?

A: Everyone wants to know how much their home is worth and many unfortunately make assumptions about this based on inaccurate online estimates which tend to be on the higher end compared to the true market value. It is always good to have a sense of how much your home may be worth in today’s current market so that you can be prepared to make a sudden move if needed and to know how much equity you have built up in your home. The best way to determine the value of your home and the amount of equity you have built is to receive a complimentary home evaluation from a reputable real estate agent. I would be more than happy to provide you with a no obligation, complimentary home evaluation if you are interested. Contact me below at any time to request your home evaluation; it’s 100% free with no strings attached.

Do you have any real estate questions that weren’t answered here?

If you do, feel free to contact me any time with your questions. I’m always here and happy to help.

If the last year has taught us anything, it’s the 𝘪𝘮𝘱𝘰𝘳𝘵𝘢𝘯𝘤𝘦 𝘰𝘧 𝘱𝘦𝘳𝘴𝘰𝘯𝘢𝘭 𝘤𝘰𝘯𝘯𝘦𝘤𝘵𝘪𝘰𝘯. With so many meetings, gatherings and even family holidays turned into virtual events, we’ve missed out on the sights, the smells, the noise, and the handshakes and hugs. We’ve missed out on these experiences. Technology just can’t replace personal connection.

Similarly, in real estate, so much about a home has to do with the “experience.” The views, the impact of noise from a busy road, the neighbourhood, the smells – all have an effect on the way a house feels. This just doesn’t translate into data and algorithms. 𝗢𝗻𝗹𝗶𝗻𝗲 𝗽𝗿𝗼𝗽𝗲𝗿𝘁𝘆 𝘃𝗮𝗹𝘂𝗮𝘁𝗶𝗼𝗻𝘀 𝗰𝗮𝗻 𝗲𝗮𝘀𝗶𝗹𝘆 𝗯𝗲 𝘂𝗽 𝘁𝗼 𝟭𝟬% 𝗼𝗳𝗳, 𝗮𝗻𝗱 𝘀𝗼𝗺𝗲𝘁𝗶𝗺𝗲𝘀 𝗺𝗼𝗿𝗲! which could cost you a lot of money should you decide to work off of the estimate provided.

For accurate information, you need an in-person valuation with someone who knows the local market. You need someone who will actually walk through your home with you, and take the time to understand what you love about your home, updates that you have done over the years, how your home compares to other recently sold homes in your area as well as other details that make it a wonderful place to live. Although technology has taken off over the last decade with video and 3D virtual tours, there is still no better way to get the true feeling of a home without seeing, smelling, and touching it in person. If you’re wondering what your home may be worth in today’s market, don’t hesitate to reach out, even if you are just thinking about making a move. I would love to give you all of the information you need to help you make an educated and smart decision that will help you get top dollar when you decide to sell.

Also known as “off-market” listings, these homes may be for sale but are not listed on the multiple listing services (MLS) or REALTOR.ca. Yes, you read that correctly, the MLS does not account for every property on the market.

Off-market property sales happen more frequently than many people realize. Sellers most commonly choose to list off-market for privacy reasons, or because they want to test their home on the market without any history showing up on MLS should they not sell for the amount they are hoping for. The last thing you want as a seller is for there to be a history of your home not successfully selling as this will give buyers the impression that you are either an unrealistic seller or that there is something wrong with your home which will negatively effect your ability to get top dollar. In this case you could find yourself fighting an uphill battle with not many options other than to accept an offer that is substantially less than you may have obtained had you taken a different listing approach in the first place.

Real estate agents who sell off-market listings must do the legwork and get the word out to find buyers on their own, typically through their network of clientele and other real estate agents as well as making use of other marketing methods that don’t leave behind a long-lasting history of your property being listed.

If you are considering listing your property off market, make sure you discuss with your agent the different marketing methods they will make use of in order to ensure your off-market listing receives maximum exposure. Some of these methods may include various forms of print marketing, open houses, signage and other methods that don’t leave a long lasting history online.

As previously mentioned, many off-market listings are listed in this manner for privacy reasons which is why it is a common listing method for high end homes in neighbourhoods such as the Bridle Path, Rosedale, Forest Hill, Hoggs Hollow etc.

If you are currently house hunting for a new home or plan on doing so in the near future, you may want to ask your agent if they are aware of any off-market listings that may meet your criteria. You could be missing out on your dream home by not doing so.

Are you planning on making a move now or in the near future and have questions about the selling and buying process or the market in general?

Send me a message, I’m happy to answer all of your questions for you.