It’s that time of year, the time of year when the air is getting warmer, the days are longer and people are excited about getting outside after a long winter. Spring and summer are the perfect seasons to enjoy a meal outdoors on a restaurant patio with friends and family. Whether you’re looking for an early morning breakfast, lunch or a romantic evening of drinks under the stars, patios provide the perfect setting to relax and take in the fresh air while enjoying good food and company. As someone who lives and works in The Beaches area, I love the many different patio options available during the summer months. There are many restaurants in The Beaches with great patios and each one has its own unique charm. I’ve included my list of the top 10 patios in The Beaches (in no particular order).

#1 The Stone Lion

The Stone Lion is one of my personal favourites. With two separate spacious patios, outdoor TV’s and great service and food, this is definitely one of the best patios in The Beaches.

1958 Queen Street E

Toronto, ON

416-690-1984

Instagram: @stonelionpub

#2 Riptide Beach Pub

Riptide Beach Pub offers an expansive patio with great food and drinks.

1980 Queen Street E

Toronto, ON

Instagram: @riptidebeachpub

#3 Outrigger

Whether you are looking for pleasant patio to enjoy a weekend breakfast on or you are looking to unwind over some evening cocktails, Outrigger has a great patio for both.

2232 Queen Street E

Toronto, ON

647-748-2232

Instagram: @outriggerto

#4 Beaches Brewing Company

The Beaches Brewing Company is a great place to enjoy some locally brewed beer as well as some delicious pub food. With an open air front and a street level patio that they set up each summer, it’s a great place to enjoy the nice weather.

1953 Queen Street E

Toronto, ON

647-492-3224

Instagram: @beachesbrewco

#5 Gull And Firkin

Whether you are looking for a place to have dinner and drinks or you are looking for a lunch spot. The Gull and Firkin has a great patio that includes several outdoor heaters as the temperatures get cooler later in the year.

1943 Queen Street E

Toronto, ON

416-693-9337

Instagram: @gullandfirkin

#6 Murphy’s Law

With one of the only rooftop patios in The Beaches, Murphy’s Law is a great place to unwind and enjoy food and drinks while enjoying views of the city and the surrounding Beaches neighbourhood.

1702 Queen Street E

Toronto, ON

416-690-5516

Instagram: @murphyslawto

#7 The Beacher Cafe

The Beacher Cafe is one of the most popular spots in The Beaches for brunch. During the spring, summer and fall months, they have a very picturesque patio arrangement that almost has a European feel. They serve breakfast/brunch, lunch and dinner and there is plenty of seating.

2162 Queen Street E

Toronto, ON

416-699-3874

Instagram: @thebeachercafe

#8 Toronto Beach Club

Toronto Beach Club is like being in LA, Toronto and the Mediterranean all at once. If you are looking for gourmet food and upscale atmosphere, this is your spot. Make sure you call ahead of visiting as you may require a reservation.

1681 Lake Shore Blvd E

Toronto, ON

416-694-8844

Instagram: @torontobeachclub

#9 Mira Mira Diner

This stylish diner is a great place for brunch, lunch, diner or simply drinks on the patio with friends or family.

1963 Queen Street E

Toronto, ON

416-792-6472

Instagram: @eatmiramira

#10 Sauvignon Bistro & Bakery

If you are a fan of french cuisine, this is the spot for you. With a charming patio and delicious food and drinks, you won’t be disappointed.

1862 Queen Street E

Toronto, ON

416-686-1998

Instagram: @sauvignonbistro

Hopefully this list of the top 10 patios in The Beaches has been helpful and provides you with some options that you may want to consider trying.

Are you thinking about buying or selling in The Beaches or do you have questions about the current market? Contact me any time with your questions. I’m always happy to help.

If you’ve been considering buying or refinancing any time soon, you may have come across the term “Stress Test” and wondered what is a stress test and why does it matter to you.

We aren’t talking about a medical stress test, although many of us may need one if the home prices keeps rising at the rate they have been, we are talking about a mortgage stress test which can affect your ability to purchase the home you’ve fallen in love with. With Toronto real estate prices as high as they are and at the speed in which they are rising at the time of this blog post (February 2022), it is important to understand what a stress test is and how it applies to you when making a move. Below is a detailed explanation as to what a stress test is and how it can affect your purchasing power.

What Is Stress Test:

Because mortgage rates can fluctuate, as of 2016, the Canadian government introduced a minimum qualifying rate in order to reduce the risks associated with mortgage lending. This qualifying rate ensures that you are still able to cover your mortgage payments even if rates rise above your original qualifying rate as the qualifying rate is higher than your contract rate with your lender. This rate is based on a number of factors including your current credit score, credit history, total amount being mortgaged, current debts and your income.

How A Stress Test Works:

When you apply for a mortgage with a lender, your lender will provide you with a contract rate which is based on current interest rates, your credit history, the structure of your mortgage and current economic factors at the time of your application. Although your lender will provide you with a contract rate, they are required to qualify you first at a higher qualifying rate in order to ensure that you could cover your mortgage payments even if rates rise. This process is simply a risk assessment for your lender.

Why The Stress Test Was Introduced:

The test was introduced in 2016 when the Toronto real estate market was thriving and when homeowners were taking on substantial household debt. The test was originally only required for insured mortgages (a mortgage that includes mortgage default insurance) and with less than a 20% downpayment. The main goal of introducing this test was to provide both the lenders and homeowners with a buffer should anything happen that would increase the interest rate or monthly payments. The Canadian Government later extended this test requirement to uninsured mortgages as well (mortgages without default insurance and with more than 20% down). Not only does this test affect those who are applying for their first mortgage but also those who are looking to refinance.

How Does The Stress Test Affect Borrowers:

Due to the fact that borrows need to be approved on a higher rate than the contract rate, some buyers (depending on their financial situation) will have reduced buying power and may have to settle for a home at a lower price point. This can make the buying process somewhat frustrating if you aren’t able to find a property that fits your needs.

One positive aspect of the test is that you as the buyer know you won’t be over extending yourself financially.

Can You Avoid A Stress Test:

Unfortunately, you cannot avoid a stress test as all major banks and lenders are required by law to complete stress tests on their borrowers.

How To Calculate What You Can Afford Based On The Stress Test:

The Government of Canada has created a mortgage stress test calculator which allows you to calculate what you can afford based on the test. You can access the calculator HERE to determine how much you can be approved for based on your specific information and circumstances.

It’s very important that you always speak with your lender and get pre-approved before submitting an offer on a property in order to avoid running into any financial hiccups.

Are you thinking about making a move and have questions? Contact me any time, I’m always happy to help.

“Should I wait to sell my home?”

This is a common question that I have been asked by my current clients and new clients who have been considering selling. I also see people asking this same question in various community group pages on social media sites. It’s clearly a common question these days for many homeowners and a question that should be answered. So, should you wait to sell your home? Continue reading to find out.

Historically, Toronto’s real estate market has been more predicable with very busy spring and fall markets and slower summer and winter markets. However, things have changed. With record low inventory of only 2 months’ worth of inventory, there really hasn’t been a better time to list your home for sale in Toronto. Based on only 2 months’ worth of inventory, all of Canada could run out of available properties by mid-March if no new properties come to market (hopefully this doesn’t happen!). With high demand, record low inventory and the Bank of Canada’s recent announcement that they will not be increasing their rate at this time, this is one of the best “seller’s markets” that Canada has ever seen (I’m sorry buyers).

Chestnut Park’s CEO, Chris Kapches, discussed the latest trends in the Toronto housing marketing in detail at our recent office meeting and in Chestnut Park’s latest blog: “During December 5,174 new properties came to market, almost 12 percent fewer than what came to market in 2020. What is even more shocking is the fact that entering 2022 there are only 3,232 active listings for the entire greater Toronto area, more than 46 percent of which are condominium apartments. By contrast last year there were 7,892 active listings which at the time we reported were totally inadequate to meet the growing pandemic demand.”

If the market continues in this manner, we will continue to see prices increasing. This would be caused by the likelihood that newly available properties will continue to attract multiple offers, ultimately driving up the final sale price and the overall average sale price for Toronto and the GTA.

On the basis of these statistics and trends, it is clear that there hasn’t been a better time in recent history to sell your home here in Toronto.

Contact me any time if you are considering selling your home and have questions about the market or would like to receive a complimentary, no obligation home evaluation in order to learn how much your home could potentially sell for. It might be more than you think!

You’ve just moved into your new home and you’re over the moon excited. Congratulations on your new home, this is definitely one of the most exciting times of your life, take a moment to soak in the moment, times like these are precious!

With all of the commotion and excitement, you’re likely not thinking straight about all of the things you need to do and consider at this point. In order to make your transition smoother, I have put together this to-do list which includes items you will want to definitely attend to as well as other things you may want to consider.

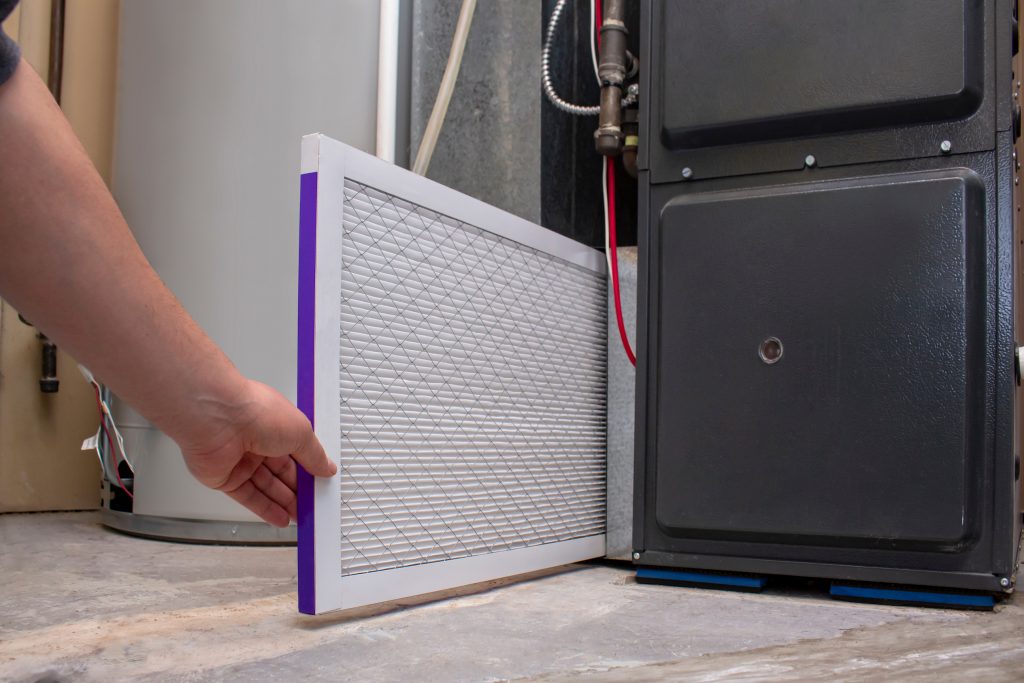

1) Get your air ducts and HVAC system cleaned!

You wouldn’t believe how dirty unattended air ducts can get over the years. From inspecting homes on behalf of and with my clients, I have seen some pretty disgusting and disturbing air ducts. From pet hair, household dust, pieces of drywall, insulation and even rodent feces, I’ve seen a lot of really gross stuff. This is why it is important that you have your air ducts and HVAC system cleaned when you first move in and prior to your furniture being moved into your new home. It is much easier for you to have this work completed without furniture in the home as there is typically large equipment and hoses that need to be run throughout your home which could damage your furniture. Make sure you also change the furnace filter after the duct cleaning is done. There are different qualities of filter that offer various levels of protection. You should change this filter at least every 3 months to ensure you are breathing clean air. It is also important that you get the right size of filter for your furnace. If you remove the existing filter, there are typically numbers printed on the side, for example “16 x 25 x 1”, which reflects the size of filter. In some cases, more advanced systems will have different types of filters, if you do not see a filter with a similar number as previously mentioned, take a photo of what you have and show the hardware store the photo to determine what you need for your home. In addition to having your main air ducts cleaned, you should also have your dryer vent cleaned as lint can build up over time and cause a fire hazard. You can view some HVAC filter options HERE.

2) Renovate & paint before your furniture arrives

As much as you may be excited to move your furniture into your new home, I highly recommend completing any needed renovations or painting prior to moving your furniture in. Completing renovations and painting with furniture in place makes it much more difficult to complete the work and you run the risk of your furniture being damaged. Some moving companies provide temporary storage solutions if you need it. They will pick up your furniture from your current home and take it to their storage facility for storage. When you are ready to have it moved to your new home, they will transport it to your home from their storage facility. This option allows you time to get your work completed without your furniture being in the way or it being damaged.

3) Change the locks!

You will want to ensure that all of your exterior door locks are changed the day you take possession. This ensures that both your belongings, yourself and your property are safe. The last thing you want is a stranger having access to your home. You should also consider hiring the locksmith to install child safety locks while they are there to do the work if you have young children.

4) Make sure the fire & carbon monoxide alarms are up to date and working properly

Once you have possession of your new home, one of the first things you should do is check to make sure the fire alarms and CO alarms are working properly and change all existing batteries with new batteries. You can view some additional fire safety tips HERE.

5) Ensure that your home insurance is set up

This is extremely important. Make sure your home insurance is set up and effective as of the date that you take possession. Hopefully you never have to make use of it but it could be very costly should you have any problems without your home being insured.

6) Get to know your neighbours

Not only is it nice to get to know your neighbours, it’s also helpful from a security perspective. Suggest exchanging your phone numbers and email addresses. This is helpful in case one of you are away and there’s an issue with one of your homes.

7) Have your chimney inspected and cleaned

If you have bought an older home in Toronto and it has a wood-burning fireplace, you should have it inspected by a W.E.T.T certified inspector to ensure that it is safe to use. This inspection should be completed prior to using the fireplace as your fireplace and chimney can be a very serious fire hazard should they not be in good working order. If the inspector has confirmed that it is safe to use, you should have the chimney cleaned prior to having your first fire to avoid any chimney fires due to the build of creosote. Ideally, you would have the chimney inspected as a part of a home inspection, however, with Toronto’s current competitive market, many buyers are forced to waive any inspection conditions and essentially buy the home as is. If you have the opportunity, make your offer conditional on a home inspection and have the fireplace and chimney inspected at that time as the overall home inspection.

8) Test all appliances

There is a good chance that your offer includes a clause stating that all appliances should be in good working order on closing. If your offer includes such a clause, it is always best to test all of the appliances the same day you take possession. Should any of the appliances not be in good working order, take photos, videos and notes and send them to your real estate lawyer and inquire about what options you have at that point.

9) Test the sump pump or consider installing one

If your new home has a sump pump, make sure you test it once you take possession. Water damage is one of the most common and costly threats to a home. Certain areas of Toronto are more prone to basement flooding so it is important that you take this into consideration. If your sump pump doesn’t already have a battery backup, you should definitely install one as soon as possible. A battery backup will provide your sump pump with the electricity it needs should your power go out and you have a flood.

10) Deep clean your home

I probably don’t have to point this out but you should definitely complete a deep clean of your entire home. Whether you do it yourself or you hire a professional cleaning service, you will want to make sure you clean all of the bathrooms, kitchens (including the interior and exterior of the cupboards), the interior and exterior of all kitchen and laundry appliances, window sills, door frames, baseboards and floors. If you are keeping any existing drapes that are being sold with the home, you may want to check their tags and wash them in hot water if possible. Benefect Botanical Disinfectant is a natural cleaning product that is as strong and in some cases, stronger than cleaning products with harsh toxic chemicals. It is a commercial grade cleaner which is used by hospitals and restoration companies. I personally use this product for my own home and love it. I have no affiliation with them, I’m just a big fan of their products. You can learn more about them HERE .

Hopefully this list is helpful to you whether you have just moved in or you are moving into a new home in the near future.

Are you thinking about making a move and have questions about the buying process? Contact me any time with your questions or concerns. Whether you are considering a move now or in the future I am here any happy to answer any questions you may have.

The thought of selling your home can be exciting, but in reality, it can also be very stressful and costly if not done properly. Avoiding common mistakes when selling can help make your selling experience a positive one and keep more money in your pocket.

Below are 5 common mistakes that sellers make and how to avoid them:

1) Not properly preparing your home to sell

Regardless of how strong your local market may be, you should always ensure that your home is in the best showing condition as possible before listing. This includes ensuring that both the inside and outside of your home is in good condition and is visually appealing to buyers. Staging your home can drastically enhance your chances of receiving higher offers and selling for more money. Speak to your agent about what pre-listing home preparation services and staging options you have before listing your home for sale.

2) Listing at the wrong time

If you live in Toronto, based on our current record low inventory that we are experiencing as of today’s date, there is almost no bad time to list your home for sale. With that being said, historically speaking, the spring and fall are typically good times to list your home. The weather is nice, people are in a better mood and likely haven’t left for the cottage or their summer vacations. Over the years, it has been very clear that the market slows down substantially during July and August in the summer and December, January, February in the winter.

3) Listing too high

With more online resources available to buyers which include statistical information such as recent sale prices, average days on market and more, buyers know when a property is overpriced. The last thing you want to do is list your home too high and not receive any interest from buyers which will ultimately force you to reduce your list price and potentially stigmatize your property. By lowering your list price after not receiving offers for what you originally wanted, buyers may question if there is something wrong with your home and feel that they may be able to purchase your home at a discount. This could ultimately result in you receiving low ball offers which you definitely don’t want. Depending on your current market, you may want to speak to your agent about possibly listing your property below market value and holding an offer date in order to hopefully generate a multiple offer situation which can result in a higher final sale price.

4) Hiring the wrong agent

Selling a home for the highest amount of money while avoiding litigation at the same time isn’t as easy as putting a FOR SALE sign in the lawn. With over 50,000 real estate agents in Toronto and the GTA, it’s likely that you probably know an agent or two. Some may be friends, others might be family, some may be local while others may be from outside the city, some may be new in the industry and others may have been in the industry for a while. With so many agents in the industry, how do you know which one to use? Below I have included a list of what to look for and what to avoid when choosing an agent to list your home for sale.

5) Trying to sell your home on your own or through a discount brokerage

We all want to make and save as much money as possible. The fact that you may be considering selling your home on your own or with a discount brokerage is understandable, especially if you don’t have a lot of experience in selling real estate. Many people think selling a home is as easy as running a garage sale on the weekend, you simply put a sign in the lawn and wait for all of the buyers to show up to submit offers on your home. Unfortunately, it’s not that simple. There is a lot that goes into selling a home for the highest price possible in the least amount of time. A reputable agent may charge the full commission but if they are good at what they do, it will be worth every penny and will put more money in your pocket at the end of the day. Most respected agents will provide their clients with a complete concierge service from start to finish when listing a client’s home for sale. From arranging, managing and covering the cost for decluttering, cleaning, minor home repairs and staging services to professional photography, videography, 3D virtual tour designs, marketing and advertising services in addition to providing you with years of real estate knowledge all while looking out for your best interest throughout the process, an agent who charges full commission to sell your home for top dollar and does everything needed to ensure that happens is well worth the investment.

Are you thinking of selling and have questions about the process or your local market? Feel free to contact me any time with any questions or concerns you may have, I am always here and happy to help you. Want to learn more about the selling process? Click HERE to learn more.

Staging your home, even in a hot seller’s market is always recommended! Even though the market may be hot with lots of demand, staging your home will help your home stand out from the competition. Remember, you only get one chance to make a good first impression. If you want to sell your home for top dollar in the least amount of time and with the least amount of headaches, staging will most definitely help.

Below are some interesting stats from 2021 related to staging from the National Association of Realtors:

• 23% of sellers’ agents reported an increase of 1-5% of the dollar value offered by buyers, in comparison to homes that were not staged. This is a prime example of how staging can help put more money in your pocket.

• 82% of buyers’ agents said staging a home made it easier for a buyer to visualize the property as a future home. I see this on a daily basis when helping my clients with finding their next home. There is a clear difference in their response when viewing a property that is staged. The first response when we walk through the front door of a staged home is often “WOW!”.

Staging doesn’t have to be expensive or complicated either. I’ve included a list below of some basic staging tips that you can do on your own. Most reputable Toronto real estate agents will provide complete staging services for their clients as a part of their service but if you want to help out with getting your property prepared to sell for top dollar, you can tackle most of the items below on your own:

If you have questions about how to get your property in top showing condition, contact me any time, I am happy to answer any questions you may have and to provide you with professional advice. As a full-time Toronto real estate agent with over 20 years of design experience as the previous owner of a design and build firm, my invaluable experience helps my clients with preparing their homes to sell for top dollar. Click HERE to learn about the selling process and how I can help you sell for top dollar in the least amount of time!

2) Should you go to use your sink or shower and no water come out, it is likely that you have a frozen pipe along that water supply line. If this happens to you, it’s best to leave the sink or shower faucet in the on position in order to alleviate pressure from the pipes. Once you have done this, you will need to track the water supply pipe and figure out a way to heat it up in order to speed up the thawing of the pipe.

3) Make sure you move as much snow away from your homes foundation and basement windows and below grade doors. This includes at the back and sides of your home. When the times comes for the snow to melt, you don’t want the water to end up in your basement.

4) Make sure any exterior drains in front of basement entrances are cleared from snow and ice. If you neglect to do this, you could possibly find water making its way into your basement. As a preventative tip, in the fall, you should hire a plumber to visit your home in order to snake the drain in order to ensure that there aren’t any blockages.

5) If you have a sump pump, make sure it is working properly before the snow melts so you can have any necessary service completed prior to the snow melting. You should ideally inspect your sump pump and test it before the winter and again before the spring thaw to ensure it is working properly.

6) Make sure that snow or ice doesn’t cover any of your intake or exhaust pipes for your furnace. If these pipes get blocked it could be a deadly health hazard to you and your family. This is another reason why it is important to have carbon monoxide detectors in your home and to ensure that the batteries are changed on a regular basis.

7) Make sure you continue to clean the snow off your car throughout the snowstorm to ensure that you are ready to leave promptly in case of an emergency.

8) As per the Canadian Red Cross recommendations, it is important to not overexert yourself when shovelling snow. If there is a lot of snow, take breaks instead of trying to do it all at once. This will help protect your heart, your back and body in general.

9) If you know you will be getting a lot of snowfall, visit your local gas station to pick up a can of gas for your snowblower or generator before the roads get bad.

10) If you don’t have a snowblower and only have shovels, make sure you keep your shovels in an accessible area that won’t be blocked by snow should you get a heavy downfall over-night.