Whether it be the high Toronto real estate prices, the chaotic energy of the city or the need for a larger home with a yard, there are many reasons why some Toronto residents trade the convenience of living in the city with living in a smaller community, despite having to commute into the city for work. With Toronto home prices as high as they have been and with the introduction of higher interest rates bringing down the average sale price of many of the GTA communities that saw substantial gains during the pandemic, now could be a good time to consider making a move to one of the top 10 communities in the GTA with a GO station listed below. Purchasing a home in a community that has a GO station isn’t only beneficial to you if you work in Toronto and need to commute, it is also a selling feature that attracts potential buyers should you decide to sell in the future.

Below is a list of the top 10 communities in the GTA that have a GO station (in no particular order):

#1 Oakville

Oakville is one of the most desirable and affluent communities outside of the City of Toronto. It is home to many executives who commute into Toronto’s Financial District for work. Many professionals choose Oakville as their home due to its good schools, access to the waterfront and reasonable commute time to Toronto via the GO train.

Below are the average sale prices for all property types in Oakville at the time of this blog (August 2022)

Detached $2,035,091

Semi-detached $1,090,045

Townhomes $1,101,040

Condo apartments $938,359

Condo townhomes $829,093

#2 Port Credit

Port credit is known for its stunning waterfront which was rated as number one in the GTA. This family-friendly community consists of a wide range of demographics, including professionals who work in the Financial District and families who are looking for a quieter lifestyle versus living closer to downtown Toronto. Port Credit is home to the Port Credit Yacht club and is a lively spot during the summer months when the weather is nice. The Port Credit GO Train station makes it convenient for professionals to commute to and from work on a daily basis.

Below are the average sale prices for all property types in Mississauga which Port Credit is a part of. The pricing is based on prices at the time of this blog (August 2022)

Detached $1,589,123

Semi-detached $982,556

Townhomes $1,005,494

Condo apartments $628,116

Condo townhomes $798,552

#3 Unionville

Unionville, located in the City of Markham, is one of the most charming communities just north of Toronto. Unionville has a historical main street that consists of many different shops, cafes and restaurants just steps from Toogood Pond where many children and families skate during the winter months. Along with its large beautiful homes and one of the top golf courses in the GTA, Unionville is a popular community for those who are looking for a family friendly community not far from the city.

Below are the average sale prices for all property types in Unionville/City of Markham at the time of this blog (August 2022)

Detached $1,708,333

Semi-detached $1,182,644

Townhomes $1,155,546

Condo apartments $707,776

Condo townhomes $875,375

#4 Markham Village

Similarly to Unionville, Markham Village is the older area of the City of Markham and also includes its very own main street, which, like Unionville, includes many different shops, cafes, restaurants and bars. The area consists of large lots which has resulted in builders tearing down many of the older and dated homes and building new larger luxury homes. The Go station located on Main Street Markham makes it convenient for those who need to commute to Toronto for work. Markham Village is a great community for families who are looking for a place to live with a true small town community vibe.

Below are the average sale prices for all property types in Markham Village/City of Markham at the time of this blog (August 2022)

Detached $1,708,333

Semi-detached $1,182,644

Townhomes $1,155,546

Condo apartments $707,776

Condo townhome $875,375

#5 Vaughan

The City of Vaughan is one of the fastest growing communities in the GTA and includes several small communities within it such as Maple, Kleinburg and Woodbridge. The area consists of both residential homes as well as some newer low-rise and high-rise condo buildings. Vaughan is a desirable community among families and professionals who commute to work as there is easy access to highways such as the 407 (east & west) and 400 (north & south), and it also has its own GO station.

Below are the average sale prices for all property types in Vaughan at the time of this blog (August 2022)

Detached $1,697,375

Semi-detached $1,116,357

Townhomes $1,080,793

Condo apartments $690,996

Condo townhome $931,602

#6 Aurora

Aurora was once a small town but has grown substantially over the years. Although the photo above highlights the beautiful farm land and landscape you will find in the surrounding areas of Aurora, the main area of Aurora where most residents live is made up of residential homes of all sizes. Aurora is also home to large estate size lots in communities with winding tree-lined streets that provide a a good amount of privacy. Aurora has become a popular community for those who commute to work and who appreciate living in a community filled with beautiful homes with spacious lots.

Below are the average sale prices for all property types in Aurora at the time of this blog (August 2022)

Detached $1,625,138

Semi-detached $908,000

Townhomes $987,375

Condo apartments $718,650

Condo townhome $1,116,500

#7 King City

King City is known for its small town vibe, historical homes, large lots and stylish new construction subdivisions. The area has a main street down Keele Street which includes a variety of local shops, restaurants and other businesses. The King City community consists of a variety home types including heritage homes around King Road and Keele Street, large lots with custom homes and bungalows as well as new construction subdivisions that cater to a range of home buyers including first time buyers. For those who are looking for a quieter lifestyle than living in the busy city and who are willing to commute to work, King City might be a good option to consider.

Below are the average sale prices for all property types in the King Township at the time of this blog (August 2022)

Detached $1,912,794

Townhomes $1,108,000

Condo apartments $632,500

#8 Stouffville

Once known for mostly farm land and an older community with a small main street, Stouffville has changed drastically over the last decade and a half. These days, you will find new construction subdivisions that are either brand new or approximately fifteen years old along with an older part of town with homes that have existed for quite some time. Main Street Stouffville has many different shops and businesses along with several restaurants. Although it has grown over the years, it still has a small town vibe to it. Many residents commute to Toronto for work via the GO Train.

Below are the average sale prices for all property types in Stouffville at the time of this blog (August 2022)

Detached $1,414,811

Semi-detached $988,375

Townhomes $956,669

Condo townhome $588,000

#9 Pickering

Twenty years ago you wouldn’t hear about professionals from the city flocking to Pickering. However, Pickering has drastically changed over the years and has a lot to offer those who are looking for a larger home with a larger lot in an area not too far from Toronto. These days you will find many executives who have chosen to call Pickering home. With its beautiful waterfront, sense of community and more, it’s a popular community for those who are looking for more of a suburban vibe while still being close to the city. The Go station and easy access to Highway 401 makes it convenient for those who commute into the city for work.

Below are the average sale prices for all property types in Pickering at the time of this blog (August 2022)

Detached $1,270,758

Semi-detached $902,714

Townhomes $859,336

Condo apartments $609,845

Condo townhome $727,042

#10 Whitby

Whitby is home to several large corporations such as BMW, Sony Canada and others which employ many of the local residents. Like Pickering, Whitby has its own beautiful waterfront and also a historical main street with Heritage buildings. There are a variety of home styles in the area and the pricing is typically more affordable when compared to other communities in the east end of the GTA such as Picking and Markham.

Detached $1,100,690

Semi-detached $857,500

Townhomes $849,250

Condo apartments $681,667

Condo townhome $706,500

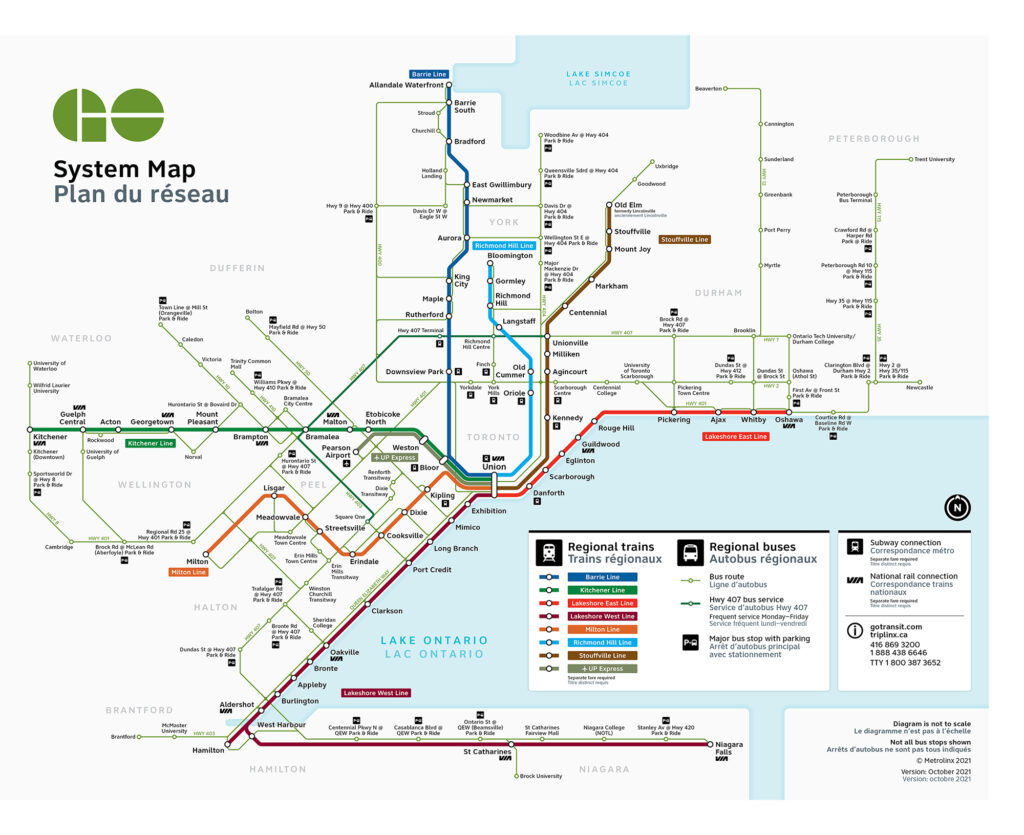

With so many great options in the GTA to consider, I’m confident that you will be able to find the right home for you. To assist you with your search, I’ve included the GO system map below which shows all of their stops in the GTA.

Credit: GO Transit

If you are thinking of making a move out of the city to one of these great communities or any other great community in the GTA and have questions about selling, buying or the market in general, feel free to contact me at any time as I am happy to answer your questions for you.

*All sale prices above are based on July 2022 stats which are released in August 2022.

You may or may not have heard the term “pre-list home inspection” before and wondered what it is and what it’s used for if you don’t already know.

A pre-list home inspection is an inspection that the listing agent typically arranges for their seller client prior to the property being listed for sale on MLS. By completing a pre-list home inspection, listing agents are able to provide such inspections to potential buyers and their agent when an inquiry is made regarding the condition of the home.

As long as your home doesn’t have any major issues, a pre-list home inspection often adds comfort to buyers, especially when they are involved in a multiple offer situation and likely won’t be able to submit an offer with a home inspection condition included.

A home inspection typically includes important information regarding different aspects and areas of the home and often includes details regarding the condition of following below as well as other items:

It is important to know that home inspectors are somewhat limited in regards to how deep they can dig into each section of the home. They mostly base their report on what is visible to the naked eye when looking over the different areas of your home.

It is also important to know that it’s extremely rare to receive a report that is squeaky clean without any issues at all, even in a newer home. Many sellers get nervous when they see a report that says there are issues with their home, even if they are minor issues. By completing a pre-list home inspection, you will have the opportunity to address the issues prior to listing your home for sale if you should wish to. Once the issues have been addressed, the home inspector will usually provide you with an updated report which reflects the repairs being completed. Over the years that I have been working in the real estate industry, I haven’t once seen a report completely free from any issues.

Now that you know what a pre-list home inspection is, make sure you speak to your agent about this option prior to listing your home for sale.

If you aren’t currently working with another agent and have questions about the market or selling your home, contact me any time. I’m always happy to answer your questions and concerns and to assist you with achieving your specific real estate objectives.

So you’ve gone through the process of hiring a Toronto real estate agent, decluttered and staged your property to ensure that it’s in top showing condition, the “For Sale” sign goes in the lawn and the listing goes live on MLS, you are excited to see how many showings and offers you receive, but you don’t receive any interest and you’re now wondering, “how could this be happening?” You’ve hired a professional Toronto real estate agent, completed all of the prep work to ensure your property shows well and you’ve heard that other properties have sold with multiple offers in only one week or sometimes less. You’re now asking yourself “Why isn’t my home selling?”

There are a variety of factors that could be getting in the way of your home selling but in most cases it comes down to expectations. Below are the top 5 reasons why a home may not sell.

1) Market Shifts

We have been spoiled over the last decade or so with Toronto home prices skyrocketing year after year. Prior to the pandemic and interest rate hikes, you could put almost any home on the market (even complete gut jobs) and they would sell for well over their list price with multiple offers. Unfortunately, things have changed and the market is no longer what it was back then (the good old days – depending on who you ask). Since the introduction of rate hikes (which we haven’t seen in a very long time), the market has continued to shift. As rates continue to go up, the buying power among buyers continues to shrink and the uncertainty continues to grow among buyers, sellers and the public in general. In one recent study completed by Hanley Mortgage Group, buyers had approximately $120,000 less buying power this past July 2022 vs July 2021; that is a substantial hit for buyers looking to buy in one of the most expensive cities both here in Canada and around the globe.

So what does this have to do with your house not selling?

It has to do with expectations.

The market has been changing weekly, sometimes daily and as previously mentioned, it’s not what it was in the past in regards to the average sale price or number of offers. Toronto hit a record high for the average sale price in February 2022 at $1,334,544 which, at that time, made Toronto the most expensive city in Canada. Since then, we have seen multiple rate increases with potentially more on the horizon. This has caused the average sale price to continuously decline month over month from $1,334,544 in February all the way down to $1,074,754 last month (July 2022). If you listed your Toronto home this summer hoping to sell for this past winter’s sale prices, your expectations are likely not in line with the current market. While interest rates increase and the buying power of buyers continues to decrease, sale prices will also continue to adjust accordingly.

In addition to the market shifting as a result of interest rate hikes, historically, we typically see seasonal shifts in the market with August typically being one of the slowest months of the year. This is due to many buyers taking vacation and travelling during this month. Unfortunately, due to the pandemic and travel restrictions being lifted, there are even more potential buyers who are looking to get away for the vacation they have been craving over the last couple of years. The amount of demand for travel is evident when considering the extremely high pricing for both flights and vacation packages when you complete a quick online inquiry for travel options.

What can you do about these market shifts in order to sell your home?

Well, this depends on your specific situation.

If you must sell now, you and your agent should discuss your options based on the current market and current comparable sales in your area. In addition to your agent providing you with statistical data based on the current market, you may also need to adjust your expectations and come to the understanding that you simply may not be able to achieve the sale price you originally had in mind when you originally listed your home for sale. Keep in mind, depending on where you are looking to move to (buy) and the rate you have locked in at, you may make up some of the loss on the buy side with the right negotiations.

If you don’t have to sell immediately, you should discuss with your agent the option of potentially re-listing your property once the market has bounced back to the level of pricing you were expecting when you originally decided to list. However, keep in mind that if you decide to take this route, be prepared that you may not be as happy with the purchase price of your next property depending on what market it’s located in as prices may have bounced back and be more than what they are today.

2) Improper Staging

Let’s be honest, not all staging is equal. It’s important that your home is professionally staged and staged in a way that makes your property stand out from the competition. Anyone can place a throw blanket on a sofa but true high quality staging requires a lot of thought and planning. Professional staging often requires the removal of all existing furniture from the property and new furniture brought in which enhances the space and makes the home feel brighter, cleaner and more airy. If your property isn’t properly staged you could potentially be turning off potential buyers. Staging was important when the real estate market was hot, it is now even more essential in this new market.

3) Poor Quality Photos

Just like any other product, the quality and type of photos used to market a product can make or break the successful sale of that product; it is no different when selling a home. Having professional photos that showcase your property in the best light possible will drastically increase your odds of selling for the most amount of money in the least amount of time. Doing otherwise will likely leave your home sitting on the market for quite some time. Your realtor should be using a professional photographer for the photos that will be shared in both online and print marketing materials.

4) A Dirty Home

The last thing you want is for potential buyers to be turned off by how dirty your home may be. When viewing homes, there’s almost nothing worse than walking into a home and wanting to leave your shoes on because the home not clean, this is definitely not the first impression you want to be making to potential buyers. Before hiring an agent, make sure the agent you decide to work with provides complimentary professional cleaning services as a part of their pre-listing services. If your home isn’t thoroughly clean, you may find yourself waiting a long time for the right buyer to come along and you will very likely receive less money for your home.

5) Incomplete Repairs or Renovations

Sellers sometimes think that buyers will be willing to complete repairs that are needed or that have been started but not fully completed, but this couldn’t be further from the truth. As a Toronto real estate agent who helps both sellers and buyers, I’ve seen the look of disappointment in the eyes of my buyer clients when they come across areas in need of repair or partially finished work. Their minds automatically go to the thought of “how much is this going to cost to fix?” and “how much should we knock off the offer price due to this?” Before listing your home for sale, complete as many needed repairs that you can and finish any partially finished projects that you may not have completed. You will likely save yourself thousands of dollars when it comes to negotiating a final sale price for your home by doing this. It is also crucial that you use a licensed professional when completing projects that require licensed trades such as electrical work, plumbing and structural work that may require an engineer.

These are just some of the many reasons why your home may not be selling. Ensuring that all of these items are addressed properly will increase the odds of your home selling for the most amount of money in the least amount of time.

If you aren’t currently working with another agent and have questions about the market or selling your home, contact me any time. I’m always happy to answer your questions and concerns and to assist you with achieving your specific real estate objectives.

*This is not intended to solicit individuals currently under contract with another real estate agent or real estate brokerage.

If you’re thinking about buying a home in Canada, one of the most important things to understand is the difference between insured and uninsured mortgages. Below is what you need to know about CMHC insurance.

What is CMHC insurance and why do you need it:

CMHC insurance is a type of mortgage default insurance that protects lenders in the event that a borrower defaults on their mortgage. It’s required on all mortgages with a down payment of less than 20%, and it’s offered by the Canada Mortgage and Housing Corporation (CMHC).

How does CMHC insurance work:

If a borrower defaults on their mortgage, the lender will be reimbursed by CMHC for a portion of the outstanding loan balance. The amount that CMHC will cover depends on the size of the down payment:

For a 5% down payment, CMHC will cover up to 95% of the outstanding loan balance

For a 10% down payment, CMHC will cover up to 90% of the outstanding loan balance

For a 15% down payment, CMHC will cover up to 85% of the outstanding loan balance

What are the benefits of CMHC insurance:

CMHC insurance provides a level of security for lenders, which in turn makes it easier for borrowers to qualify for a mortgage. Without CMHC insurance, lenders would likely require a larger down payment, a higher credit score, or both which could negatively affect your buying power.

How to get CMHC insurance for your mortgage:

If you’re applying for a mortgage with a down payment of less than 20%, your lender will automatically include CMHC insurance in your loan. You won’t need to apply for it separately.

What are the differences between insured and uninsured mortgages in Canada:

The biggest difference between insured and uninsured mortgages is the down payment requirement. For an insured mortgage, the minimum down payment is 5%. For an uninsured mortgage, the minimum down payment is 20%.

Other differences include:

Which type of mortgage is right for you:

The type of mortgage that’s right for you depends on your personal circumstances. If you have a down payment of less than 20%, an insured mortgage may be the best option. If you have a down payment of 20% or more, an uninsured mortgage may be the best option.

Final thoughts

Understanding the difference between insured and uninsured mortgages is important if you’re planning on buying a home in Canada. Be sure to speak with a qualified mortgage professional to determine which type of mortgage is right for you. You can visit CMHC’s website HERE to learn more.

Are you thinking about buying or selling and have questions about the current market? Contact me any time with your questions as I’m always happy to help.