If you live in The Beaches, you are likely well aware that it is a very pet friendly community. During all months of the year, residents walk their dogs along Queen Street East, through Glen Stewart Ravine and along the boardwalk. You yourself may even be one of these furry friend lovers who enjoys taking your dog for a walk in this beautiful community. If you are reading this blog post, it’s likely that you may be looking for pet stores in The Beaches. I’ve put together this post in order to help local residents of The Beaches find what they are looking for when they are in need of pet supplies.

If you’re looking for pet supplies such as pet toys, pet food or other pet related items, there are several pet stores in the area and nearby, each with its own unique selection of supplies. So whether you’re looking for items for your dog, cat, bird or even something more exotic, you’ll likely be able to find it at one the stores listed below in and near The Beaches.

The Dog Market located at 2116 Queen Street East, Toronto, M4E 1E2.

They have a wide selection of dog related products including:

For Dogs

For Cats

You can contact The Dog Market at 416-699,1313 or visit their website at thedogmarket.ca

Pet Valu locations located in The Beaches area. One located at 1656 Queen Street East, Toronto, M4L 1G5 and another located at 2210 Queen Street East, Toronto, M4E 1E7.

Pet Valu carries a wide selection of pet supplies and provides various services including:

You can contact the 1656 Queen Street East location at 416-694-8176 or visit their website at store.petvalu.ca/location/2332/

You can contact the 2210 Queen Street East location at 416-693-4456 or visit their website at store.petvalu.ca/location/2167

Global Pet Foods located at 1747 Queen Street East, Toronto, M4L 3Y4

Global Pet Foods is a popular pet store which carries a wide range of pet supplies for a variety of pets including:

Some of the supplies they carry are the following:

You can contact Global Pet Foods at 416-686-9468 or visit their website at beaches.globalpetfoods.com/product/shop/

The DOGSPAWS located at 1089 Kingston Rd Unit 8, Scarborough, M1N 4E4

The DOGSPAWS is a popular pet grooming location for those who live in The Beaches and the surrounding area. You can contact them for pricing and to book an appointment at 416-691-7778 or by visiting their website at thedogspaws.ca/pages/contact

Paws’ World is located at 763 B Woodbine Ave, Toronto, M4E

For those who live in the Upper Beaches, Paws’ World carries a wide selection of pet foods as well as pet supplies. You can contact them at 416-686-9030 or visit their Facebook page.

Hopefully the above list of pet stores in The Beaches has been helpful and you find what you are looking for.

If you are considering a move and are looking to buy the perfect home for a perfect home for you and your furry little one, contact me any time with any questions you may have. I’m always happy to help.

If you’ve considered buying a condo and have completed some preliminary research regarding the process of buying a condo, you may have come across the term “status certificate” and wondered what a status certificate is. If you decide to purchase a condo, you definitely should understand what a status certificate is and why it is important to review the status certificate of your building of interest either before submitting an offer or before waiving a status certificate condition (we will discuss this in detail below).

I’ve helped many sellers and buyers with the sale and purchase of condos throughout Toronto. Many of my first-time buyer clients are unaware of what a status certificate is, so don’t feel like you are the odd one out for not knowing. To answer your questions about what a status certificate is and why it is important, I have included the information below to explain what is included within this document, the importance of reviewing a status certificate, how to order a status certificate and risks associated with not reviewing a status certificate.

What’s Included In A Status Certificate

A status certificate includes a variety of important details relating to the building and condo corporation. You can think of this document as a report card for the building and condo corp; some buildings have better report cards than others depending on how they were built and how they are managed and maintained. Some of the information you will find in a status certificate include:

A reserve fund is a pool of money that is accumulated over time from a portion of the monthly maintenance fees that the owners pay. This fund is used to repair and replace different components within the interior and exterior of the building and throughout the entire property. Should there ever be any major repairs needed, the reserve fund is in place to assist with covering the repair or replacement costs. A poorly managed reserve fund can result in maintenance fee increases and potentially a special assessment which could require you and all of the other owners in your building to pay a large lump sum out of pocket to cover repairs or replacement costs that the reserve fund is unable to cover.

As explained above, a special assessment is an additional payment or levy the condo corporation has to impose should there not be enough funds available in the reserve fund to cover budget related items or repair and replacement costs.

This will typically include any information relating to any upcoming increases and whether or not the current owner has defaulted on their payments.

This will include details relating to the agreement your condo corporation has with the current property management company.

This will include details regarding what coverage your condo building has.

The minutes is a document which includes all of the important decisions made by the co-owners during the general meeting.

A reserve fund study determines how much money needs to be in the reserve fun in order to ensure that future repairs can be completed.

Why It’s Important To Review The Status Certificate When Buying And Before Selling

When Buying:

When buying a condo, it is essential that you have the status certificate reviewed by a reputable real estate lawyer. A good real estate lawyer will complete an in-depth review of the documents and will provide you with a breakdown of the status certificate details and highlight any red flags that you should be aware of. Without reviewing the status, you could potentially find yourself in a serious financial dilemma if the status states that there have been any special assessments, the reserve fund is under funded, there are maintenance fee increases on the horizon or if the condo corporation is involved in any litigation. Having a lawyer review the document will help you make your purchase with confidence.

When Selling:

When selling your condo, it is wise to review the current status certificate (for the current month) in order to familiarize yourself with the info within it. This is helpful in case there are any big items that may be brought up by buyers as negotiating tools. Some buyers will try to negotiate down from their original offer price if they submit an offer that’s conditional on the review of the status certificate and find details that make them uncomfortable. By reading your certificate before listing your condo for sale, you will be able to prepare for any issues that may be brought up by the buyer or their lawyer. An experienced real estate agent will be able to assist you with planning for potential hiccups that could arise from any problematic details within your status certificate.

How To Order A Status Certificate In Toronto

There are a few different ways to order a status certificate here in Toronto. The three most common ways to order are listed below:

Through the CONDUIT website which you can visit by clicking HERE

Through the CondoCafe website which you can visit by clicking HERE

If you are unable to find the condo address and status certificate at one of the two websites above, you may need to request the status certificate directly from the property management company. Below is a list of some of the common property management companies that provide management services throughout Toronto. The list is not inclusive of every single management company.

Crossbridge Condominium Services

Mapleridge Community Management

If you still aren’t able to obtain a copy of the status certificate through one of the options listed above or can’t determine which management company services your building of interest, you can go directly to the property of interest and ask the concierge to confirm which company manages the building and ask for the contact info of the property manager.

The Risk Of Buying A Property Without Reviewing The Status Certificate

There are many potential risks which could result from not reviewing a status certificate. Below are just some of the risks you could run into and want to consider:

Hopefully the above information has been helpful to you and has answered some questions you may have had about status certificates.

Are you thinking about buying or selling or do you have questions about the current market? Contact me any time with your questions or to discuss how I can help you achieve your specific real estate objectives.

Have you completed some research on how to invest in real estate and seen references to the term “REIT” and wondered what it is? The acronym “REIT” stands for Real Estate Investment Trust. A REIT is modelled after mutual funds and they finance, purchase, own and operate properties that generate income.

REITs are a popular real estate investment tool for those who may not have the funds to purchase or the time to manage their own investment property. A REIT pools together investments from multiple investors and pays out dividends to those investors from the rental income generated from the investment.

REITs invest in various property types, including:

Some REITs specialize more on the residential side while others specialize more on the commercial side and some focus on both markets. For example, RioCan Real Estate Investment Trust is Canada’s second largest REIT and owns mostly supermarkets and shopping centres while Granite Real Estate Investment Trust focuses on multi-residential apartment buildings throughout North America and Europe.

A lot of REITs are publicly traded on the stock market, which means you can purchase REITs the same way you would purchase stocks. Investors buy “Units” of a REIT similar to purchasing shares of a stocks. Most REITs have something called a ticker symbol in front of them when being traded on the stock market such as “UN” for Unit since investors are buying a unit and not a share. Investors will often invest through a corporation or numbered company in order to avoid paying capital gains tax on their return on investment as you will be required to pay capital gains if you hold your unit(s) in a personal account.

You may be wondering if REITs are a good investment.

Like most investments, whether it be investment properties, businesses, stocks or REITs, the better the understanding you have in regards to the market that you are investing in, the more likely you are to succeed. For those who have a good understanding of real estate in general, real estate development and economics, REITs are a great way to invest. If you are not familiar with the above, you may want to consider speaking with and using a portfolio manager that is knowledgeable in regards to REITs.

Below are the pros and cons of investing in REITs

The main benefits of investing in a REIT are the following:

The potential negatives of investing in a REIT are the following:

Below is a list of some of the REITs that are traded on the Toronto stock exchange:

RioCan REIT – Retail (see performance here: REI.UN)

Canadian Apartment Properties REIT (CAPREIT) – Residential apartments (see performance here: CAR.UN)

Granite Real Estate – Industrial (see performance here: GRT.UN)

SmartCentres REIT – Retail (see performance here: SRU.UN)

First Capital Realty – Commercial (see performance here: FCR.UN)

Summit Industrial Income REIT – Industrial (see performance here: SMU.UN)

Chartwell Retirement Residences – Healthcare (see performance here: CSH.UN)

Minto Apartment REIT – Residential apartments (see performance here: MI.UN)

American Hotel Income Properties REIT – Hotel (see performance here: HOT.UN)

Allied Properties Real Estate Investment – Office (see performance here: AP.UN)

Hopefully the above information has helped you understand what REITs are and why you may or may not want to consider investing in them.

Are you thinking about making a move or do you have question about the current Toronto real estate market? Contact me any time with your real estate questions or to discuss your real estate plans and how I can assist you with achieving them.

If you’re considering the possibility of buying an investment property in Toronto, it’s important that you understand how to calculate cash flow of an investment property. As a landlord, you ideally want to have positive cash flow and not be breaking even each month, or even worse, your property being vacant or your tenant being behind on their payments (this is called negative cash flow).

What Is Cash Flow

Cash flow is the net amount of cash that flows in and out of a business during a given period of time. It is important to monitor cash flow when investing in property, as it can give you an idea of how well the property is performing and whether or not it is a good investment. For example, if a property is generating positive cash flow, this means that it is bringing in more money than it is spending. This can be a good indicator that the property is doing well and is a wise investment. On the other hand, if a property is generating negative cash flow, this means that it is costing more money than it is making. This can be a red flag that the property might not be a good investment. By keeping an eye on cash flow, you can make sure that your property investments are sound and are likely to generate good returns.

How To Calculate Cash Flow Of An Investment Property

To calculate the cash flow, you will need to know the property’s gross income, operating expenses, and mortgage payments. The gross income is the total amount of rent that is collected from tenants. Operating expenses include things like repairs, insurance, and taxes. Mortgage payments are the monthly payments that are made towards the loan used to purchase the property. Once you have all of this information, you can calculate the cash flow by subtracting the operating expenses and mortgage payments from the gross income.

Factors That Can Affect The Cash Flow Of An Investment Property

There are a number of factors that can affect the cash flow of an investment property. The most obvious is the amount of rent that is collected each month. However, there are also other factors to consider, such as the costs of maintenance and repairs, property taxes, and insurance. In addition, the cash flow can be affected by the vacancy rate, if the property is vacant for long periods of time, it can be difficult to make a profit. Finally, the location of the property is also important. A property in a desirable area is more likely to have higher rents and be easier to fill than a property in a less desirable area. By taking all of these factors into account, investors can maximize their chances of generating positive cash flow from their investment properties.

Ways To Increase Cash Flow

For any investor, cash flow is essential to the success of their investment property. Here are a few tips to help improve the cash flow of an investment property:

1. Review expenses and identify areas where cost savings can be made. This could include anything from renegotiating contracts with ongoing service providers such as lawn maintenance or snow removal companies to implementing energy-saving measures such as changing light bulbs to LED bulbs, improving the insulation and replacing old windows and doors to reduce heating and cooling costs.

2. Increase rental income by making improvements that will appeal to excellent tenants or by making improvements that will allow you to increase the rent to current market rates (if you aren’t already hitting that target) or potentially even higher.

3. Make use of tax breaks and incentives that are available to investment property owners, such as depreciation allowances.

4. Keep a close eye on vacancy rates and make sure that the property is marketed effectively to minimize periods of vacancy. Use high end photos that showcase your property in its best light possible.

By following these tips, investors can help to ensure that their investment property generates a healthy cash flow.

You can use the following online rental property calculator HERE to get a sense of what your numbers would be.

Hopefully the above information has been helpful and has answered any questions you may have had relating to what cash flow is and how to calculate it.

Are you thinking about purchasing an investment property or are you considering selling or leasing out your investment property? Contact me with any questions you may have or to discuss how I can help you achieve your specific real estate objectives.

Whether you live in a condo or a smaller home with little storage space, you likely are in need of somewhere safe and clean to store your extra belongings. It may be your winter skis during the summer months, bikes during the winter months or maybe it’s boxes of old photo albums filled with memories you don’t want to throw out, there are many reasons for needing extra storage. With Toronto condos and the majority of Toronto homes being on the smaller side, I often have clients ask me where they can store their extra belongings. In order to help you solve your storage dilemma, I’ve put together a list of the Top 10 Toronto storage companies below:

Access Storage has many state of the art storage facilities located throughout Toronto and provide a wide range of storage unit sizes for your belongings. Some locations even allow you to use their moving van for FREE (at the time of this post). Click the image above to visit their website to learn.

Apple Storage is one of the larges storage companies in Toronto with many different locations to choose from. They offer small, medium and large size storage lockers and provide 24 hour, 7 days a week keypad access. Click the image above to visit their website to learn more.

XYZ Storage currently has 3 locations at the time of this post. It is a great solution for those who live in the east end of the city such at The Beaches, Upper Beaches, Leslieville, Riverdale, Danforth Village and East York. They offer “Compact” (extremely small units that are 12-24 sq ft), small, medium and large storage units. You can access your secure storage unit 24hours, 7 days a week. Click the image above to visit their website to learn more.

Green storage provides small, medium and large storage units and has several locations throughout the GTA with the two closest locations to Downtown Toronto being located at Cherry Street and Eastern Ave as well as another location in Scarborough near Birchmount Rd and Danforth Rd. They take pride in being a “green” storage solution due to their net-zero facilities that are powered by solar panels. Click on the image above to visit their website to learn more.

SmartStop Self Storage has several locations throughout Toronto and provides small, medium and large self storage solutions. Click the image above to visit their website to learn more.

Vaultra Storage is the second largest storage facility in Ontario (at the time of this post) and offers secure indoor climate controlled storage units of various sizes. Click the image above to visit their website to learn more.

AJ self storage is conveniently located on Commissioners St two blocks west of Logan Avenue making it a great storage option for those who live in the east end. They offer 6 different storage sizes which are accessible 24/7. One thing to consider wit the property is that this facility is an outdoor facility and the storage units are not climate controlled, you will want to be careful about what you store in the unit. Click the image above to visit their website to learn more.

Migson Public Storage is a convenient option for those who live in The Beaches, Upper Beaches and East York and Leslieville. All storage units are heated and 90% of the units are located on the ground level. There are no long-term contracts required. Click the image above to view their website to learn more.

Bluebird Self Storage has several locations with the closest location to downtown Toronto being located in Leaside. They offer a variety of secure, climate controlled self storage solutions. Click the image above to view their website to learn more.

Public storage has several different locations throughout Toronto. They provide a range of individually alarmed, heated storage units and sizes for your storage needs. Click the image above to view their website to learn more.

Although the above list doesn’t include every single storage option in Toronto, the companies mentioned above are the leading companies within the storage industry here in Toronto. Hopefully this list helps you with deciding where to store your personal belongings.

Are you thinking of making a move? I assist my clients with their storage needs when listing their home for sale. Contact me to learn more about how I can help you achieve your specific real estate objectives or to to ask any questions you may have about the current market. I’m always happy to help, I look forward to hearing from you.

If you’ve had any thoughts of potentially selling your Toronto home now or in the near future, you may have wondered what you can do to increase the value of your home in order to ensure that your home sells for top dollar.

Over the last decade or so, Toronto real estate has been on fire with homes receiving multiple offers and selling for well over their list price within a few days (sometimes after only 1 day on the market). As I write this blog post in September 2022, things have drastically changed. With the introduction of increased interest rates and the potential of another rate hike announcement tomorrow (Sept 6, 2022), the market has cooled in regards to the number of buyers looking to buy. This is partly due to uncertainty, as well as buyers simply having less buying power. As I continue to check the local Toronto listings on a daily basis for my clients, I’m surprised by the homes that are not selling within a week and are often on the market longer than fifteen or twenty days, and in some cases, even longer. This amount of time on the market would have been unheard of a couple of years ago when buyers were fighting tooth and nail just to have their offers considered during a bidding war, let alone accepted.

Today, in this new market that we find ourselves in, it has never been more important to ensure that your home shows as best as possible. Buyers currently feel they have more negotiating power than they have had over the last several years. The last thing you want to do is to provide them with reasons to devalue your home during negotiations.

In order to help you sell for the highest price possible, I’ve included the top 10 ways to increase the value of your home below. Keep in mind, not all items on this list will apply to each home as some homes may require more (or less) upgrades to be in top listing/showing condition.

1) First impressions matter (enhance your curb appeal)

The saying “you only get one chance to make a first impression” is true, so make sure you make the right impression from the start. The first thing buyers will see when they visit your property is the front of your home, including your landscaping. For this reason, it’s essential that you take the time and invest into making sure that the front of your home shows well. Below is a list of items to consider attending to prior to listing your home:

In addition to ensuring the front of your home makes a good first impression, it’s just as important that your back garden does the same. By applying the same options as above to the back of your home, you will be able to leave potential buyers with a positive first impression.

2) Kitchens can be deal killers

One of the rooms in a home that I often see clients look over in detail when visiting a home is the kitchen. Buyers often spend a lot of time looking over the kitchen and the appliances and take the time to visualize themselves making use of the space. Below is a list of items you may want to consider addressing prior to listing your Toronto home for sale:

3) Beautiful bathrooms sell homes

Another top room of concern for buyers when viewing homes is the bathroom(s). If your bathroom is outdated, you will very likely receive offers at lower price points than if your bathroom is updated. Like kitchens, buyers tend to spend a lot of time considering the bathrooms in a home. It’s important to leave potential buyers with a positive impression and one that they will remember once they have left your home. Below are some items you may want to consider:

4) Add a fresh coat of paint

Adding a fresh coat of paint can drastically improve the look of your home. If you decide to use the same colour as the existing colour on your walls, adding a fresh coat of paint will remove any scuff marks and will make the room feel newer. If you decide to change the colour, it is best to stick to light and neutral colours. I’ve included a list of both Farrow & Ball and Benjamin Moore colours that you may want to consider if you plan on painting your rooms with a new colour. I highly recommend using one of these two top brands when painting, if possible, as the quality of the paint is noticeable when compared to more cost effective paint brands. If these two brands are not within your budget, consider sticking to similar colours as the ones suggested below.

Farrow & Ball

“California Collection: Salt” CC5

Benjamin Moore

5) Update your lighting game

Light fixtures don’t only provide light, they also make a statement when they are both on and off. It’s important that your light fixtures make the right statement and not a statement that leaves potential buyers with the impression that your home is dated or hasn’t been taken care of. Below is a list of some prominent lighting stores where you can browse through many different light fixture options. My advice is to stick to a style that is timeless yet modern.

Union Lighting (best to view their products in person)

6) Replace your outdated flooring

Whether you have a pet whose claws have scratched up your floors, kids or grandkids whose toys have left their mark or you have broadloom/carpeting, you may want to consider replacing your outdated or damaged floors. These days there are a wide range of both hardwood, engineered hardwood, laminate and tile products to choose from.

7) Make your home smarter with a smart home product

With new technology becoming more popular by the day and with society becoming accustomed to homes having cool features such as smart home systems, you may want to consider installing a smart home system in your home. Many smart home systems allow you to control various aspects of your home such as the temperature, lighting, alarm and more. The best part about these systems is that they are usually quite simple to install.

8) Cool down your home with an air conditioner

With the summers getting warmer and warmer, if your Toronto home doesn’t currently have air conditioning like many older homes in Toronto, you may want to consider installing an air conditioner. If you don’t have duct work already running throughout your home, don’t worry, there are many different styles and sizes of air conditioners these days. Speak to a licensed HVAC company about your air conditioning options as there will very likely be one that works for you and your home. If you’re selling your home any time between spring to late summer, buyers will definitely appreciate the fact that you have an air conditioner and will likely be willing to pay more for your home.

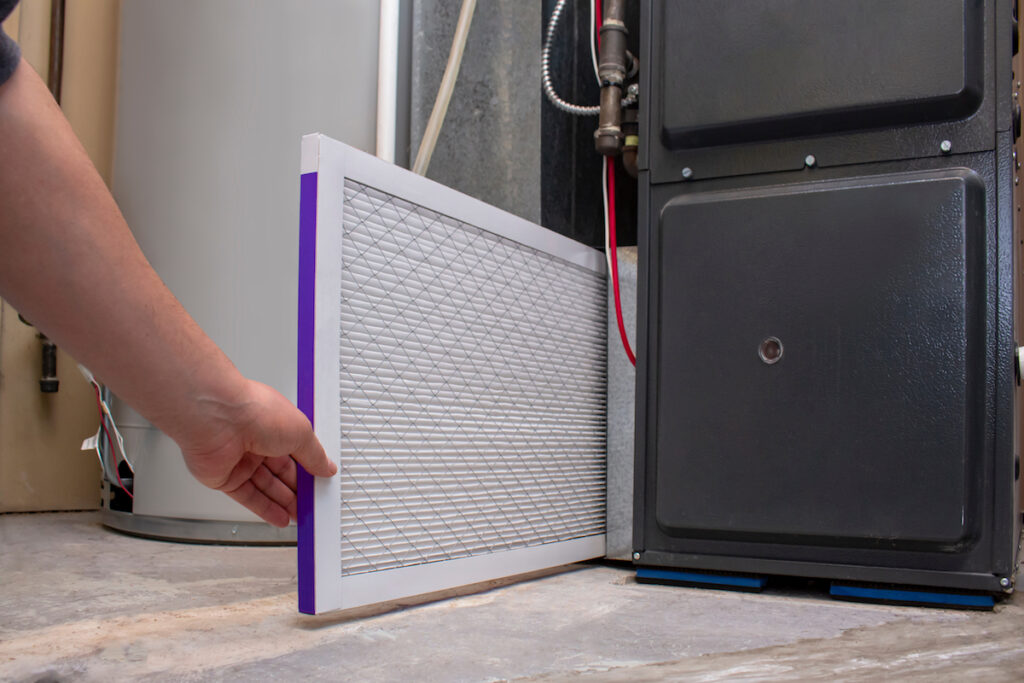

9) Upgrade your furnace

If your furnace is coming to the end of its life, it may be worth considering replacing it with a new one. If there are any issues with your furnace and it isn’t working properly, buyers will likely use this as a negotiating tool to bring down the value of your home. In a red hot real estate market, you may not need to worry about this as much but when the market is cooler, this is definitely something to consider and not put off.

10) Transform your old wood-burning fireplace with a modern gas insert

Last November, I wrote a blog about the importance of checking the fireplace before submitting an offer which discussed the fact that many of the older homes have outdated and unsafe wood-burning fireplaces and chimneys that are just as unsafe. A great way to increase the value of your home is by installing a gas insert fireplace into your old wood-burning fireplace opening.

Although this list may not be exhaustive of every single option available to increase the value of your home, I believe that these are the top 10 ways to increase the value of your home.

With over fifteen years of previous experience as the owner of a design and build firm prior to entering the word of Toronto real estate and as a full-time, award winning Toronto real estate agent, I have seen my fair share of homes throughout Toronto and the GTA and know what helps to sell a home for the most amount of money. If you are thinking about selling your home and have questions about how you can increase the value of your home or if you have any questions about the market, contact me any time – I’m always happy to help.

It is difficult to provide a monthly market report, in this case for August, with all the economic and destabilizing changes that are impacting the Toronto and area housing market. The salient data is clear, as the chart below indicates.

The residential resale housing market has changed dramatically since last year. Sales are down, the number of active, available properties for sale has increased, properties are taking longer to sell, and although the average sale price appears to be holding up quite well compared to August 2021, it is off by almost 20 percent compared to the $1,334,000 achieved in February of this year. February and March were the zenith of the Covid-19 pandemic market – cheap money, lack of supply, the need for space and real and psychological security, not to mention the prevailing belief that if you did not acquire and own real estate, the accumulation of wealth would be impossible, were the driving forces.

The major change that has had an overwhelming impact on the Toronto and area housing resale market has been the sky-rocketing cost of borrowing money. All the market changes set out above – decline in sales, increase in available properties, sale times, and declining average sale prices can be directly linked to the Bank of Canada’s continual increase of its benchmark rate. In March, the Bank’s policy interest rate was 0.25 percent. At the end of August, it was 2.50 percent.

If there was no further threat of further Bank rate increases, by the end of August, it could be said, with some certainty, that the resale market had stabilized – sales, prices, and the length of time it took properties to sell. Unfortunately, on September 7th the Bank increased its policy rate by a further 0.75 percent, bringing it to 3.25 percent. The last time the Bank rate was 3.25 percent was April 2008. Early September data indicates that the most recent increase has had a further cooling effect on the residential resale market. The pace of sales is slower than it was in August. At the time this Report was prepared the pace of sales in September was 25 percent slower than at the same time in August, a number that correlates with the percentage increase in the September policy interest rate by the Bank of Canada.

The sharp increases in the policy rate by the Bank of Canada continue to destabilize the residential resale market, not to mention the residential rental market (beyond the scope of this Report) that has seen rents increase by as much as 25 percent in a single year. The decline in average sale prices has not made Toronto’s residential resale market more affordable. Whereas the average sale price may have declined by 20 percent since February, mortgage interest rates on average have increased by more than 150 percent over the same period. Coupled with the impact of the mortgage interest stress test, buying a house in the Toronto and area marketplace has become exponentially more expensive, even as compared to February and March when average sale prices peaked at $1,334,000. Regretfully in its latest policy statement, the Bank of Canada made it clear that it was prepared to implement further increases in order to contain inflation which currently is 7.6 percent, down from 8.1 percent in June – of advanced economies only Japan (2 percent) and Switzerland (3.5 percent) have inflation rates anywhere near the magical 2 percent that the Bank of Canada is determined to achieve.

The good news, not only for the housing market but for the economy generally, is that inflation appears to have peaked, with some indication that it is declining in various sectors. If this is a continuing trend, the Bank may stall further increases. That would be the signal that will cause the housing market to reignite. Buyer sentiment will change – there will be a new understanding that prices and sales will not decline further. Unless some unforeseen economic event occurs that should happen before the end of this year.

Have questions about the market, selling or buying?

Contact me any time. I’m happy to answer any questions you may have.

Prepared by Chris Kapches, LLB, President and CEO, Broker, Chestnut Park® Real Estate Limited, Brokerage.