With the cold temperatures and the snow already on the ground, it’s important to go over your winter home checklist to ensure your Toronto home is prepared for this winter season. In order to help you prepare, I have put together this winter home maintenance checklist which includes tasks to consider prior to winter as well as ongoing tasks to complete throughout the winter season in order to protect your home and family.

Although this list may seem overwhelming, the potential harm that can be done to your home, equipment and family would surely be even more overwhelming. Take the time to tackle as many of these winter home maintenance tasks so that you can sleep well at night.

Are you thinking about buying or selling this winter and have questions about the buying or selling process or questions about the market in general? Contact me any time with your questions, I’m always happy to help.

You may have heard the term “garden suite” lately and wondered what is a garden suite? That’s a great question and it’s important that you know the answer if you own real estate in Toronto. In order to bring you up to speed with this hot topic, I’ve put together this blog in order to answer any questions you may have.

What Is A Garden Suite?

Toronto’s bylaw includes the following definition for this type of secondary suite:

“a self-contained living accommodation for a person or persons living together as a separate single housekeeping unit, in which both food preparation and sanitary facilities are provided for the exclusive use of the occupant(s) of the suite and is in an ancillary building not abutting a lane. A laneway suite is not a garden suite.”

It is important to understand that a laneway suite is not considered a garden suite based on the above definition. For clarity purposes, the City of Toronto defines a laneway suite as the following:

“a self-contained living accommodation for a person or persons living together as a separate single housekeeping unit, in which both food preparation and sanitary facilities are provided for the exclusive use of the occupants of the suite and is in an ancillary building abutting a lane. A garden suite is not a laneway suite.”

It is also important to note that the new bylaw clearly states that only one ancillary building is allowed on a lot. A lot owner is not permitted to construct both a garden suite and a laneway suite on their property, regardless of how large their lot may be. The City’s exact wording is included below:

“A maximum of one ancillary building containing either a laneway suite or a garden suite is permitted on a lot. A lot may not contain both a laneway suite and a garden suite.”

Why Is Toronto Allowing These Secondary Suites?

As you are likely aware, Toronto has been facing a supply and demand crisis for quite some. The lack of supply has played a major part in skyrocketing real estate prices throughout Toronto and the GTA making it very difficult for people to get into the real estate market as both an owner as well as for tenants looking for a place to rent.

In an attempt to alleviate the supply and demand crisis, the City of Toronto is now allowing property owners to erect secondary suites on their properties (with restrictions).

“Through the adoption of the Official Plan and Zoning Bylaws amendments, Council has put policies in place to increase the supply and type of housing available in the City. The new policies and zoning requirements will allow garden suites to be permitted on properties in most residential zones across Toronto.”

The Affordable Laneway and Garden Suite Program

Not only has the City of Toronto opened the doors to building secondary suites, they are also providing initiatives through the “Affordable Laneway and Garden Suite Program” to property owners who meet all of the requirements.

“The Affordable Laneway and Garden Suite Program provides funding in form of a forgivable loan of up to $50,000 for eligible property owners developing a laneway or garden suite. The loan will be forgiven in 15 years from the date when the first tenant occupies the laneway suite. The rent being charged cannot exceed the City of Toronto Average Market Rent, by bedroom type at any time during the 15 year affordability period.”

Building Requirements & Restrictions

Square Footage Restrictions:

Although the City clearly states that there are no minimum lot size requirements for these types of secondary suites, they did release the “Garden Suites – Summary of Rules and Regulations” document which states:

“The maximum footprint (area the building covers) of a garden suite is the smaller of 40% of the rear yard area, and 60 square metres. The total area of a lot that all ancillary buildings and structures may cover, including a garden suite and any other sheds or garages, cannot exceed 20% of the lot area.”

Height Restrictions:

The City states the following in regards to height restrictions:

“A garden suite may be built up to a maximum height of 4.0 metres where the garden suite is located a minimum of 5.0 metres from the main residential building on the lot.

If a garden suite is at least 7.5 metres from the main residential building on the lot, the garden suite may be built up to a maximum of 6.0 metres. However, this is subject to additional angular plane rules.”

Basement Restrictions:

Basements ARE PERMITTED

Use Restrictions:

“A garden suite may be used for living accommodations and home occupations. Short term rentals are permitted only in accordance with the Short-Term Rental By-law.”

Visit the Short-Term Rental By-law for more information.

The City also mentions on their website that other factors will be taken into consideration before approving a suite. These factors include the site size of the proposed garden suite, the lots width and depth, size of the main structure on the property, adequate emergency access and location of mature trees on the property.

Hopefully the above information has answered all or at least most of your questions relating to this popular topic. Contact the City of Toronto for more information regarding garden and laneway suites and to learn more about The Expanding Housing Options in Neighbourhoods initiative EHON@toronto.ca.

Are you thinking about buying or selling a home in Toronto or do you have questions about the current market? Contact me any time, I am always happy to help and to answer your questions.

Are you looking to purchase property in the Toronto area? If so, you may have heard of Land Transfer Tax (LTT) and its importance when it comes to closing on a real estate transaction. This blog post will provide an overview of what Land Transfer Tax is, how much it costs, who pays for it, and other important information about LTT in Toronto. We’ll also discuss strategies that can help buyers lower their overall costs associated with purchasing property in the city. With this knowledge, you can make sure you’re fully informed and prepared when it comes time to buy a home or commercial space in Toronto. Keep reading to learn more!

Land Transfer Tax (LTT) is a fee charged by the province of Ontario on all transfers of ownership of real estate property within Toronto and Ontario. It is based on the purchase price and paid at the time of closing to the provincial government.

The amount of Land Transfer Tax that must be paid depends on several factors, such as where in Toronto the property is located, how much you are paying for the home, and if there are any special exemptions or rebates offered by your municipality.

For example, First-time buyers may be eligible for a rebate of the provincial and municipal (Toronto) land transfer taxes, to a maximum of $4,000 of the payable provincial land transfer tax and $4,475 of the payable municipal land transfer tax (Toronto), respectively.

This is designed to help make housing more affordable to young people just getting into the market. However, as you are likely aware, these rebates are nothin substantial when taking into consideration the average sale price of a home in Toronto.

Regardless of any exemptions or rebates, the amount of Land Transfer Tax paid is usually a significant sum and should be factored into your overall financial plan when buying a home in Toronto. To help you estimate what your LTT may amount to prior to closing, you can use TREBB’s online land transfer calculator HERE.

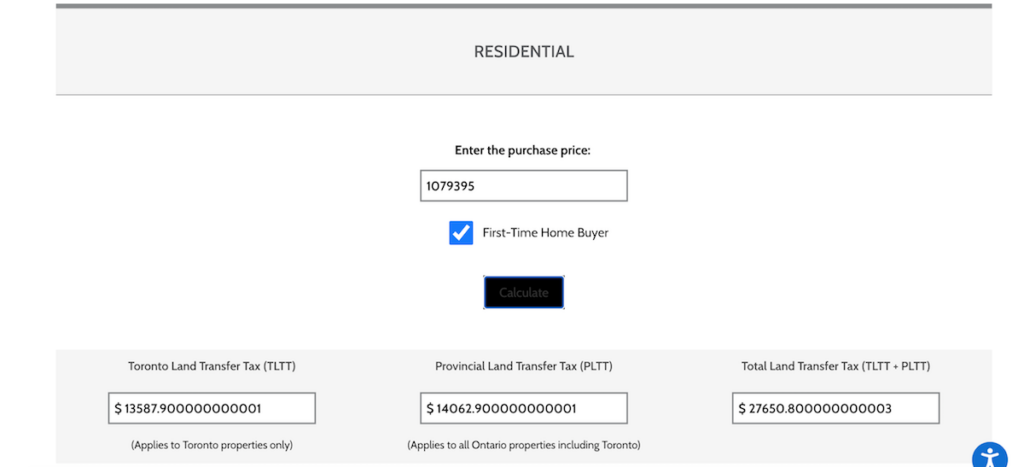

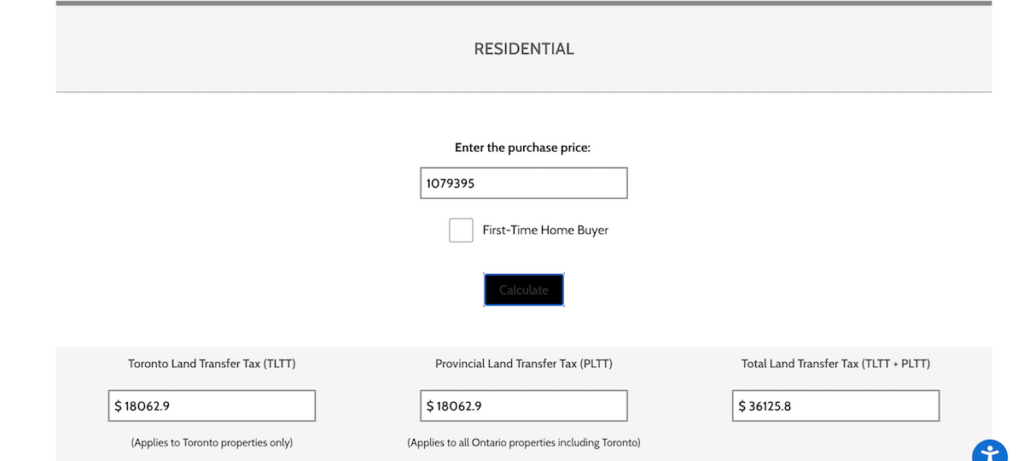

At the time of this blog post, November 2022, the average sale price for a home in Toronto is currently $1,079,395. In order to provide you with an example of the calculation of LTT that a buyer would be required to pay on this amount, I have included screenshots below which show both the LTT due on a home at a sale price of the current average sale price as a first-time buyer as well as the amount due for a purchase at the same price by someone who doesn’t qualify as a first-time buyer.

If you would prefer to avoid paying both the municipal (Toronto) LTT in addition to the provincial land LTT, you may want to consider buying a home outside of Toronto. When buying a property outside of Toronto, you are only required to pay the provincial LTT.

Overall, understanding the amount of Land Transfer Tax you need to pay prior to closing can ensure that you have all the funds necessary before taking ownership of your new home in Toronto. It’s important to factor this tax into your pricing plans so you don’t end up with unexpected surprises at closing time!

Feel free to reach out if you have further questions on the Land Transfer Tax and how it applies to your specific situation or if you have questions about buying or selling. I’m always happy to help.

What’s The Difference Between A Listing Agent And Buying Agent?

Historically speaking, more agents used to designate themselves as either a listing or buying agent. However, times have changed with more agents offering both services to their clients these days. With that being said, there are still agents who focus only on listing properties for sale while others focus only on helping buyers with finding the perfect home.

A listing agent and a buying agent both play a vital role in the real estate industry, but there are some key differences between them. For prospective home buyers and sellers who are considering entering the real estate market, understanding how these two professionals operate can help ensure a successful purchase or sale of a property. Although the classification of listing vs buying agents is less common these days, in this blog post, we’ll explore the differences between a listing agent and buying agent to help you understand the differences should you come across an agent that identifies as one or the other. Read on to learn more!

The Listing Agent

A listing agent is a real estate professional who specializes in representing sellers in a property transaction. They are responsible for helping the seller determine the appropriate list price, arranging and covering the costs associated with preparing and marketing their home, as well as negotiating with potential buyers on behalf of the seller. Many reputable agents will arrange and cover the costs associated with providing the following pre-listing services before their client’s property goes live on MLS and REALTOR.ca:

In addition to the pre-listing services mentioned above, a listing agent will typically offer and cover the costs for the following services while the listing is live:

The listing agent’s commission is typically paid by the seller and is typically 5% of the final sale price plus HST.

The Buying Agent

By contrast, a buying agent is a real estate professional who specializes in representing buyers in a property transaction. This type of real estate agent helps buyers research properties and neighbourhoods, negotiate with sellers on their behalf, books and attends showings of homes and handles paperwork associated with the purchase of a home.

The buying agent’s commission is typically paid by the seller and the typical commission in Toronto for a buying agent’s service is 2.5% + HST which comes out of the total 5% + HST commission that is paid to the listing brokerage by the seller.

The Modern Day Agent

These days, you will find that most agents assist both sellers and buyers. Based on my own personal opinion and experience, I believe you are better off working with this type of agent as they will have invaluable previous experience from being on both sides of the deal table. I myself have benefited from my past experiences of assisting both sellers and buyers. When helping a seller client, I often understand the negotiating tactics that the buyer’s agent is attempting to use on me to persuade my thinking and I am able to rebut such tactics in order to ensure my client’s interests are protected and that they receive the best result possible. Conversely, when assisting my buyer clients, I often know what the listing agent is dealing with in regards to handling any offers they have received as well as their seller’s expectation. Due to my experience of being on both sides in the past, I am able to read between the lines when negotiating with a seller’s agent in order to understand what will likely get the deal done. I also understand the different pressures that each side are under during the negotiating process and try to capitalize on these pressures when I am able to in order to get the best results for my clients.

Ultimately, understanding the differences between a listing agent and buying agent is essential for anyone entering into a real estate transaction and who comes across such agents who classify themselves as one or the other. Whether you are looking to buy or sell a home, having an experienced professional on your side can make all the difference in achieving a successful outcome. With the right real estate agent, you can have the confidence that your purchase or sale is in good hands.

If you’re considering listing your home or buying real estate in Toronto and need professional assistance or have questions about the process, contact me today. With the right real estate agent on your side, you can have the confidence that your sale or purchase is in good hands!

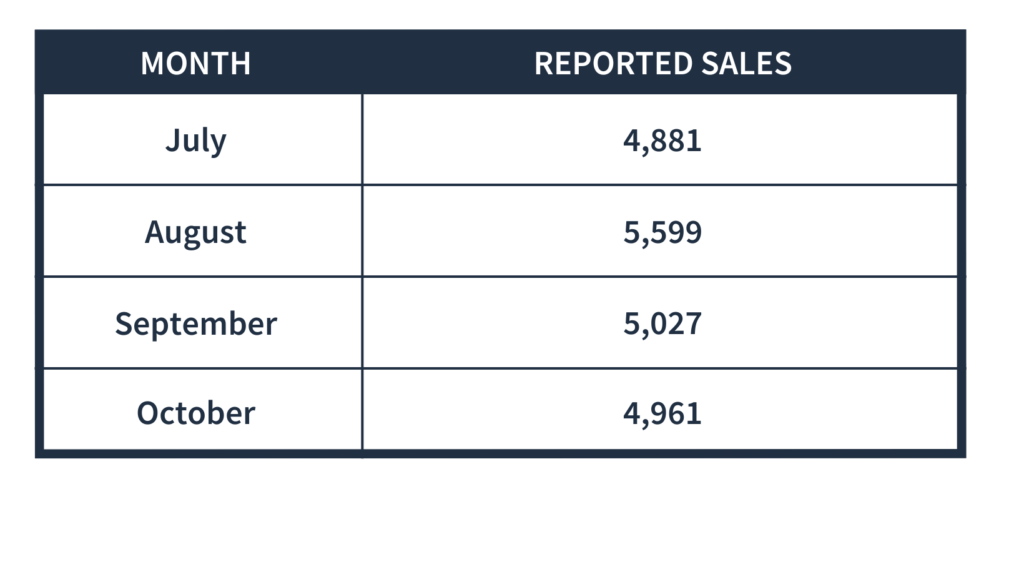

As forecast in our September Market Report, sales have continued to decline on a year-over-year basis. In October 4,961 properties were reported sold in the greater Toronto area, almost 50 percent fewer than the 9,743 properties that changed hands last October. The decline in sales is a continuation of a pattern that started in March when the Bank of Canada began its fight against inflation by increasing its benchmark rate. The Bank further increased the benchmark rate by 0.5 percent in late October bringing the current rate to 3.75 percent. In early March the rate was 0.25 percent, an eye-popping increase of 1,400 percent.

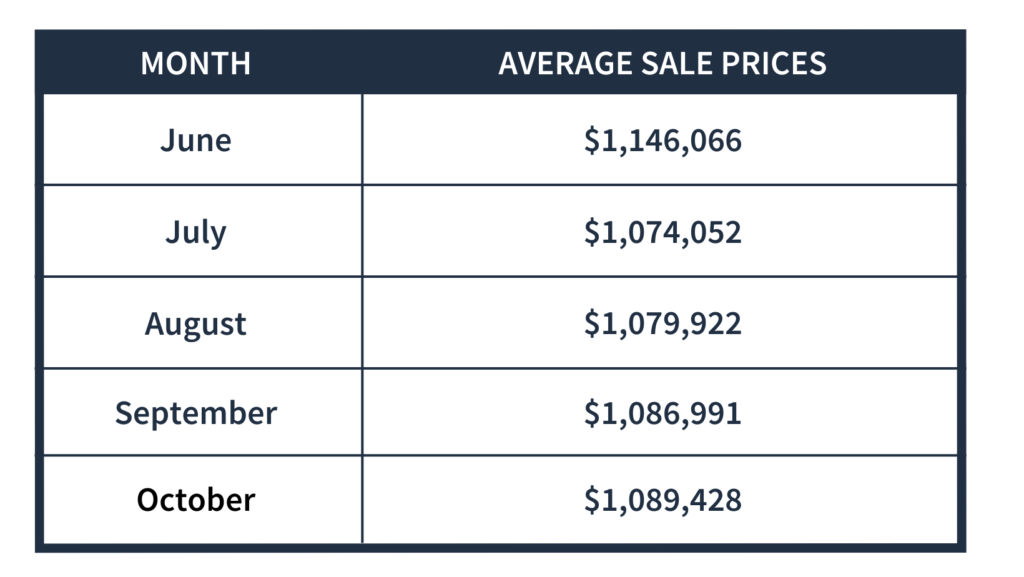

Notwithstanding these incredible rate increases, which in turn have been reflected in rising mortgage interest rates, which currently range between 5.25 to 5.75 percent, there are aspects of the resale market that reflect its underlying strength and resilience. Although average sale prices are substantially lower than in February, over the last few months they have stabilized, and in fact are slowly rising.

Average sale prices hit a low of $1,074,052 in July. At this point rising mortgage interest rates were still being absorbed. Since then average sale prices have increased by almost 1.5 percent to $1,089,426, inspite of further mortgage interest rate increases.

Similarly, the number of monthly reported sales has also stabilized.

Monthly sales have plateaued around 5,000, again notwithstanding the impact of the rising benchmark rate and, even more surprising, the rise in average sale prices, albeit moderately, over the same period.

It should also be noted that the number of properties coming to market have also been decreasing. In October 10,390 new listings were posted on the Toronto Regional Real Estate Board’s MLS system, almost 12 percent fewer than the 11,749 listed last October.

Granted the number of reported sales is consistent with the reported sales in 2008 during the catastrophic downturn in the equity markets, these three factors stabilized sales, rising (moderately) average sale prices, and the declining number of new properties coming to market – portend what will happen to the Toronto and area resale market at the first sign that mortgage interest rates have stabilized, and more importantly when they reverse and start heading downward. When that happens the market will dramatically accelerate, returning to a pace reminiscent of pre-pandemic levels. Based on the Bank of Canada’s most recent pronouncement on the economy and inflation, that should happen by the second quarter of 2023. The Bank indicated that by the end of next year inflation should be reduced to 3 percent returning to 2 percent by 2024.

On November 1st, the Federal Government announced that it is planning a massive increase in the number of immigrants entering Canada, with a goal of bringing 500,000 new immigrants to this country by 2025. In the interim, over 400,000 new immigrants will be entering Canada in each of 2023 and 2024, and close to half of them finding their way to Ontario. All of these factors point to the resurgence of an incredibly strong resale market in the greater Toronto area. Notwithstanding the recent provincial government announcement of legislation designed to increase supply (More Homes Built Faster Act, 2022), optimistically by 1.5 million homes over the next decade, demand will painfully outstrip supply, creating pandemic-like resale market conditions.

Looking ahead to the end of 2022, what we have been experiencing, both in terms of sales and average sale prices and as set out in the charts in this Report, will continue with little change, except for a further seasonal slowdown in December and January of 2023.

Have questions about the market, selling or buying?

Contact me any time. I’m happy to answer any questions you may have.

Prepared by Chris Kapches, LLB, President and CEO, Broker, Chestnut Park® Real Estate Limited, Brokerage.

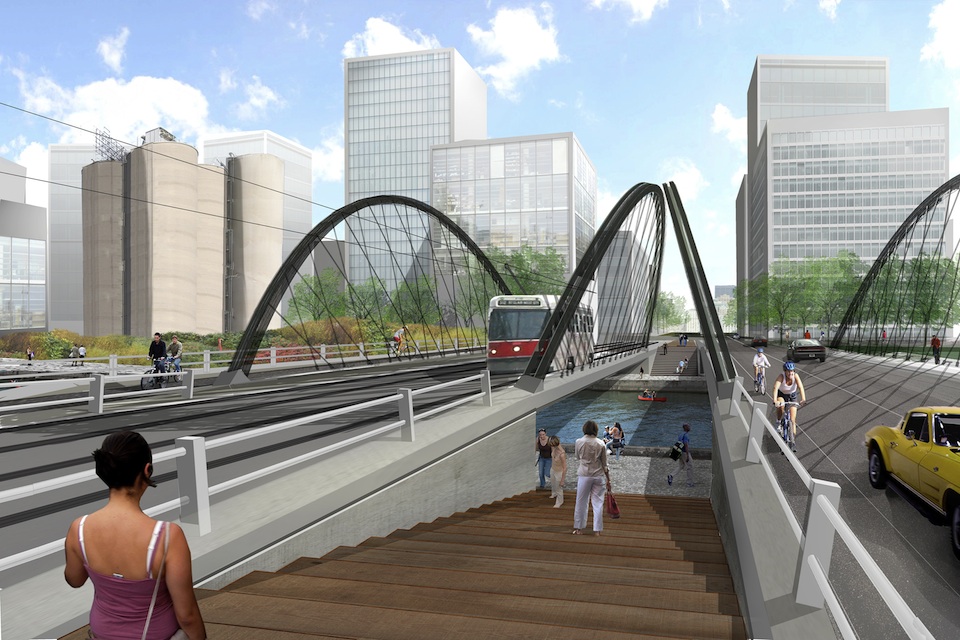

If you live in Toronto, you have likely noticed all of the construction taking place in the Port Lands just south of Toronto’s historical Distillery District. What you are witnessing is the massive Port Lands revitalization project which will completely transform this part of Toronto.

What Is The Port Lands Revitalization Project?

The Port Lands is an area in Toronto that was heavily industrialized for many years. However, with the decline of heavy industry in the city, the has become increasingly derelict, rundown and quite an eyesore. In order to revitalize the area, Waterfront Toronto in collaboration with architect Michael Van Valkenburgh Associates Inc and LEA Consulting has embarked on a major redevelopment project. The Port Lands revitalization project is a large-scale urban planning initiative that aims to transform the area into a vibrant and livable community. The project includes plans for new residential and commercial development, flood protection, relocating the mouth of the Don River as well as creating parks, trails, public spaces, and infrastructure improvements. The goal of the project is to create a thriving neighbourhood that will attract new residents and businesses, while also providing much-needed amenities for the existing community.Ultimately, the goal of the Port Lands revitalization project is to create a more prosperous and sustainable future for the east end of Toronto. The project is one of the largest urban redevelopment projects in Toronto, and it is sure to have a transformative impact on the city.

When Will The Project Begin And End?

Construction has already started and is expected to be completed by 2025.

Below are some videos and renderings relating to the project. To learn more about the project, visit the Waterfront Toronto Portlands project page HERE.

Flood Protection

A New Island

Nature And Parks

Space To Live And Work

Engineering A New River

Progress (May 2022)

Renderings Gallery

Are you thinking about buying or selling or do you have questions about the current market? Contact me any time, I’m always happy to help.

“Should I get pre-approved for a mortgage?”

This is a common question that buyers often ask themselves, particularly if they are new to buying real estate in Toronto.

If you’ve been considering purchasing your first property or you are looking to make a move to a larger home, you may have wondered if you should get pre-approved for a mortgage. If you’re not familiar with lending terminology, you may even wonder what getting pre-approved for a mortgage means.

I’ve put together this blog post in order to help answer your questions so you can make the right decisions throughout your buying journey.

First, let’s discuss the difference between getting pre-qualified vs pre-approved by a lender.

What Does Getting Pre-qualified Mean?

The process of getting pre-qualified from a lender is typically a quick process that requires you to provide certain basic information such as your annual income as well as your debts and assets. Once you have provided this information, the lender will be able to provide you with an amount that they would be willing to lend you for the purchase of a home. However, it’s important to understand that the pre-qualified amount provided by the lender is not guaranteed, therefor, you should avoid submitting any offers until you complete the pre-approval process.

If you are simply curious to know how much your mortgage payments may be based on a certain purchase price and aren’t ready to go through the official pre-qualification and pre-approval processes, many of the major banks have online mortgage calculators that will provide you with an approximate figure. These calculators allow you to insert your purchase price, down payment amount, interest rate and amortization period in order to provide you with an approximate mortgage payment. I’ve included links below to most of major bank mortgage calculators below:

TD Canada Mortgage Payment Calculator

Scotiabank Mortgage Payment Calculator

CIBC Mortgage Payment Calculator

RBC Mortgage Payment Calculator

BMO Mortgage Payment Calculator

What Does Getting Pre-Approved Mean?

Getting pre-approved for a mortgage is the next step following the initial step of pre-qualifying and provides you with a more accurate figure than a pre-qualification figure. During the pre-approval process, you will provide supporting documentation relating to your income, debts and assets and will discuss your downpayment and financial limits and specific needs with your lender of choice. Additionally, you will also discuss the different mortgage options available to you such as variable rate mortgages and fixed rate mortgages along with the different terms, amortization period and payment options available. Once you are pre-approved, you will have a better understanding of how much you can afford when shopping for a home. It’s important to keep in mind that your pre-approval is typically valid for a certain period of time which is typically anywhere between 60-120 days.

Tip: Hold off on making any large purchases or applying for new credit such as credit cards or loans prior to getting pre-approved and prior to closing on your new home. Making large purchases such as purchasing a new car or applying for a new credit card will negatively affect the amount you will be approved for by your mortgage lender.

How Long Does It Take To Get Pre-Approved For A Mortgage?

Getting pre-approved for a mortgage can take as little as a couple of hours or as long as a week (sometimes longer) depending on whether you provide your lender with the required documentation and depending on your lenders requirements. Banks typically take longer than other lenders such as independent mortgage brokers due to their strict pre-approval requirements. If you’re in a rush to get pre-approved for a mortgage because you’ve found the home of your dreams, you may want to consider speaking with an independent mortgage broker as they may be able to get an approval faster.

Is There A Fee For Getting Pre-Approved For A Mortgage?

At the time of this blog post, most of major lenders and mortgage brokers do not charge a fee for completing the pre-approval process. However, it is wise to ask your lender if there are any fees associated with getting pre-qualified or pre-approved in order to avoid any surprises.

Hopefully the above information has answered all or most of the questions you may have had about getting pre-approved for a mortgage. If you still have unanswered questions, feel free to contact me or speak with a lender such as your bank or an independent mortgage broker.

Are you thinking about buying or selling or do you have questions about the current real estate market? Contact me any time with your questions. I’m always happy to help.

If you’re thinking about buying or selling real estate in Toronto, it’s important to understand why you should use a local real estate agent and not an agent from out of town (even if it’s your friend, cousin or sister etc).

Lately, I’ve been seeing many agents advertising that they work in various parts of the GTA outside of their own community. For example, one agent I recently came across advertised that they are located in Hamilton but also stated that they work in “Burlington, Mississauga, Hamilton, Toronto and the GTA”. From the east side of the city, I see many agents who are located in the Durham Region advertising that they work in “Whitby, Pickering, Oshawa, Toronto and the GTA”. Anyone who understands geography and real estate markets knows that it’s practically impossible to truly have your finger on the pulse of that many different real estate markets all at once. Just the city of Toronto alone has several micro markets based on different areas and neighbourhoods throughout Toronto.

Real estate markets are changing by the day and so are different important aspects of each community. For example, many of these areas mentioned above have different bylaws, different new development projects taking place, different short-term rental laws, different politics, different cultures and core values amongst the community members as well.

Although I can appreciate that agents want to make as much money as possible, it’s important to remember that a client should receive the best service possible, even if that means referring business to an agent who is more knowledgeable when it comes to a specific neighbourhood and market.

I always scratch my head when I see people using agents from out of town to list their Toronto home or condo or to assist them with buying a home in Toronto. However, I’m never surprised when the “FOR SALE” sign sits in the lawn longer than other listings that are listed by local agents who know the local market better or when I see that the property sold for less than it should have.

To be fair, I strongly believe the same thing when it comes to Toronto agents assisting clients outside of Toronto. An agent from Toronto simply won’t know other GTA markets as well as the local agents from those markets. Which is why you are often better using a local agent from one of these smaller markets.

In order to help you truly understand the benefits of using a local agent, I have provided the following helpful information below as to why you should use a local real estate agent.

They Know The Community Better – A local agent knows your community extremely well and can answer buyers’ questions correctly while also providing additional local insider tips and info about the neighbourhood that outside agents won’t know. Whether it be answering questions about the best schools in your area, the demographics of the neighbourhood, the best coffee shops and restaurants nearby, the closest Go Train or subway station, the local festivals and events, the best dog parks, playgrounds, or simply what makes your neighbourhood the best option for them compared to the other neighbourhoods they are considering. A local real estate agent will be able to address all of these items which most definitely will help sell your home faster and potentially for more money.

They Know The Inside Scoop – local agents are more likely to know the inside scoop on different ideal streets and condo buildings which can be helpful when you are buying. Experienced local agents will be familiar with any issues that may come up in the status certificate of a building that you are considering buying in due to past experience with submitting offers for other clients in that building. There’s also a better chance that they will either have other clients who live in the building or on the same street who can provide valuable insider information that may sway your decision and help you avoid making the wrong decision. Additionally, they will likely be aware of any upcoming construction and or developments that may be coming up in the future which may affect your ability to enjoy your new home or condo.

Avoiding Costly Misrepresentations – As many of the homes in Toronto were built in the 1920’s and even earlier, they are not built the same as cookie-cutter suburban homes found in new-build suburban developments. In addition to them being older, almost every home in Toronto is unique in its own way. Whether it’s the way that it was built, the heating and cooling system within it, the sewer system, the easements on title or the encroachments along the property lines. You will rarely find a home or property without unique attributes and features that need to be taken into consideration when listing a property for sale or buying a property. As a seller, it’s important to understand that any misrepresentation made by your real estate agent can fall back on you which could potentially land you in a legal dilemma that can become both costly and time consuming. By using a local, knowledgable and experienced Toronto real estate agent to sell your Toronto home, you can greatly reduce your chances of running into legal and financial issues when selling.

They Know The Local Market Better – A good local Toronto real estate agent will know the markets and neighbourhoods that they work in extremely well. They will be keeping an eye on their local market on a daily basis and will be watching the market trends such as the average selling price, average days on market, the list-to-sale price ratio etc. They will also have seen most of the properties in the area in person from showing them to other buyer clients in the past. This is invaluable as outside agents will not be viewing comparable homes in person and won’t be able to provide valuable information that could only be discovered in person such as knowing that a comparable home to yours sold for less money because the photos in the listing didn’t include a photo of the moldy bathroom.

They Have Stronger Relationships With Other Local Agents – Local agents talk with one another and are often on the opposite sides of the deal table helping their clients come to an agreement. Due to the ongoing local relationships that agents have with one another, it’s likely that the local agent you are considering hiring versus the outsider agent will likely be up to date with more local information that could affect the sale of your home. Whether it be discussions relating to a new development that will be built down the street in the near future, a large streetcar track renovation that could take months, new zoning bylaws that have just passed etc, a local agent is more likely to be aware of such relevant information that could negatively affect your home’s value. Also, due to their relationships with other local Toronto real estate agents, they will likely be aware of any “exclusive” (off market) listings that may meet your requirements.

They Are More Readily Available In Person – It’s not uncommon for sellers to move out of their homes during the first week of showings in order to avoid the hassle of having to leave all of the time while also having to worry about keeping the home in top showing condition. Should there ever be any issues with the listing during the showing period, your local real estate agent will be able to promptly address the issue whereas an agent from out of the city won’t be able to. As an example, what happens if a buyer’s agent can’t open the lock box, how will this be addressed promptly if your real estate agent needs to drive an hour to get to your home? A local real estate agent will be able to address such a situation in a much shorter period of time. This is just one example of the many things that can go wrong during a listing and just one of the benefits your local agent being close by for emergencies.

Investing Back Into The Local Community – Many real estate agents invest back into their local community in various ways. For example, I sponsor a number of local kid’s soccer teams in my area. I also pay for advertising signs where a portion of the advertising fee that I pay goes towards maintaining the hockey rink in which the local kids learn to skate and play hockey. Additionally, I regularly donate to several important causes such as SickKids Hospital, Princess Margaret Cancer Centre and the Child Development Institute which are all great causes located here in Toronto. By hiring an agent from outside of your area, you won’t be reinvesting back into your community, you will be investing in their community outside of Toronto.

As you can see from the above, there are many reasons why you should use a local real estate agent for your real estate needs.

Are you thinking about buying or selling in Toronto or do you simply have questions about the current market? Contact me any time with your questions or to discuss how I can help you achieve your real estate objectives.

As a full time real estate agent, my seller clients often ask me “what if the buyer doesn’t deliver the deposit?”. This is a great question and if you are wondering the same thing, I’ve included an explanation below.

I completely understand the stress that sellers may feel when waiting for the deposit to be delivered, it’s not an easy time waiting and wondering if the money will arrive. I myself have been in this position in the past when I have sold my previous properties prior to becoming a real estate agent. The process of selling a home can be confusing when you don’t do it on a daily basis.

Although many people think that a deal is automatically dead if the deposit isn’t delivered by the buyer, this isn’t the case. There is often a misconception amongst both buyers and sellers when it comes to what happens if the buyer doesn’t deliver the deposit. Ontario law states that in order for a contract to be valid, the following must be included: an intention to contract, an offer to contract, an acceptance of that offer and consideration.

For those of you who may not be familiar with legal terminology, the term “consideration” applies to the deposit when referring to a real estate transaction. Based on this wording, many would assume that if there is no deposit (consideration), there is no binding deal and that the buyer can simply walk away from the deal without any penalty, but isn’t correct.

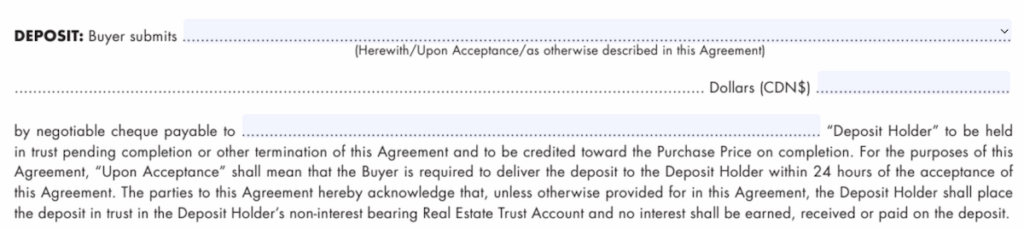

The majority of (standard form) offers that are used to sell real estate in Toronto state that the buyer must deliver the deposit within 24 hours of acceptance of the offer. The exact pre-printed wording in the standard form reads as follows:

In most cases, when the buyer doesn’t deliver the certified deposit at the same time they submit their offer, they will typically insert the wording “Upon Acceptance” in the top line. This means they will deliver the deposit to the listing brokerage within 24 hours of the offer being accepted, whether the offer ends up being accepted by the seller or buyer once negotiations are completed and both parties have come to an agreement. The “Upon Acceptance” option tends to be the more common approach versus delivering the deposit with the offer. This is mainly due to buyers avoiding the hassle of taking their deposits back to the bank if their offer isn’t accepted.

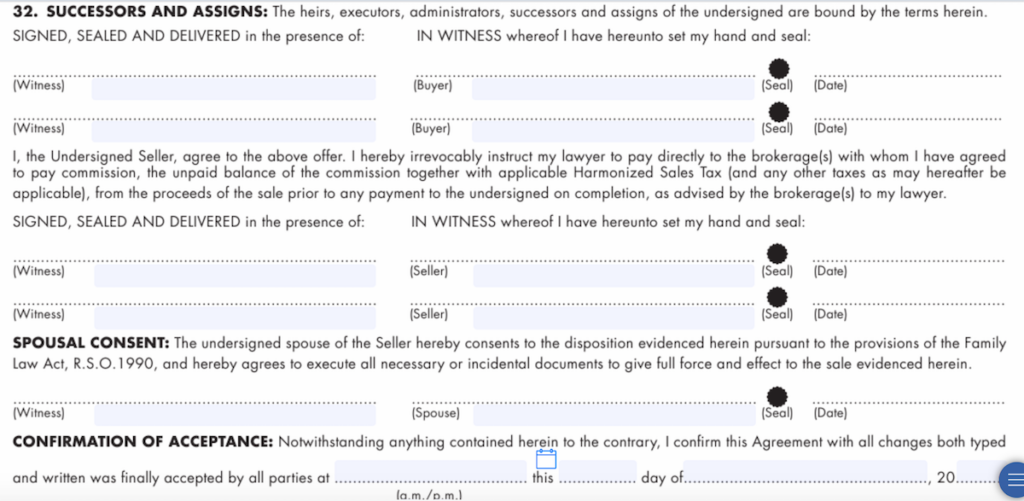

So, what if the buyer doesn’t deliver the deposit? Well, the good news for you as a seller is that according to the law the deal isn’t dead. On page 5 of 6 of the offer where all parties to the agreement sign, they sign “under seal”. You are likely wondering what this means. In short, based on Ontario laws, a contract signed under seal is one that is “formal” and one that does not require any consideration (deposit) to make it firm. Below, you can view the section of page 5 of 6 being referred to and can view the black dots with the wording “seal” under them. These black dots indicate that the agreement being signed is being signed under seal and that all parties are bound to the contract with or without consideration.

Now you are probably thinking, this is helpful to know but what happens next if the buyer doesn’t deliver the deposit? Once the buyer hasn’t delivered the deposit within the stated 24 hour period, they are considered to be in breach of the agreement. At this point, the listing brokerage will send the buyer’s agent’s brokerage (co-operating brokerage) a notice informing them that they are in breach and that the seller will continue to market the property at this point. Should the seller continue to market the property and accept another offer that is for less money than the original offer or an offer that requires the seller to take on any other financial losses outside of the sale price, the seller then has the right to sue the original offerer for those losses. For example, if the original offerer submits an offer for $1,500,000 but the seller can only sell for $1,300,000, the seller could then sue the original offerer for the $200K loss as well as the legal fees associated with recovering that loss.

With all of the above being said, suing a buyer can be a time consuming and costly task. If the person doesn’t have the funds to cover your loss, you may find yourself out of pocket thousands of dollars and mentally drained from the amount of time and effort dedicated to going after them.

The best way to avoid running into a situation like this is to request that all offers include a bank draft or certified cheque covering the deposit amount included with the offer at the time of offer presentation. You typically want to receive a deposit of at least 5% of the offer price or more, the higher the better. By doing this, you are ensuring that the person purchasing your property has the funds for the deposit and it is less likely for them to walk from the deal once you are in possession of their deposit. If you have any questions or concerns regarding legal aspects of your real estate deal, it is best to get advice from a local Toronto real estate lawyer as they will be able to provide you with all of your options based on Ontario’s laws.

Are you thinking about buying or selling or do have questions about the current market? Contact me any time with your questions. I’m always happy to help.

If you’ve been following the recent headlines in Canadian real estate news, you may have heard about Canada’s two year ban on foreign buyers. The “Prohibition on the Purchase of Residential Property by Non-Canadians Act” will take effect January 1, 2023 and is to be in place for a minimum of at least two years.

As you may already be aware, major Canadian cities such as Toronto, Vancouver, Montreal and Calgary have seen an influx of real estate being purchased by foreign buyers over the past decade or so.With Toronto, and Canada as a whole, being a desirable place to invest due to our relatively stable economy, growing job opportunities, consistent population growth, low crime rates (when compared to other major international cities) and a lack of supply to keep up with the demand, there is no surprise that many investors choose to invest in Canadian real estate.

Below are some highlights from the new Act in order to help you understand how it will apply to the way real estate is traded here in Toronto.

What Is Considered A “Non-Canadian”?

(a) an individual who is neither a Canadian citizen nor a person registered as an Indian under the Indian Act nor a permanent resident;

(b) a corporation that is incorporated otherwise than under the laws of Canada or a province;

(c) a corporation incorporated under the laws of Canada or a province whose shares are not listed on a stock exchange in Canada for which a designation under section 262 of the Income Tax Act is in effect and that is controlled by a person referred to in paragraph (a) or (b); and

(d) a prescribed person or entity. (non-Canadien)

permanent resident has the same meaning as in subsection 2(1) of the Immigration and Refugee Protection Act. (résident permanent)

What Is Considered A Residential Property Based On The Act?

residential property means any real property or immovable, other than a prescribed real property or immovable, that is situated in Canada and that is

(a) a detached house or similar building, containing not more than three dwelling units, together with that proportion of the appurtenances to the building and the land subjacent or immediately contiguous to the building that is reasonably necessary for its use and enjoyment as a place of residence for individuals;

(b) a part of a building that is a semi-detached house, rowhouse unit, residential condominium unit or other similar premises that is, or is intended to be, a separate parcel or other division of real property or immovable owned, or intended to be owned, apart from any other unit in the building, together with that proportion of any common areas and other appurtenances to the building and the land subjacent or immediately contiguous to the building that is attributable to the house, unit or premises and that is reasonably necessary for its use and enjoyment as a place of residence for individuals; or

(c) any prescribed real property or immovable. (immeuble résidentiel)

Who Is Prohibited From Buying Canadian Real Estate Under The Act?

4 (1) Despite section 34 of the Citizenship Act, it is prohibited for a non-Canadian to purchase, directly or indirectly, any residential property.

Exception — persons

(2) Subsection (1) does not apply to

(a) a temporary resident within the meaning of the Immigration and Refugee Protection Act who satisfies prescribed conditions;

(b) a protected person within the meaning of subsection 95(2) of that Act;

(c) an individual who is a non-Canadian and who purchases residential property in Canada with their spouse or common-law partner if the spouse or common law-partner is a Canadian citizen, person registered as an Indian under the Indian Act, permanent resident or person referred to in paragraph (a) or (b); or

(d) a person of a prescribed class of persons.

Foreign state

(4) For greater certainty, nothing in subsection (1) is to be construed as hindering a foreign state from purchasing residential property for diplomatic or consular purposes.

Non-application

5) Subsection (1) does not apply if the non-Canadian becomes liable or assumes liability under an agreement of purchase and sale of the residential property before the day on which this Act comes into force.

What Are The Penalties For Offences?

6 (1) Every non-Canadian that contravenes section 4 and every person or entity that counsels, induces, aids or abets or attempts to counsel, induce, aid or abet a non-Canadian to purchase, directly or indirectly, any residential property knowing that the non-Canadian is prohibited under this Act from purchasing the residential property is guilty of an offence and liable on summary conviction to a fine of not more than $10,000.

Party to offence

(2) If a corporation or entity commits an offence, any of the following persons that directed, authorized, assented to, acquiesced in or participated in the commission of the offence is a party to and liable for the offence whether or not the corporation or entity has been prosecuted or convicted:

(a) an officer, director or agent or mandatary of the corporation or entity;

(b) a senior official of the corporation or entity;

(c) any individual authorized to exercise managerial or supervisory functions on behalf of the corporation or entity.

Although this new two year ban on foreign buyers appears to have good intentions for Canadians, this Act would have been more beneficial to Canadians back in 2016 when we were seeing an influx of foreign investment and offer amounts substantially higher than the list prices due to lower interest rates.

If you are a foreign investor considering buying a property here in Toronto, it is important to review the full Act and discuss your options with a local Canadian real estate lawyer before moving forward with submitting an offer on a property.

Are you thinking about making a move or have questions about the current real estate market? Contact me any time with your questions. I’m always happy to help.